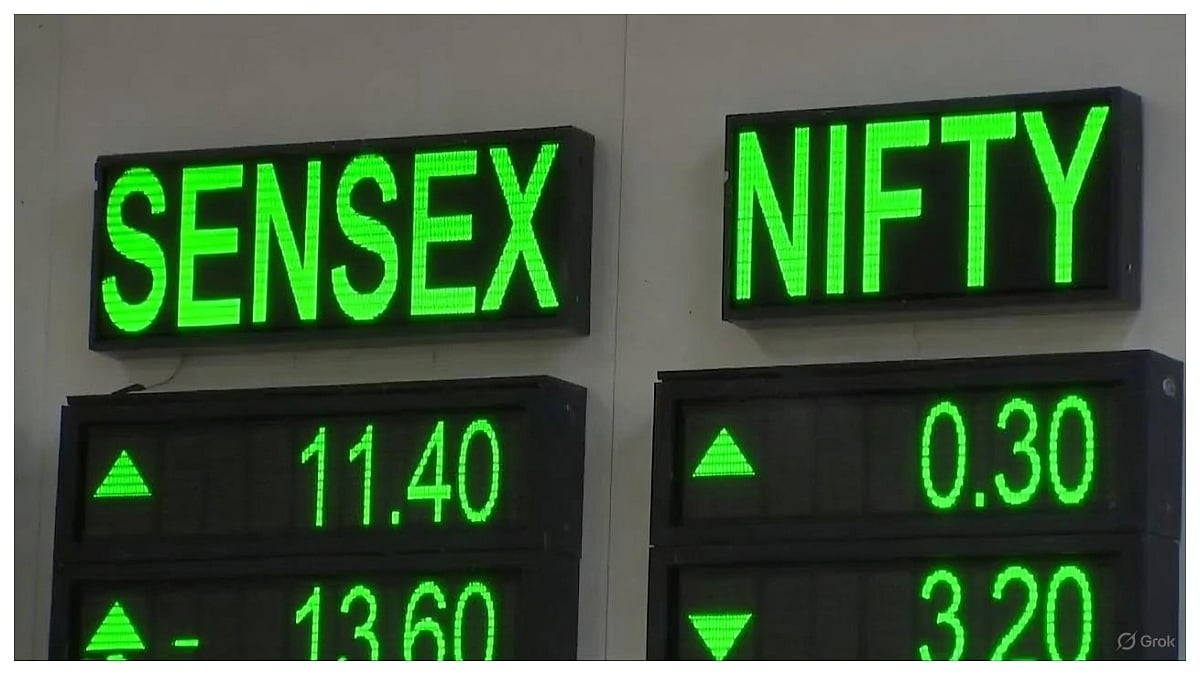

Mumbai: Indian stock markets closed almost unchanged on Friday as investors avoided taking big positions ahead of the important Q2 GDP announcement. Mixed global signals and constant range-bound movement kept the overall mood neutral.

Indices Move in a Narrow Range

Both benchmark indices slipped slightly after moving in a tight band all day.

Sensex: Closed at 85,706.67, down 13.71 points (0.02 percent)

Nifty: Settled at 26,202.95, down 12.6 points (0.05 percent)

Nifty faced consistent resistance near the 26,281 level, and stayed between 26,190 and 26,281 through the session.

Experts said the broader trend remains stable as long as 26,150–26,000 support holds. Resistance is firm at 26,280–26,310. On the charts, Nifty continues to move in this narrow zone, signaling a clear wait-and-watch pattern unless a major breakout happens.

Top Gainers and Losers

A few heavyweight stocks helped limit the downside:

Gainers: Hindustan Unilever (HUL), Sun Pharma, Mahindra & Mahindra (M&M), Kotak Mahindra Bank

Losers: Power Grid, Bharti Airtel, Eternal, Infosys

These mixed performances kept the indices from moving sharply in either direction.

Sector Performance Remains Mixed

Some sectors showed strength while others remained weak:

Nifty Auto: +0.62 percent

Nifty Pharma: +0.59 percent

Nifty IT: -0.11 percent

Nifty Realty: -0.19 percent

Nifty Oil & Gas: -0.69 percent

The broader market also reflected mild weakness:

Nifty Midcap 100: -0.11 percent

Nifty Smallcap 100: -0.27 percent

What’s Driving Market Sentiment?

Analysts said the market tone stayed broadly positive due to:

- Falling US bond yields

- Steady buying by domestic institutional investors (DIIs)

However, volatility in the rupee and profit-booking in select PSU and private banks kept traders slightly cautious. With Q2 GDP data around the corner, most participants preferred to stay on the sidelines.