Mumbai: Benchmark indices Sensex and Nifty ended almost flat on Wednesday after a highly volatile trading session. Gains in PSU banks, auto and pharma shares were offset by losses in IT stocks.

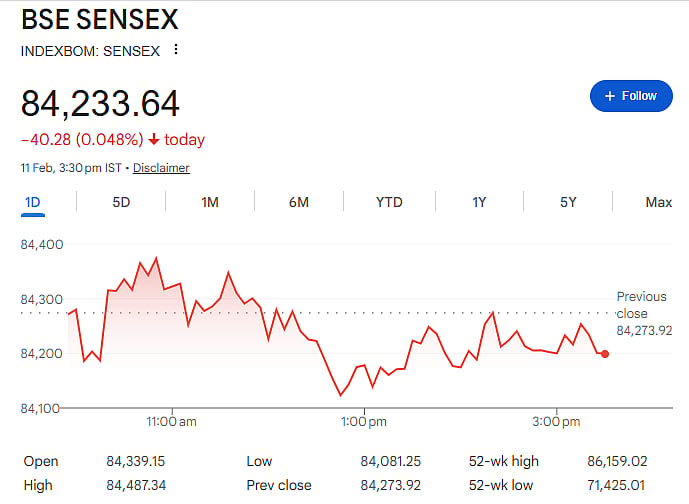

The 30-share BSE Sensex slipped 40.28 points, or 0.05 percent, to close at 84,233.64. During the day, it touched a high of 84,487.34 and a low of 84,081.25, showing sharp swings.

The NSE Nifty edged up 18.70 points, or 0.07 percent, to settle at 25,953.85.

IT Stocks Under Pressure

IT shares were among the biggest losers. Tata Consultancy Services, Infosys, HCL Technologies and Tech Mahindra declined during the session. Weak global cues and volatility linked to AI-related developments impacted sentiment in the IT sector.

Other laggards included ITC, Axis Bank, HDFC Bank, UltraTech Cement, Titan, Adani Ports, Bajaj Finserv and Tata Steel.

Banks, Auto And Pharma Provide Support

On the positive side, PSU banks and auto stocks helped limit the market’s losses. State Bank of India, ICICI Bank and Bajaj Finance were among the gainers.

Auto major Maruti Suzuki and airline IndiGo also advanced. Reliance Industries, NTPC, Sun Pharma, Hindustan Unilever and Bharat Electronics Ltd ended in the green.

Market experts said domestic equities may see a short consolidation phase after the recent rally driven by optimism around the US-India trade deal. Investors are now focusing on mixed Q3 earnings, upcoming inflation data and final details of the trade agreement.

Strength in auto and healthcare stocks reflects better-than-expected earnings, while IT stocks faced pressure due to global uncertainties.

Global Cues And Institutional Activity

Asian markets such as South Korea’s Kospi, Hong Kong’s Hang Seng and China’s Shanghai Composite ended higher. Japanese markets were closed for a holiday. European markets were trading mostly lower, and US markets ended weak on Tuesday.

Brent crude rose 1.44 percent to USD 69.78 per barrel.

Foreign institutional investors bought shares worth Rs 69.45 crore on Tuesday, while domestic institutional investors purchased equities worth Rs 1,174.21 crore.

On Tuesday, Sensex had gained 208.17 points and Nifty had risen 67.85 points.