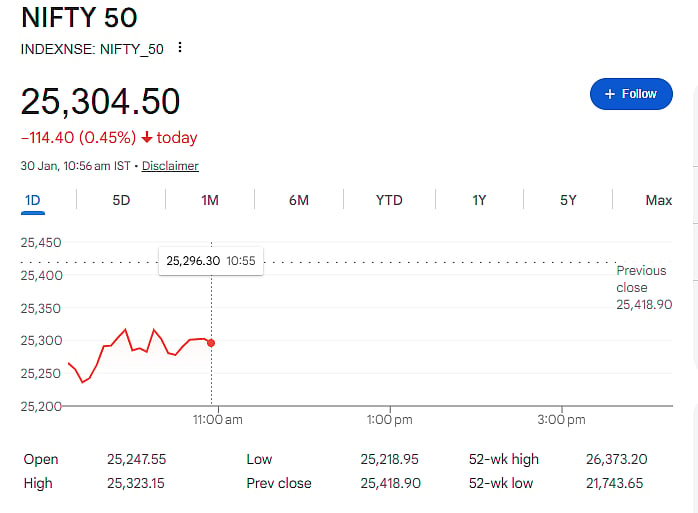

Mumbai: Indian stock markets saw sharp profit-taking on Friday as investors became cautious ahead of the Union Budget. Both benchmark indices moved lower after touching recent highs.

The Sensex fell by around 625 points, or 0.75 percent, to hit an intraday low of 81,941. The Nifty 50 also dropped nearly 194 points, or 0.75 percent, to 25,224, slipping below the important 25,300 level.

Within the first 15 minutes of trading, nearly Rs 4 lakh crore was wiped out from investors’ wealth, showing how strong the selling pressure was.

Budget uncertainty worries investors

The biggest reason behind the fall is nervousness ahead of the Union Budget, which will be presented this weekend. Investors prefer to stay cautious before such a major event, as policy announcements can impact taxes, spending, and corporate earnings.

Many traders chose to reduce their exposure and book profits after the recent market rally. The Budget is expected to give direction on economic growth, government spending, and reforms, making investors cautious in the short term.

Rupee weakness adds pressure

The Indian rupee is trading near record-low levels against the US dollar, which has increased concerns in the market. On Friday, the rupee was around 91.92 per dollar, after hitting an all-time low of 91.98 earlier.

A weak rupee makes imports more expensive and raises worries about inflation. It also reflects foreign money going out of Indian markets, which usually puts pressure on stock prices.

Rising crude oil prices hurt sentiment

Crude oil prices have moved close to five-month highs due to rising tensions in the Middle East. Brent crude is trading near $70 per barrel.

Higher oil prices are bad for India because the country imports most of its oil. This can increase inflation, raise costs for companies, and worsen the trade balance. Energy-heavy sectors like airlines, logistics, and manufacturing are especially affected.

Global markets remain uncertain

Global markets also showed a risk-off mood. US stock futures were in the red, while Asian markets were mixed. Political uncertainty in the US, concerns over interest rates, and rising geopolitical tensions have made investors across the world more cautious.

Even assets like cryptocurrencies and metals were under pressure, showing that investors are moving away from risky investments.

Technical signals turn weak

Technical indicators also suggest caution. Analysts say Nifty is facing resistance at higher levels and needs strong triggers to move up again.

Without clear positive news, the market may remain volatile in the near term, especially around the Budget period.

Disclaimer: This article is for informational purposes only and does not constitute financial or investment advice. Market movements are subject to risks and uncertainties, and readers should consult qualified financial advisors before investing.