Mumbai: Shares of major metal companies fell sharply on Thursday, January 30, dragging the Nifty Metal index down by nearly 5 percent in early trade. The sector became the worst performer in the market for the day, ending a three-day rally during which it had gained close to 9 percent.

The Nifty Metal index dropped to around 11,855 levels as investors rushed to book profits and reacted to falling commodity prices across global and domestic markets.

Profit booking after strong rally

One of the main reasons for the fall is profit booking. Metal stocks had seen a strong rise over the past few sessions, and many investors chose to sell and lock in gains.

After such a fast rally, even small negative triggers can lead to sharp corrections. Traders preferred to reduce exposure, especially in highly volatile stocks like metals.

Metal prices fall sharply

Another big reason behind the fall is the sharp decline in metal prices. On the MCX, gold and silver futures fell around 6 percent each. Copper and aluminium futures with February expiry dropped up to 4 percent during morning trade.

When metal prices fall, it directly impacts the earnings outlook of metal companies. Lower prices mean lower profits, which makes investors nervous and leads to selling in related stocks.

US Fed uncertainty hits sentiment

Global factors also played a role. There is growing uncertainty about who will become the next chairman of the US Federal Reserve. US President Donald Trump said he would soon announce his pick to replace Jerome Powell.

Markets fear that the new Fed chief could be more hawkish, meaning higher interest rates for longer. This strengthens the US dollar and puts pressure on commodity prices, including metals.

As the dollar rises, metals become more expensive for other countries, reducing demand and pushing prices lower.

Top metal stocks that fell

Hindustan Copper was the biggest loser, falling over 10 percent to around Rs 680. This came just a day after the stock had jumped 20 percent to hit a record high.

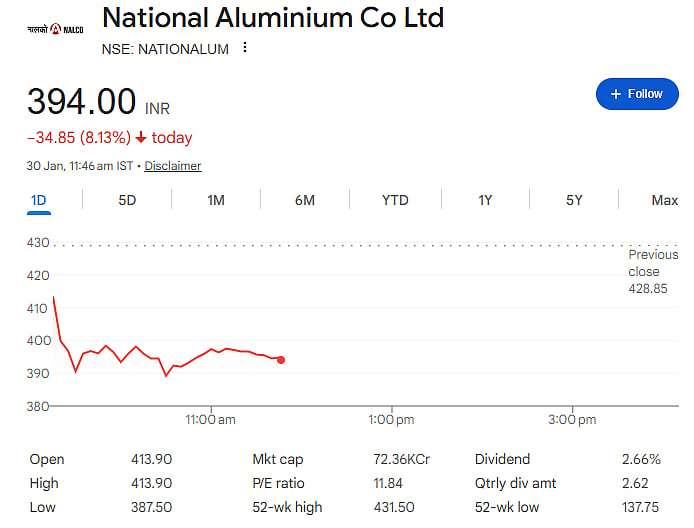

NALCO shares also dropped nearly 10 percent. Vedanta fell around 8 percent, despite reporting a strong 60 percent jump in Q3 FY26 profit.

Hindustan Zinc declined about 7 percent. Hindalco and NMDC were down nearly 6 percent each. SAIL fell close to 5 percent, while Tata Steel, Jindal Steel and Lloyds Metals dropped over 4 percent. JSW Steel and Jindal Stainless slipped more than 3 percent.

What investors should know?

The fall shows that metal stocks remain highly sensitive to global cues and commodity prices. While the long-term outlook may remain positive due to infrastructure demand and energy transition, short-term movements can be very sharp.

Investors should be prepared for volatility and track global metal prices, dollar movement, and US interest rate signals closely.

Disclaimer: This article is for informational purposes only and is not intended as investment advice. Readers should consider their financial goals and consult certified financial advisors before making any stock-related decisions.