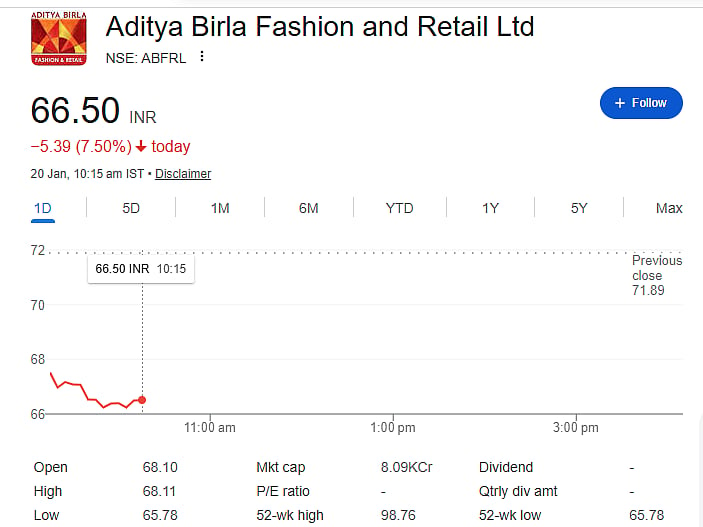

Mumbai: Shares of Aditya Birla Fashion and Retail Ltd. (ABFRL) fell sharply on Tuesday, January 20, after a large block deal in the stock weighed on investor sentiment. The stock slipped as much as 8 percent during the day, making it one of the top losers in early trade.

Around 4.35 crore shares, or 3.57 percent of the company’s total equity, changed hands in a single large transaction. These shares were traded at an average price of Rs 66.4 per share, taking the total value of the deal to nearly Rs 289 crore. The sudden jump in trading volumes led to selling pressure, pulling the stock lower.

.jfif)

Alongside ABFRL, activity was also seen in Aditya Birla Lifestyle Brands Ltd., the demerged entity. About 2.8 percent of its outstanding equity was involved in a large trade. However, the deal in the demerged company is still awaited.

The buyers and sellers in both transactions have not been disclosed. On Monday, January 19, CNBC-TV18 had reported, citing sources, that block deals were likely in the two Aditya Birla Group companies. The report also said it was not clear which investor was planning to exit.

In the case of Aditya Birla Lifestyle Brands Ltd., sources said an institutional investor was expected to sell up to 3 percent stake through a block deal worth around $43 million. The floor price for the deal was fixed at Rs 106.14 per share, and the transaction was described as a clean-out trade, meaning a full exit by the seller.

As of the end of the September quarter, Pilani Investment and Industries held 3.67 percent stake, while SBI Life Insurance owned 2.25 percent in Aditya Birla Lifestyle Brands.

Separately, for Aditya Birla Fashion and Retail Ltd., sources indicated that an undisclosed institutional investor planned to offload up to 3 percent stake via a USD 32-million block deal at a floor price of Rs 65.78 per share. This transaction was also said to be a clean-out trade. At the end of September, Theleme India Master Fund held a 2.45 percent stake in ABFRL.

In an earlier deal, Flipkart Investments sold 6 percent stake in Aditya Birla Lifestyle Brands in October 2025 for about Rs 998 crore.

Following Tuesday’s transaction, ABFRL shares were trading nearly 7 percent lower at around Rs 67, reflecting cautious investor sentiment.

Disclaimer: This news report is based on exchange disclosures and media reports. It does not constitute investment advice. Readers should consult financial advisors before making investment decisions based on this information.