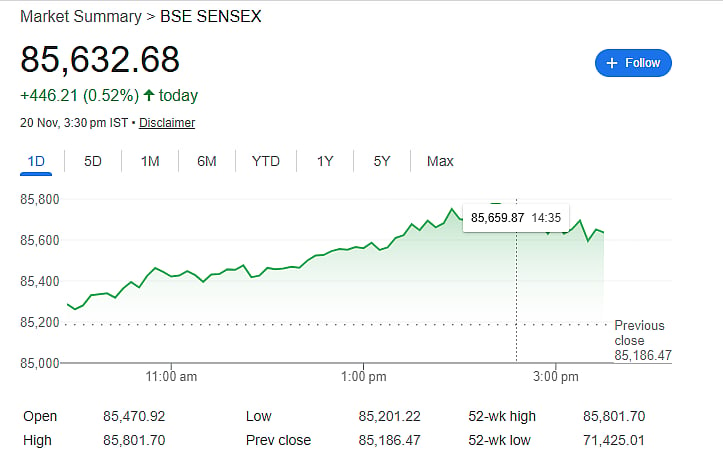

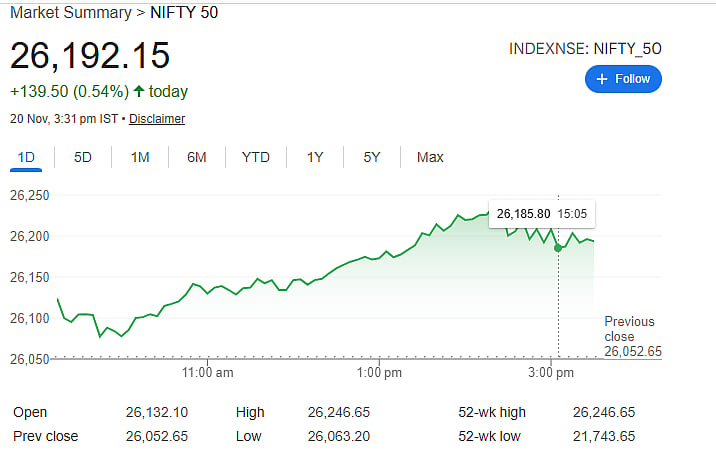

Mumbai: Indian stocks shot up on Thursday, with the main indices finishing just shy of their all-time highs from September 2024. Investors kept the energy high all day, thanks to upbeat signals from global markets and steady buying in heavyweight sectors—especially big names in large-cap stocks. Sensex jumped 446 points, closing at 85,632, while Nifty hit a fresh 52-week high during the session before ending up 140 points at 26,192.

Financials and Oil & Gas power the rally

Financials and Oil & Gas led the charge. HDFC Bank, Bajaj Finance, and Bajaj Finserv powered the Sensex higher. Over on the NSE, Eicher Motors joined Bajaj Finance and Bajaj Finserv at the top of the day’s gainers. Not every stock had a great day, though—Asian Paints, Titan, and HCLTech lost ground and pulled back some of the momentum.

Technical picture remains strongly constructive

Looking at the charts, the setup still favors the bulls. The Nifty’s key demand zones sit around 26,180, 26,070, and then down to 26,000–25,900. If the index breaks above 26,277, analysts see room for more gains, possibly heading up toward the 26,350–26,500 range.

The broader market was a mixed bag—Nifty SmallCap 100 dipped just a bit, down 0.05 percent, while the MidCap 100 inched up 0.02 percent.

Sector movement and global influences

Sector-wise, Financial Services came out on top, while Media and PSU Banks lagged behind. Global tech stocks and strong corporate earnings helped boost the mood, especially after some big US companies posted solid numbers. There’s also a new wave of optimism about India–US trade talks, with early agreements moving along and adding to the positive vibe.

Market outlook and expert commentary

Shrikant Chouhan at Kotak Securities said the market kept its bullish momentum through the session, even forming a strong bullish candle on the daily charts. He thinks pullbacks during the day are good chances to buy, while rallies could be used to lock in some profits. For the Nifty, support sits at 26,100–26,000, and for Sensex, it’s 85,500–85,200. Resistance is likely near 26,250/85,800 and up at 26,400/86,300. If the indices drop below 26,000 or 85,200, though, this rally could run out of steam.