Risk appetite is a primary factor one must consider before making investments. If you are a citizen above 60 years of age, you might not want to invest your hard-earned savings in a market-linked volatile investment tool that puts your capital at risk. It would help if you ideally looked for more stable financial instruments that offer secured returns and capital preservation. Multiple financiers in India provide quite a few useful financial tools. But, generally, these fixed-income instruments do not guarantee generous returns.

However, you can benefit from both stability and attractive returns wisely. The Bajaj Finance Fixed Deposit is one such option where you can take advantage of the high FD interest rates and safety of deposit. Along with high FD rates and stability, they also have a suite of other benefits that you can avail of.

Read on to know more about this smart investment tool. Given below are the highlights of this investment plan.

1. Secured returns

With Bajaj Finance Fixed Deposit, you can take the liberty of investing and not have to check on your investment every second day. It is not only a fixed-income instrument that guarantees capital preservation but it is also accredited with the highest safety ratings from the leading credit rating agencies in India. Bajaj Finance Fixed Deposit carries ICRA’s MAAA rating and CRISIL’s FAAA rating. These high credit ratings indicate a default-free investment experience with timely payouts.

2. Attractive FD interest rates

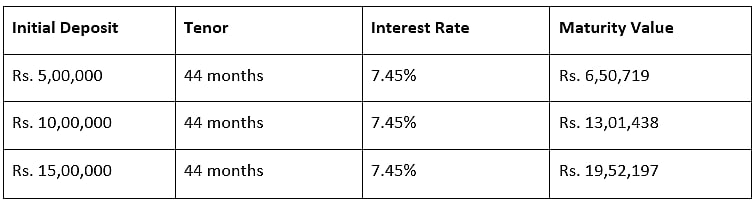

Bajaj Finance offers FD rates that go up to 7.20% p.a. for all investors. Senior citizens get an additional rate benefit of 0.25% p.a. This enables them to park their funds at interest rates that go up to 7.45% p.a. With such good returns and stability; you can easily earn more from your savings without worrying about returns and default. You even have an option to choose your final payout disbursal method. You can get a lump sum at maturity of the interest incurred during the tenor or choose a non-cumulative payout. With the non-cumulative payout, you can get your returns credited monthly, quarterly, half-yearly or annually. By choosing the non-cumulative payout option, senior citizens can use their periodic payouts as a salary to fund their recurring expenses.

Since your applicable interest rate remains constant throughout your tenor, you can easily estimate your returns at maturity even before investing in an FD with Bajaj Finance. You need to use the FD calculator on the Bajaj Finance website and put in your investment payout option, the desired tenor, and initial deposit amount and click on calculate. Your earnings, including your initial deposit, will be reflected on the screen. This feature is handy for senior citizens who need to plan their expenses.

Consider an example where a senior citizen invests Rs. 5,00,000, Rs. 10,00,000 and Rs. 15,00,000 in an FD with Bajaj Finance for 44 months. How much they will receive at the end of their chosen tenor.

One can earn handsome returns at the end of the tenor when investing in an innovative tool like Bajaj Finance Fixed Deposit. For a more regular income to fund expenses during your post-retirement years, you can pick a non-cumulative FD. The regular payouts you get can be used to fund repetitive expenses like rent, medical bills, household expenses, and more.

1. Loan against FD facility

Having a corpus saved up is as essential as having liquidity when required. With the Bajaj Finance FD, you can use your money when needed, even when your tenor is not over. With the loan against the FD facility, you can quickly get an advance without having to liquidate or stop your investment midway. Emergencies come uncalled and require a free flow of cash. This facility can be used for the free cash flow needed during such situations.

2. End-to-end online investment process

Another advantage of parking your life’s savings with Bajaj Finance Fixed Deposit is that they offer an end-to-end paperless and online investment process that is easy and quick. With just a few clicks, you can book FD online from anywhere at any time without waiting in long queues and filling in tiring documents.

Retirement planning is an essential and strategic task requiring the investor to account for risks, returns, safety, convenience, taxation, etc. Considering all this, it is safe to say that the Bajaj Finance online Fixed Deposit is an ideal investment option to safeguard your post-retirement years.