While it was a critical tool in the fight against the burgeoning inflation, this turn in the upward revision in interest rate cycle could be a significant headwind to real estate demand, said property consultant firm Knight Frank India.

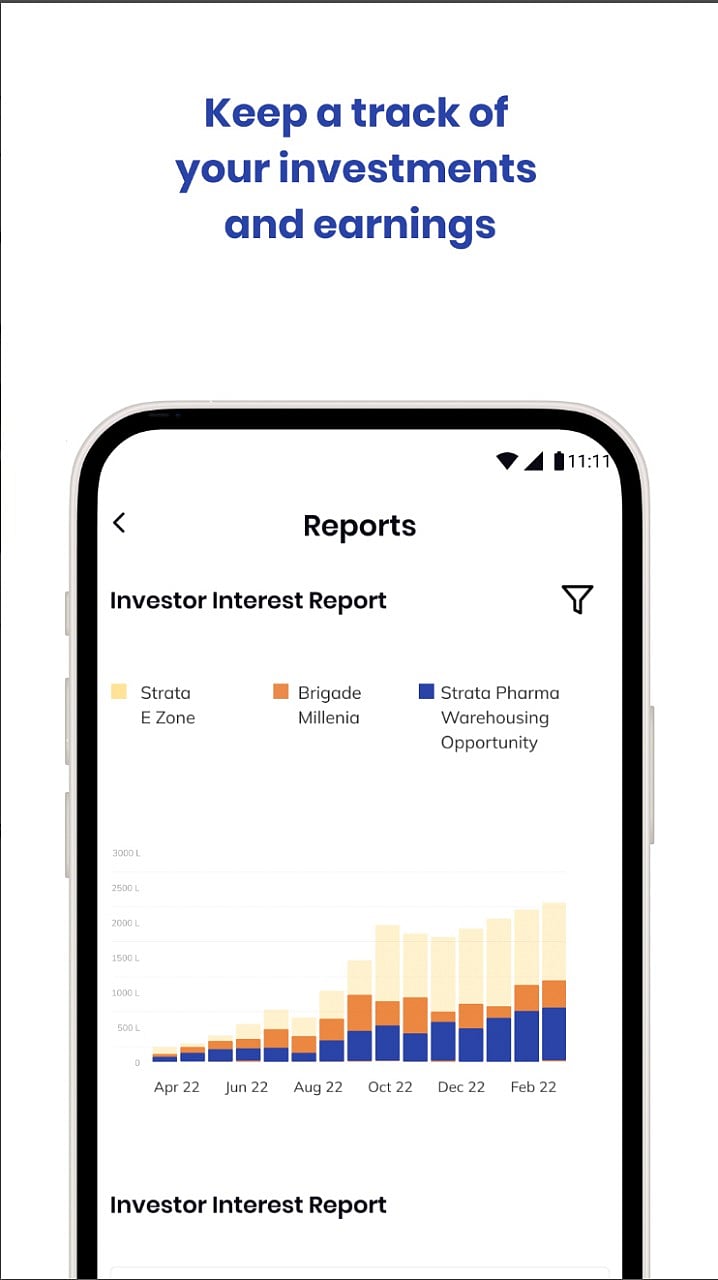

The real estate sector has been on a strong recovery path after surviving the worst of the pandemic. Annual residential sales in 2021 have reached within striking distance of 2019 volumes and recent monthly sales trends also show strong momentum.

The revival in the sector has largely been driven by low interest rates which supported homebuyer demand.

On June 8, the Reserve Bank of India raised the repo rate by 50 basis points to 4.9 per cent.

For FY23, the RBI sees an overall inflation at 6.7 per cent, which is 100 basis points higher than its previous estimate.

The significant increase in the FY23 consumer inflation estimate to 6.7 per cent, which is higher than the RBI's upper tolerance band of 6 per cent, also suggests that further repo rate hikes are likely, the property consultant said in a report.

"The RBI is likely to continue increasing the policy rate to narrow the gap between consumer inflation and repo rate and reduce the extent of negative real interest rate in the economy, which still stands at -1.8 per cent."

Home loan rates are still approximately 150 basis points below those prevailing in 2019 and a reversion to those levels will result in an 11.73 per cent increase in the EMI load for the homebuyer and an effective 3.38 per cent decrease in affordability, the report said.