The Goods and Services Tax (GST) collection in Punjab jumped 15.69 per cent to Rs 19,222 crore in the current financial year so far, while the state's excise revenue rose 11.71 per cent to Rs 8,093.59 crore.

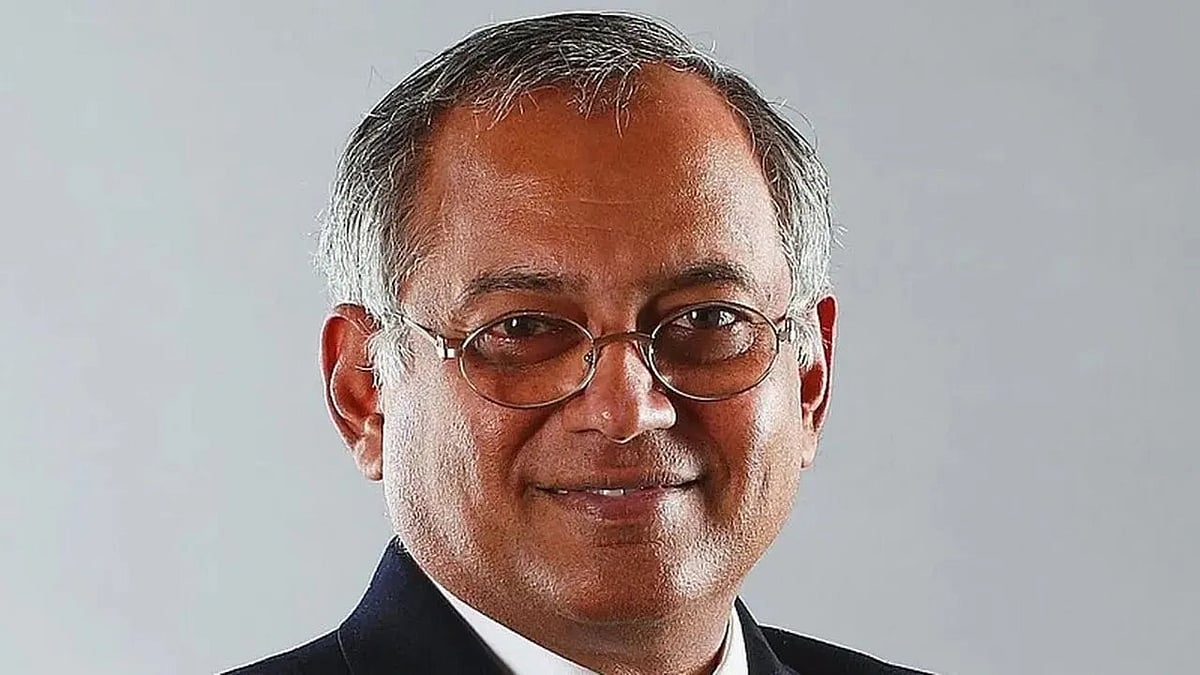

The net GST collection up to February in the current fiscal year stood at Rs 19,222.5 crore, up from Rs 16,615.52 crore collected during the same period of the preceding fiscal, finance minister Harpal Singh Cheema said on Sunday.

State excise revenue sees a hike

Cheema further said that the state's excise revenue also witnessed an impressive growth of Rs 842.72 crore with the overall collection of Rs 8,093.59 crore as against Rs 7,244.87 crore recorded during the same period a year ago, according to an official statement.

Cheema said that the state has seen a shift in its fiscal trajectory since Chief Minister Bhagwant Singh Mann-led AAP government assumed office in March 2022.

"With better planning and implementation, the state has recorded net tax revenue growth of 13.85 per cent, surpassing Rs 34,158 crore in revenue from VAT, CST, GST, PSDT (Punjab state development tax), and excise by the end of February," he added.

'Testament to sound financial management'

"These figures represent not just numbers but the trust that the people of Punjab have placed in our government," Cheema said, adding, "the Punjab government is dedicated to using this revenue responsibly to fund vital public services, infrastructure development, and social welfare programmes." Referring to the launch of the State Intelligence and Preventive Unit (SIPU) and GST Prime portal, Cheema said that the proactive implementation of technology-driven solutions has enhanced efficiency, transparency, and compliance in both GST and excise tax collection processes.

"This unprecedented growth in GST and excise collections is a testament to Punjab's economic resilience and our government's unwavering commitment to sound financial management.

"We have successfully streamlined tax administration, curbed evasion, and created a business-friendly environment that encourages compliance, leading to this significant revenue boost," the minister said.