RBI to seek clarification, Sebi begins probe into trading, disclosure issues

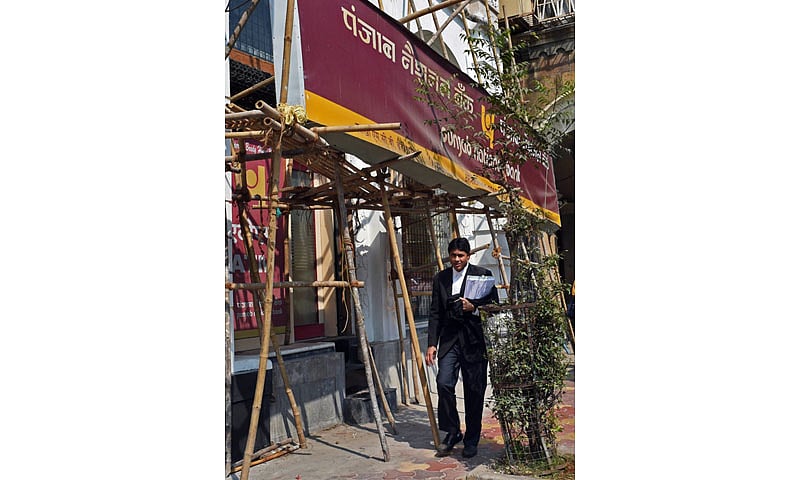

New Delhi : In the aftermath of the Rs 11,300-crore fraud, the finance ministry sources on Friday said that Punjab National Bank (PNB) is fully capable of taking the entire hit of the fraud.

The state-owned lender, which had earlier detected a $1.77 billion scam including jeweller Nirav Modi acquired fraudulent letters, said that the role of other 4 banks will be probed, and the will have to bear consequences if found to have defaulted the norms.

The sources highlighted that the recapitalisation of the PNB will not be impacted by fraud case. “The bank will get its recapitalisation share of Rs 5,000 crore, as allocated earlier,” said the sources.

The Reserve Bank of India (RBI) will seek clarifications from PNB on how such large volumes of transactions were handled by the bank without involving core banking solutions, two senior industry sources.

“The risk management has failed at multiple counts. Without CBS input, there is no trail for audit, but even SWIFT transactions had to be inputted into the system manually which the bank failed to spot, and even the auditor did not throw it up in routine branch level audit,” a banking source said.

The regulator is working with the government and the bank to ensure there is no contagion effect of the fraud on other banks which have lent against the Letters of Undertaking issued by PNB.

Market regulator Sebi has launched a probe into trading and disclosure related issues of the state-owned bank, which has lost Rs 8,731 crore in market capitalisation in three days. The stock hit its 52-week low on both BSE and NSE on Friday.

Meanwhile, PNB said it is hopeful of coming out of the problem in the next six months. “We will get back to normalcy within six months. Bank has the size and capacity to come out of the problem,” said Sunil Mehta, MD andCEO. He said the bank was going through some problems but “we will fix it.”