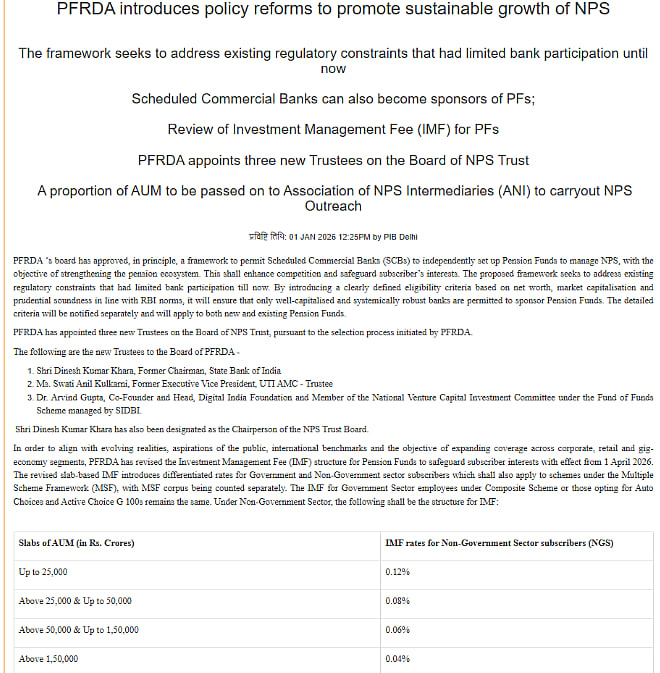

New Delhi: Regulator PFRDA on Thursday permitted banks to set up pension funds to manage the government's flagship National Pension System to enhance competition and safeguard subscriber interests. Current regulations constrain banks' participation in sponsoring pension funds.

Press Release |

A pension fund is an intermediary responsible for receiving contributions, accumulating them, and making payments to subscribers as specified by regulations. The board of Pension Fund Regulatory and Development Authority (PFRDA) "has approved, in principle, a framework to permit Scheduled Commercial Banks (SCBs) to independently set up pension funds to manage NPS, with the objective of strengthening the pension ecosystem, enhancing competition and safeguarding subscriber interests", the regulator said in a statement.

The proposed framework, it said, seeks to address existing regulatory constraints that had limited bank participation till now, while introducing clearly defined eligibility criteria based on net worth, market capitalisation and prudential soundness in line with RBI norms to ensure that only well-capitalised and systemically robust banks are permitted to sponsor Pension Funds.

"The detailed criteria will be notified separately and will apply to both new and existing Pension Funds," PFRDA said. There are 10 pension funds registered with the regulator. In order to align with evolving realities, aspirations of Indian citizens, international benchmarks and the objective of expanding coverage across corporate, retail and gig-economy segments while safeguarding subscriber interests, PFRDA has also revised the Investment Management Fee (IMF) structure for Pension Funds with effect from April 1, 2026.

The revised slab-based IMF introduces differentiated rates for government and non-government sector subscribers and shall also apply to schemes under the Multiple Scheme Framework (MSF), with MSF corpus being counted separately. However, the Annual Regulatory Fee (ARF) of 0.015 per cent payable by pension funds to PFRDA remains unchanged. The regulator expects the policy reforms to help the subscribers and stakeholders to access a more competitive, well-governed and resilient NPS ecosystem, leading to improved long-term retirement outcomes and enhanced old-age income security.

Meanwhile, PFRDA has appointed three new trustees to the board of the NPS Trust. The new trustees are Dinesh Kumar Khara, former chairman of State Bank of India, Swati Anil Kulkarni, former executive vice president of UTI AMC, and Arvind Gupta, co-founder and head of Digital India Foundation. Dinesh Kumar Khara has also been designated as the Chairperson of the NPS Trust Board. NPS has over 9 crore subscribers and an AUM of Rs 15.5 lakh crore as of August 31.

Disclaimer: This story is from the syndicated feed. Nothing has changed except the headline.