Mumbai: Global brokerage firm Goldman Sachs has upgraded One97 Communications, the parent company of Paytm, to a ‘Buy’ rating, shifting from its earlier ‘Neutral’ stance.

The brokerage has also sharply raised its price target to Rs 1,570, up from Rs 705, marking an increase of over 100 percent. The new target suggests a potential 21 percent upside from Thursday’s closing price.

Regulatory Environment Improving

Goldman Sachs believes the regulatory pressures that had earlier hurt Paytm’s stock performance are now gradually easing.

This improvement is helping Paytm show early signs of recovery in its payments market share. It is also leading to better visibility of earnings, especially as the company relaunches some of its key products that were affected earlier by regulatory actions.

The brokerage expects Paytm to maintain over 20 percent revenue growth in the near future as business stability returns.

Multiple Triggers for Future Growth

Goldman Sachs highlighted strong additional upside potential for Paytm over the next 1–2 years, especially if:

- The regulator takes positive steps on payment charges

- Paytm continues to gain market share

The brokerage further predicts that Paytm’s EBITDA margins could more than double in the coming 3–4 years, indicating stronger profitability going ahead.

Other Brokerages Turn Positive Too

In the previous month, Axis Capital had also made a major upgrade—moving Paytm from ‘Reduce’ to ‘Buy’ and raising its price target to Rs 1,500.

This is currently the second-highest target from analysts, after Ventura Securities’ Rs 2,074.

Out of 19 analysts covering Paytm:

- 12 recommend ‘Buy’

- 5 suggest ‘Hold’

- 2 recommend ‘Sell’

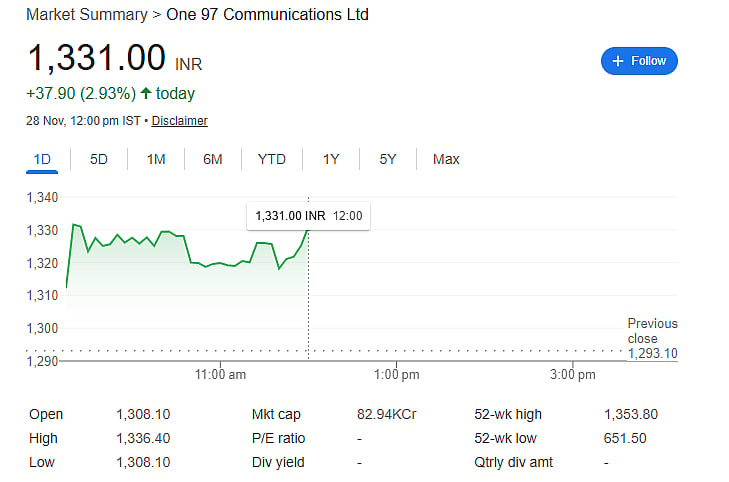

Where the Stock Stands Today

Paytm shares closed 0.51 percent higher at Rs 1,293 on Thursday.

Even after Goldman Sachs’ upgrade and the new target of Rs 1,570, the stock is still:

- 27 percent below its IPO price of Rs 2,150

- 40 percent lower than the issue price at current levels

This shows that although sentiment is improving, Paytm still has a long way to go to return to its original listing value.

Disclaimer: The views and recommendations above are those of individual analysts, experts, and broking companies, not of The Free Press Journal. We advise investors to consult certified financial experts before making any investment decisions.