Mumbai: GAIL (India) shares fell sharply on Friday morning after the Petroleum and Natural Gas Regulatory Board (PNGRB) announced a pipeline tariff hike that was much lower than what the company had hoped for.

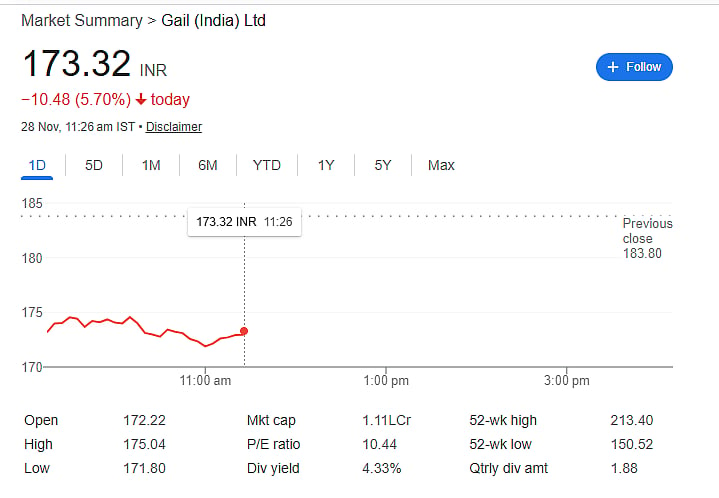

The stock slipped up to 6 percent in early trade and was down 5.70 percent at Rs 173.32 on the BSE around 11:27 am.

Tariff Hike Much Lower Than GAIL’s Expectation

PNGRB increased the integrated pipeline tariff to Rs 65.69 per mmBtu, up from the earlier Rs 58.60.

However, this is far below the Rs 78 per mmBtu that GAIL had requested.

Reports also say the new tariff will be effective from January 1, 2026, not January 1, 2025, as GAIL had proposed.

The next detailed tariff review will occur on April 1, 2028.

Why the Tariff Was Important for GAIL?

Back in March 2025, GAIL Chairman Sandeep Kumar Gupta had said the company expected a 35 percent tariff hike, which could have increased the annual pre-tax profit by about Rs 3,400 crore.

He also pointed out that tariffs had not been revised since 2018, even though the pipeline network has grown and costs have increased.

GAIL had submitted updated details and officially filed for a Rs 78 per mmBtu tariff request.

Analysts had argued that a meaningful tariff increase was long overdue and would help GAIL manage the ups and downs in its trading and petrochemicals business.

How Brokerages Responded

Citi’s View: Citi said the 12 percent hike is below the 15 percent increase it had expected and much lower than GAIL’s demand of 33 percent, calling the update disappointing.

Citi believes the regulator opted for an interim increase to avoid a sudden burden on consumers.

It added the decision could speed up the rollout of the unified tariff regime, which would benefit gas distributor IGL.

UBS’ View: UBS noted that the hike has disappointed the market.

It said that the 12 percent increase does not translate directly to higher realised tariffs for GAIL because only certain cost components were revised.

UBS also said PNGRB delayed a full review until FY28 because approving a complete tariff true-up now would have caused a much larger price jump, putting unexpected pressure on customers.

Disclaimer: The views and recommendations above are those of individual analysts, experts, and broking companies, not of The Free Press Journal. We advise investors to consult certified financial experts before making any investment decisions.

.jpeg)