Mumbai: Shares of Oracle Financial Services Software (OFSS) have gained about 14 percent over the past four trading sessions. On September 11, 2025, the shares rose 4 percent in a single day, continuing their strong run. This rally follows Oracle Corporation’s impressive Q1 fiscal 2026 earnings report, which boosted confidence across the Oracle group.

However, OFSS clarified in recent stock exchange filings that Oracle Corp’s results do not directly affect its own business operations. Despite this, investor optimism in the Oracle family of companies has helped OFSS shares climb steadily.

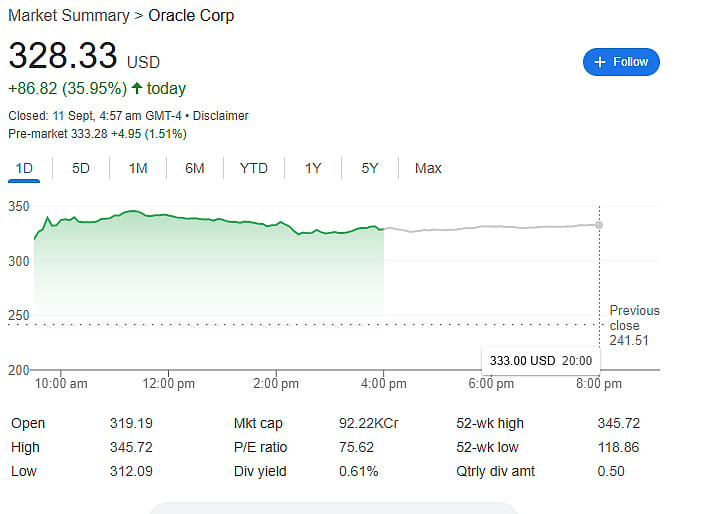

Oracle Corporation Shares Zoom 36 percent

Oracle Corporation shares surged 36 percent on September 10 after posting healthy quarterly earnings and a bright outlook for its cloud infrastructure business. This jump pushed Oracle’s stock to an all-time high, with its market value briefly nearing USD1 trillion before stabilizing above USD920 billion.

Oracle founder Larry Ellison’s net worth temporarily surged, making him the 'World’s Richest Man' during the stock peak. Oracle’s gains also lifted other AI-related stocks like Nvidia, Broadcom, and TSMC.

Oracle’s Game-Changing OpenAI Deal

A major factor behind Oracle’s rise is its new contract with OpenAI, the company behind ChatGPT. Oracle will provide 4.5 gigawatts of data center capacity over five years, in a deal valued at more than USD300 billion—roughly one-third of Oracle’s current market capitalization.

Cloud Infrastructure Growth Drives Future Prospects

Oracle’s cloud business grew 77 percent in the first quarter, reaching USD18 billion in sales. Oracle CEO Safra Catz revealed the company signed four multibillion-dollar contracts with three customers and expects more soon. The outstanding contracts now total over USD500 billion.

Oracle aims to reach USD144 billion in annual cloud sales by fiscal year 2030, making it a key growth engine.

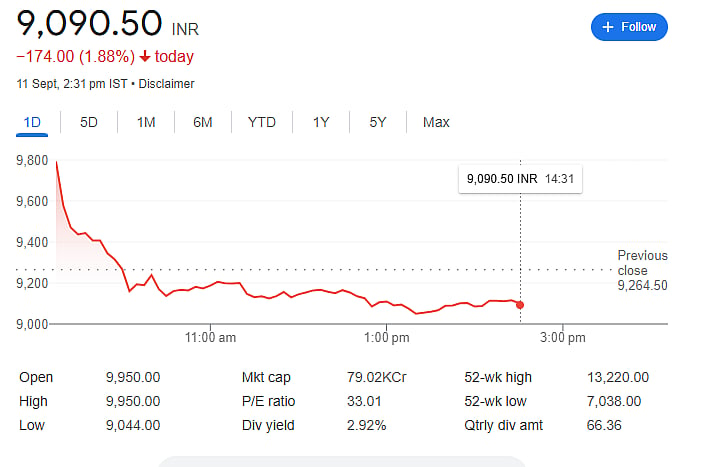

OFSS Share Performance and Valuation

On September 11, OFSS shares traded slightly lower at Rs 9,164.40 after hitting a 52-week high of Rs 13,203.60. The stock’s price-to-earnings ratio is 23.41x based on trailing earnings per share of Rs 391.47, and its price-to-book ratio stands at 15.37. The stock remains an active choice for investors following Oracle’s cloud and AI growth story.