New Delhi: India’s Digital Public Infrastructure (DPI) including Aadhaar, Unified Lending Interface (ULI) and Unified Payments Interface (UPI) should be leveraged to provide credit access to 450 million untapped borrowers, a report said on Monday.

India's DPI played a key role in transforming onboarding, underwriting, and collections of the lending process through consent-driven, paperless, app-first lending nationwide, said the report from RBI-recognised self-regulatory organisation in the fintech sector, the Fintech Association for Consumer Empowerment (FACE).

According to the report, in collaboration with D91 Labs by Setu, fintech NBFCs account for 74 per cent of personal loan volumes in FY 2024-25, and Aadhaar-based onboarding alone is now at a massive scale, with over 39 crore e-KYC transactions processed every month.

The report mentioned that Aadhaar-based e-KYC, DigiLocker, and eSign reduced onboarding costs from $23 to $0.5, the Account Aggregator framework has helped underwrite over 189 lakh loans, and UPI enables more than 151 million debt collections every month. It highlighted the need for deeper collaboration between regulators, financial institutions, and innovators to ensure sustainable adoption. “India’s DPI turned smartphones into a credit gateway, bringing millions of underserved customers and unmet credit needs into formal credit.

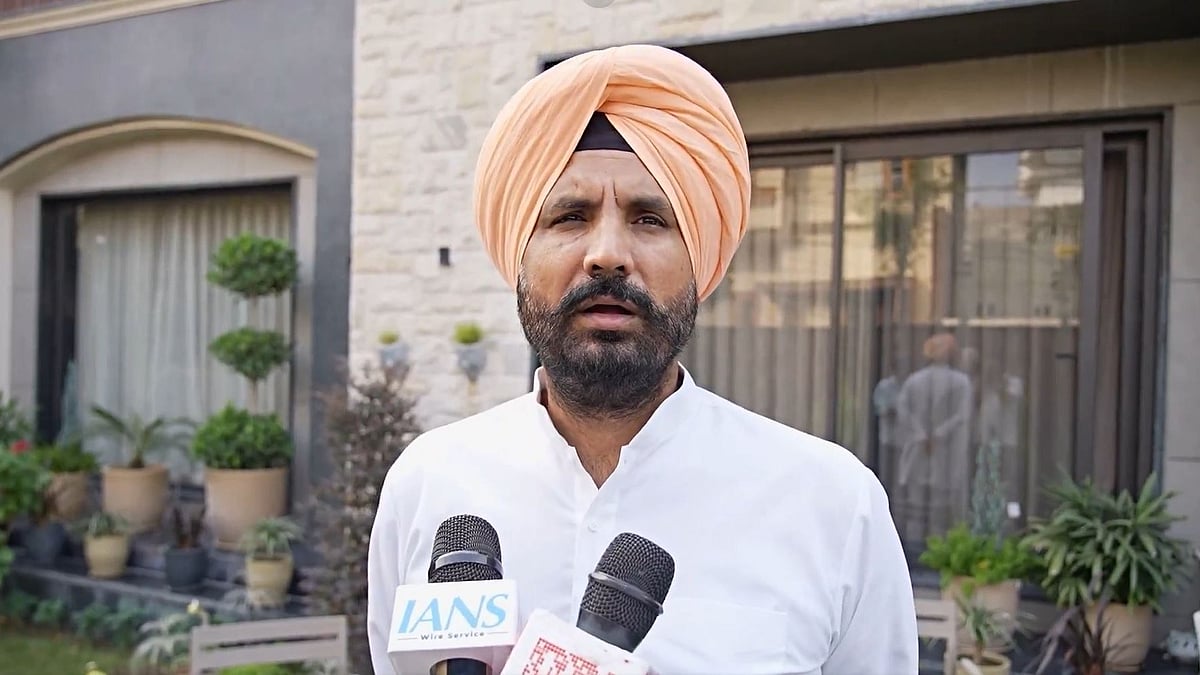

By embedding frictionless onboarding, transactions, and real-time data sharing into the lending process, DPI is making digital lending the default choice, making access to formal credit easier and faster," said Sugandh Saxena, CEO of FACE.

"The continued growth and market needs will require further innovations and enhancements in DPIs, including leveraging Aadhaar, UPI, ULI, and CBDC to deliver convenient, safe, and purpose-built credit to 450 million untapped borrowers,” he added. Regarding frictionless repayments, FACE noted that from over 491 million UPI users, collections and EMI payments average Rs 77,000 crore monthly via UPI and Rs 15,521 crore monthly via BBPS.

Disclaimer: This story is from the syndicated feed. Nothing has changed except the headline.