The Indian markets closed for the month of August on Friday, August 30. The marquee indices shuttered for the week in green. The BSE Sensex increased by 231.16 points, or 0.28 per cent, ending the day at 82,365.77. Similarly, the NSE Nifty rose by 83.95 points or 0.33 per cent, to close at 25,235.90.

Additionally, the Nifty Bank also closed in green. The index closed at 51,351.00, increasing by 198.25 or 0.39 per cent. The BSE Sensex also regained momentum and has gone past the milestone of the 82k mark.

How it Started

When we go back in time, the indices also started the 8th month of the year on a positive note. On August 1, the Indian indices opened in green. Once again, the BSE Sensex opened at 81,987.88, up by 246.54 points or 0.30 per cent.

The NSE Nifty opened at 25,039.60, up by 88.45 points or 0.35 per cent. The Nifty also hit a life-high with this opening. The Nifty Bank, meanwhile, also started in green, opening at 51,749.30, also up by 195.90 points or 0.38 per cent.

The oldest index in Asia, BSE Sensex, closed August with gains of 0.61 per cent or 498.22 points, jumping to 82,365.77. | FPJ Library

.jpg)

Monthly Progress on Markets

The month of August had a total of 21 trading days/sessions. Now, beyond the glorious start and end, when we look at the progress of the marquee, the aforementioned indices closed in a cumulative green.

The oldest index in Asia, BSE Sensex, closed August with gains of 0.61 per cent or 498.22 points, jumping to 82,365.77.

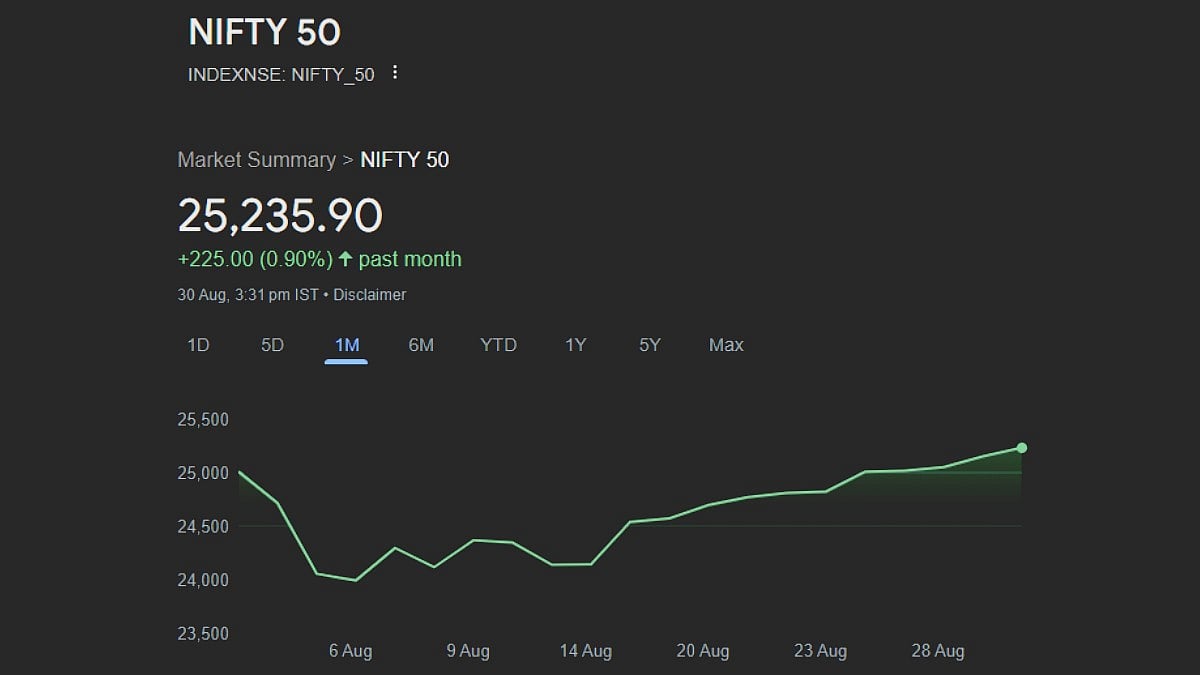

When we look at the BKC-based NSE Nifty, this index also closed August in green. Nifty closed with gains bigger than the Sensex, gaining 0.90 per cent or 225.00 points, closing at 25,235.90.

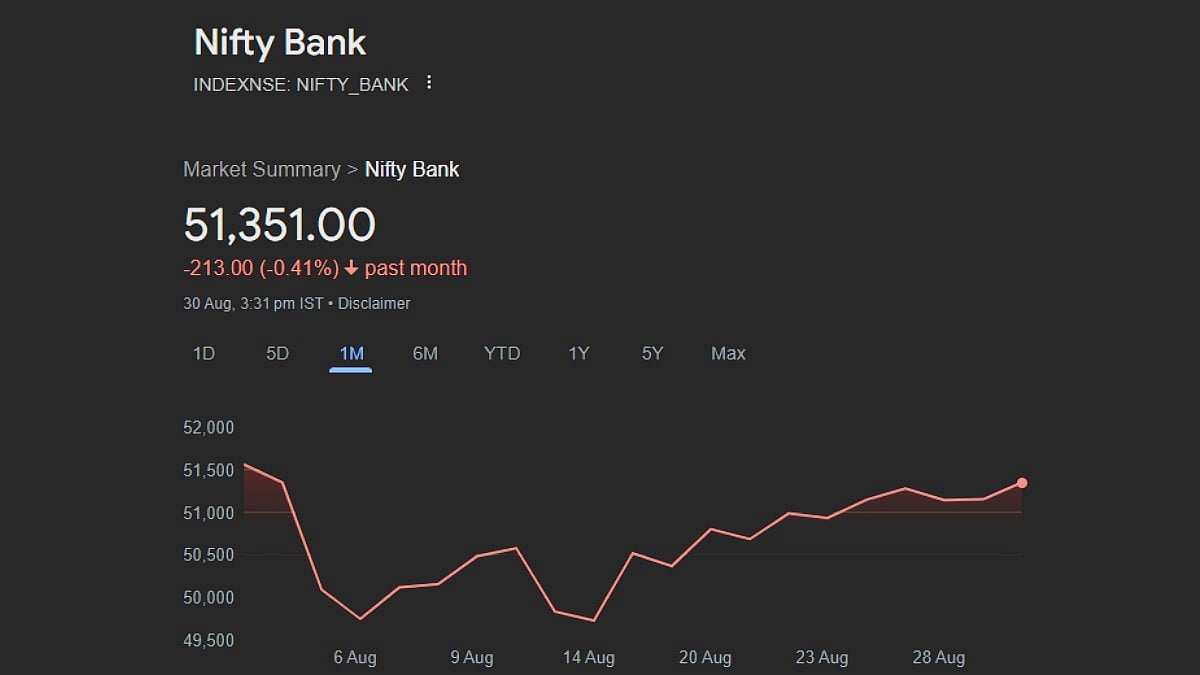

Unfortunately, the story was not exactly the same with another major index, this one carrying the all-important banking stocks. The Nifty Bank index, contrary to the other index, closed August in red. The index lost 0.41 per cent or 213.00 points, closing at 51,351.00.

Crucial Factors That Placated The Markets

The Indian indices were affected by an array of factors in the previously concluded month. One of the crucial aspects that swayed the D-Street is the earnings cycle. The month saw many major names listed on the exchanges release their quarterly earnings for the first quarter of FY25, which concluded on June 30. This played a role in the progress of the markets.

Another crucial and equally important factor is domestic and global at the same time. The anticipations over the change in interest rates in the US by the US Federal Reserve and the RBI's decision to retain its own repo-rate, were other factors that played a role.

Crude oil prices and rise in the same, with Brent Crude going up to USD 80 a barrel, also played a pivotal role in some of the market developments over the last two weeks. The apparent waning interest in AI-related companies also played a role in dictating the markets.

Last, but not least, mergers and IPOs, including the Ola IPO and the abstruse IPO of Resourceful Automobile, played their part in swaying the market. Then there was the Paytm-Zomato deal, which induced some bullishness.

The month, of course, ended with the blockbuster news of the Rs 70,000 crore Reliance-Disney merger, a development that could further its influence in September as well.