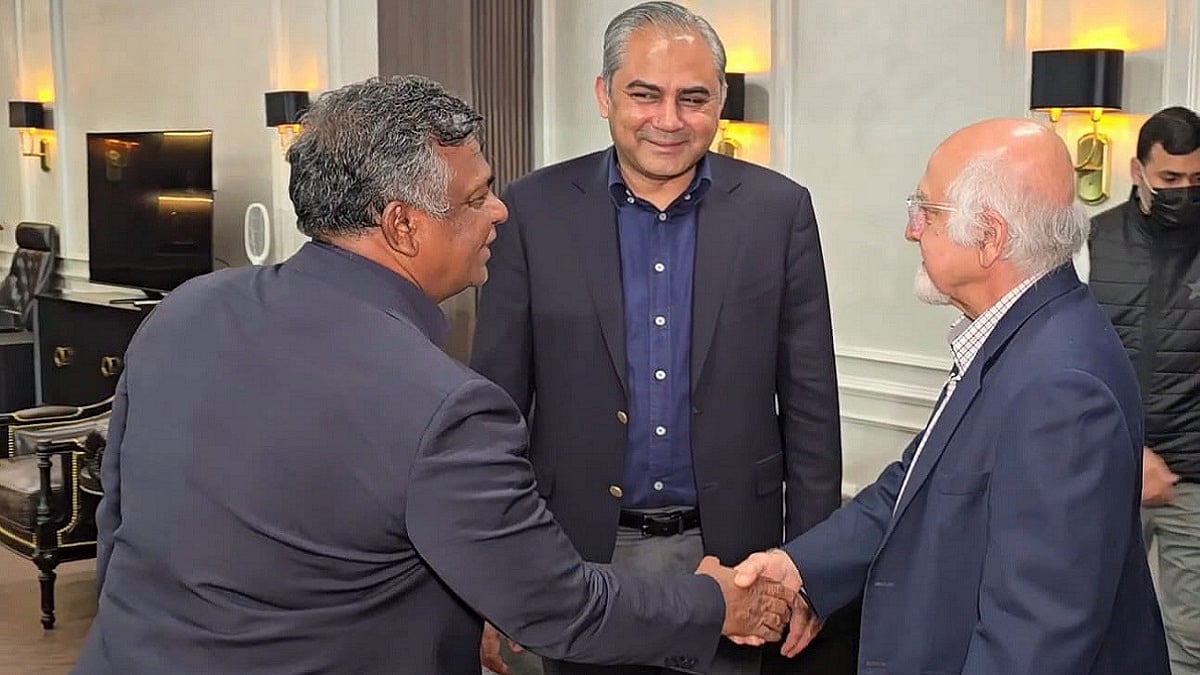

New Delhi: Maruti Suzuki India on Thursday said it has partnered with HDB Financial Services (HDBFS) to provide car loans to customers.

HDBFS is a subsidiary company of HDFC Bank.

The partnership will facilitate loans for both new and used cars. With this, the company now has a retail finance tie-up with 26 banks, 7 NBFCs and 8 regional rural banks, Maruti Suzuki India said in a statement.

"The partnership with HDBFS, will boost convenience by offering attractive loan schemes to customers. There is a huge potential in the Indian automobile industry, and attractive retail financial solutions will help us put the market on a growth trajectory," MSI Executive Director (Marketing and Sales) Shashank Srivastava said.

HDBFS has a strong network and, being an NBFC, it overcomes challenges faced in conventional lending, thus giving semi-rural and rural India the access towards credit, he added.

"This also helps in increasing penetration of financial inclusion for potential customers," Srivastava said.

MSI has a network of 3,066 new car retail outlets across 1,953 cities and towns. It also has 569 outlets of pre-owned car retail channel True Value in over 280 locations.

HDBFS has a network of over 1,425 branches in 1,038 towns and cities.

The partnership is a great step towards expanding availability of finance across the breadth of the country, HDBFS MD and CEO G Ramesh said.

It will enable customised offerings across India including deep geographies, he added.