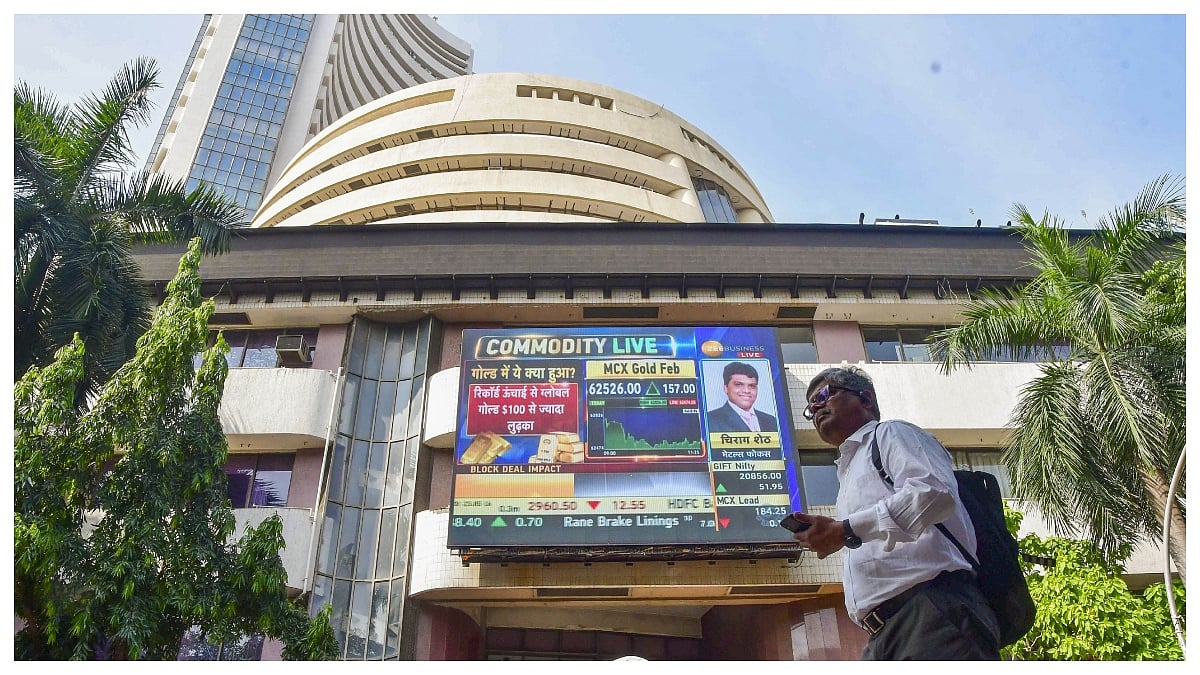

Mumbai: Investors are watching both Indian and global developments. Important data like India’s industrial output and PMI numbers will be released this week. These reports show how well the economy is doing.

On the global side, everyone is waiting for news on possible US trade deals and tariff changes. These can affect international business and investor mood.

Key Dates and Data Releases

June 30: India’s Industrial Production data for May

July 1: Manufacturing PMI for June

July 3: Services PMI for June

These numbers help investors understand the strength of India's economy and if companies are getting more orders.

Other Things to Watch

Foreign investor activity (FII flows)

Global crude oil prices

US job market data like non-farm payroll and unemployment numbers

Progress of the Indian monsoon

These all impact market mood and future expectations.

Market Recap & What’s Ahead

Last week, the Sensex rose over 2,100 points and the Nifty gained nearly 666 points, helped by lower oil prices and easing tensions in the Middle East.

Experts believe the market could keep rising slowly, especially with positive signs in foreign investments and the hope of a US-India trade deal.

What Analysts Are Saying

Vinod Nair, Geojit: Investors are focusing on early signs of company growth and global economic health.

Siddhartha Khemka, Motilal Oswal: Market trend looks positive with strong institutional inflows and trade optimism.

Ajit Mishra, Religare: Data like IIP, PMI, and monsoon progress will decide the market’s short-term direction.

(With PTI Inputs)