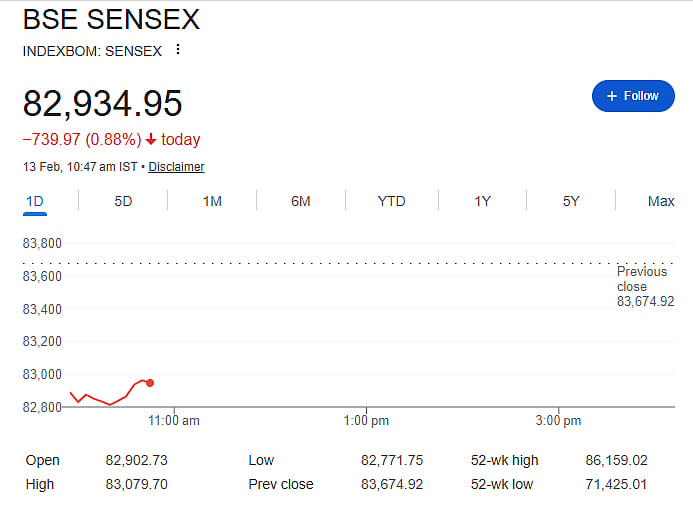

Mumbai: On Friday, 13 February 2026, the Indian stock market saw a sharp fall that increased investor worries. Weak signals from global markets and heavy selling in IT stocks pushed Sensex and Nifty down by around 1 percent. Within minutes, investors lost nearly Rs 4 lakh crore in wealth. Right from market opening, most stocks were trading in the red.

Sensex fell 844 points to around 82,830 levels. Nifty also dropped about 260 points and traded near 25,546. This was the second straight day of weakness in the market.

IT Stocks Drag The Market Down

The biggest impact came from technology stocks. The Nifty IT index fell nearly 5 percent. Infosys saw the biggest fall of about 5.6 percent. Shares of TCS, HCLTech, LTIMindtree, Coforge and Wipro also declined sharply.

Out of 30 Sensex stocks, 27 were trading in losses. Major losers included Hindustan Unilever, Trent, M&M, Adani Ports, Tata Steel, NTPC, Titan, Larsen & Toubro, Bajaj Finserv, IndiGo and Power Grid.

Only three stocks stayed in green- SBI, Bajaj Finance and Bharti Airtel - with very small gains.

Broader Market Also Under Pressure

Midcap and smallcap stocks also fell sharply. The Nifty Midcap index fell about 1.7 percent and Smallcap index dropped nearly 2 percent. India VIX, which shows market fear, rose around 4 percent, showing higher uncertainty among investors.

Metal stocks also fell nearly 3 percent. Media and FMCG stocks also declined.

Three Main Reasons Behind The Fall

IT Selling Due To AI Fear: Investors fear AI automation may reduce demand for Indian IT services.

Weak Global Signals: Global tech stocks fell. Nasdaq dropped around 2 percent, adding pressure on Indian markets.

Rise In India VIX: Higher volatility shows investors are becoming cautious.

What Investors Are Watching Next?

Investors are now watching quarterly results of many companies like Torrent Pharma, GMR Airports, Info Edge and Ola Electric. Market mood may improve only if global signals and IT sector performance stabilise.

Overall Market Mood

The sharp fall shows investors are nervous. Until global markets improve and IT selling slows, market volatility may continue. The “Friday the 13th” effect was clearly visible on investor portfolios.