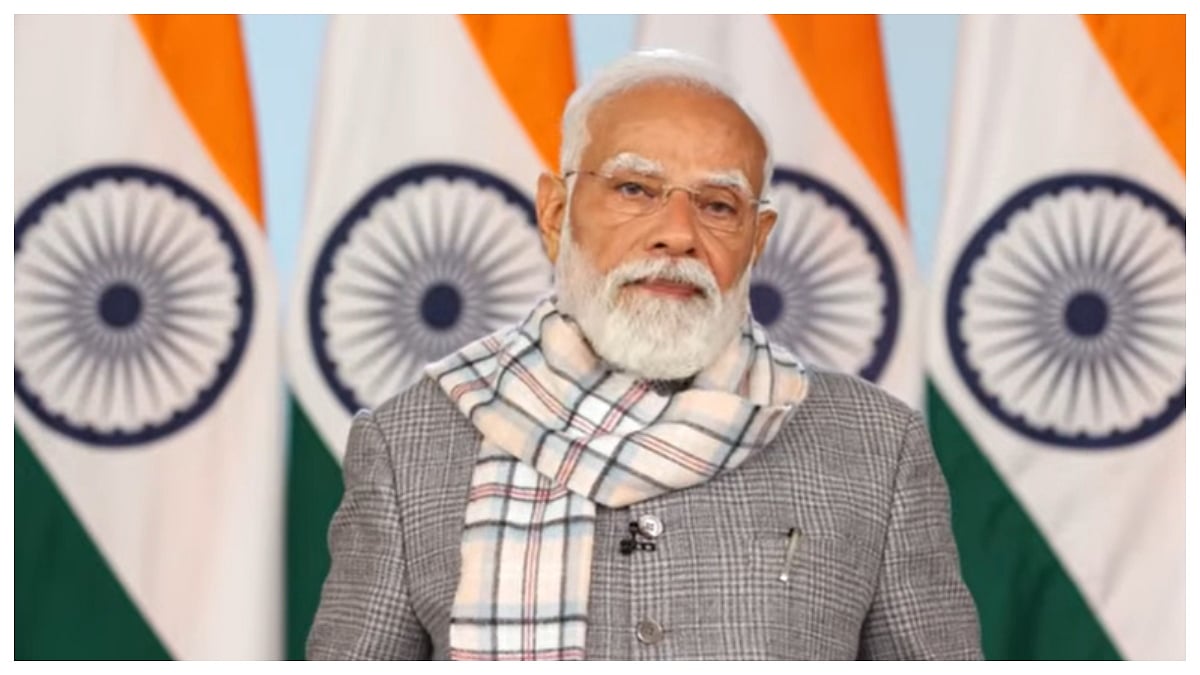

BETUL (GOA): Prime Minister Narendra Modi on Tuesday unveiled a $500bn investment vision for India’s energy sector, positioning it as a central pillar of the country’s economic strategy and a key destination for global capital.

Addressing India Energy Week virtually, Modi urged investors to “make in India, innovate in India, scale with India and invest in India”, arguing that the country’s expanding energy market and regulatory overhaul offered rare long-term opportunities at a time of global uncertainty.

Energy, he said, lay at the core of India’s development ambitions as the world’s fastest-growing major economy seeks to translate rising domestic demand into export strength. India already ranks among the world’s five largest exporters of petroleum products, supplying more than 150 countries. Officials contend that the combination of scale, policy reform and political stability provides investors with both volume and predictability.

New Delhi has widened access to exploration acreage, reduced restricted zones and simplified licensing rules. “The government’s Samudra Manthan deep-sea exploration programme is intended to boost offshore output, while more than 170 oil and gas blocks have been awarded. By the end of the decade, India aims to mobilise $100 bn in hydrocarbon investment and expand exploration to one million square kilometres, with the Andaman and Nicobar basin identified as a priority growth area, Modi said.

Refining remains the sector’s strongest asset. With a capacity of about 260m tonnes a year, India is the world’s second-largest refiner and plans to exceed 300m tonnes in coming years. Policymakers see this as a strategic advantage, enabling the country to process crude efficiently for both domestic consumption and overseas markets, reinforcing its ambition to become a regional energy hub.

Natural gas is expected to take a larger share of the energy mix. Liquefied natural gas is targeted to account for 15 per cent of demand, requiring investment in import terminals, regasification facilities and pipeline networks. A Rs 70,000 crore shipbuilding programme is designed to create a domestic LNG carrier fleet, while city gas distribution systems are expanding rapidly.

Downstream industries, particularly petrochemicals, are forecast to grow in line with population and income levels, sustaining demand for storage, transport and logistics infrastructure and broadening opportunities beyond upstream production. Modi framed the expansion as part of a wider reform agenda aimed at strengthening transparency and investor confidence. India, he said, was moving from energy security towards energy independence, building an ecosystem capable of meeting domestic needs while competing globally.

The recently concluded India–EU free trade agreement was cited as evidence of deeper integration into world markets. For investors, officials argue, the proposition is clear: a vast and growing market, rising capacity and a regulatory framework geared towards long-term capital deployment.