New Delhi: In January 2010, Mr Sharma was travelling on his scooter carrying his wife’s gold jewellery in a pouch. The jewellery was valued at about Rs 18.37 lakh and was insured under a household insurance policy. While travelling from his home towards Narela and later planning to go to Dariba Kalan jewellery market, he realised the pouch was missing.

He immediately reported the loss at Bawana Police Station and got a Non-Cognizable Report registered. The next day, he informed the insurance company about the loss and submitted the required details.

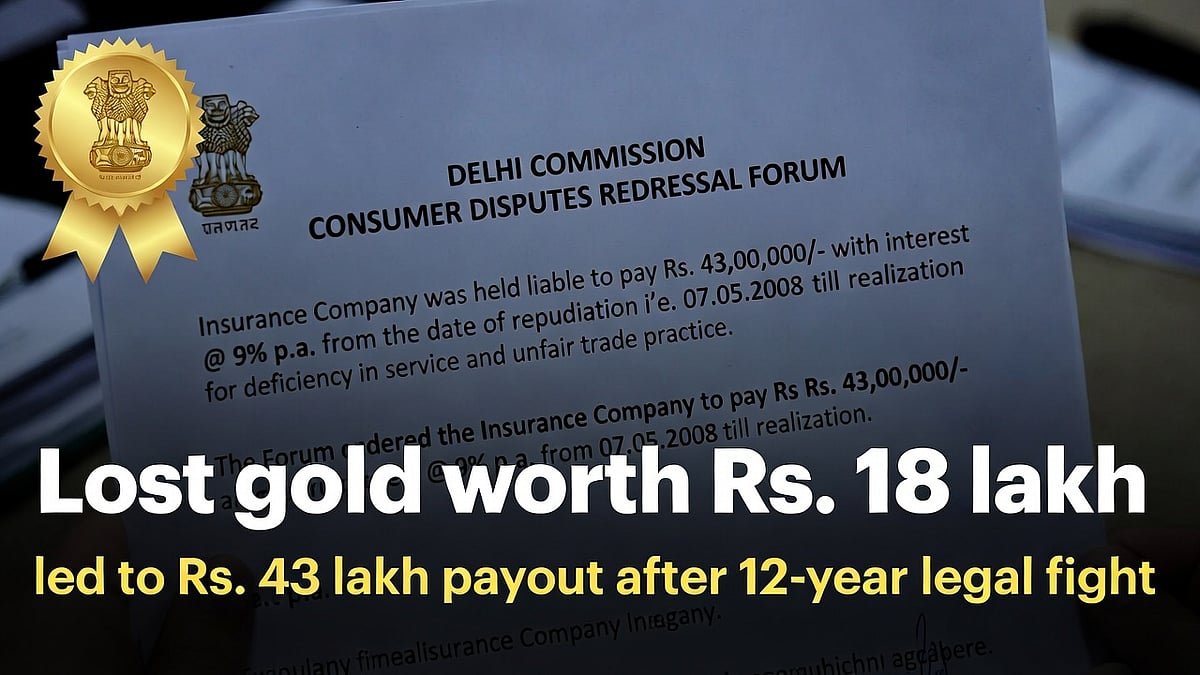

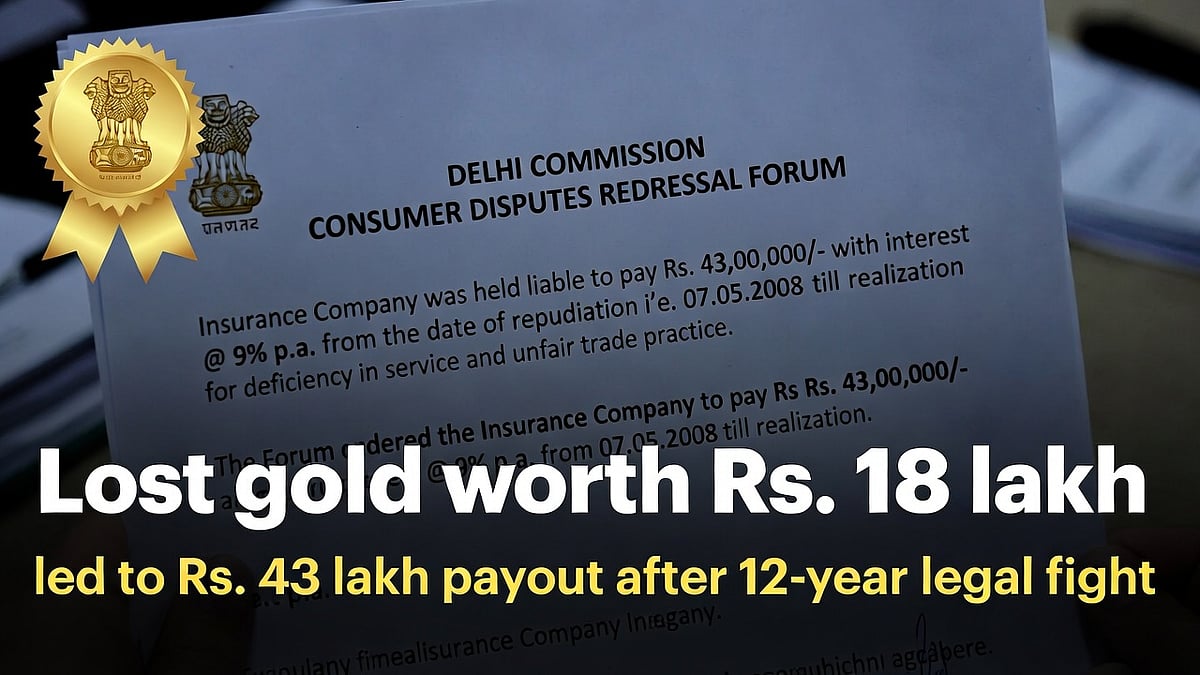

Insurance Claim Rejected

The insurance company rejected the claim. It argued that the policy was taken just days before the loss and claimed Mr Sharma did not take proper care of the jewellery. The insurer also questioned his travel route and said the story seemed unreasonable.

Feeling cheated, Mr Sharma filed a case before the District Consumer Commission.

Consumer Commission Orders Compensation

The District Commission ruled in favour of Mr Sharma. It directed the insurance company to pay Rs 17.75 lakh along with 9 percent yearly interest from April 2010. It also ordered Rs 50,000 compensation for harassment and legal expenses.

The insurance company then appealed to the Delhi State Consumer Commission.

Delhi State Commission Final Decision (2026)

In January 2026, the State Commission dismissed the insurer’s appeal. It said the insurance policy covered loss due to accident or misfortune. It also noted that the insurer had already accepted the jewellery valuation while issuing the policy.

The commission said a surveyor’s doubts cannot be the only reason to reject a claim. It added that claim rejection cannot be based on assumptions without strong proof.

Total Amount Payable After Interest

With 9 percent simple interest for about 15.75 years, the interest amount comes to about Rs 25.17 lakh.

Total payout becomes nearly Rs 42.92 lakh, excluding extra Rs 50,000 compensation and possible higher interest if payment is delayed.

The case highlights that insurers cannot deny valid claims without proper evidence once a policy is issued after verification.