Mumbai: Lenskart Solutions Ltd has taken an important step to strengthen its technology base. The company announced that its fully owned Singapore arm, Lenskart Solutions Pte. Ltd., will invest in a South Korea-based startup called iiNeer Corp. Ltd. This move shows that Lenskart is looking beyond retail and focusing more on the technology behind making lenses.

Details of the Investment

The Singapore subsidiary has approved an investment of KRW 3 billion, which is about Rs 186 crore. With this investment, Lenskart will acquire a 29.24 percent stake in iiNeer. The decision was approved by the board of Lenskart Singapore during its meeting held on December 24, 2025. The deal will be completed through cash payment.

How the Deal Will Work?

As part of the transaction, Lenskart will buy 123,945 preference shares of iiNeer. The company expects the deal to be completed by January 31, 2026. Once completed, Lenskart will become a significant minority shareholder in the Korean startup.

Who Is iiNeer and What It Does?

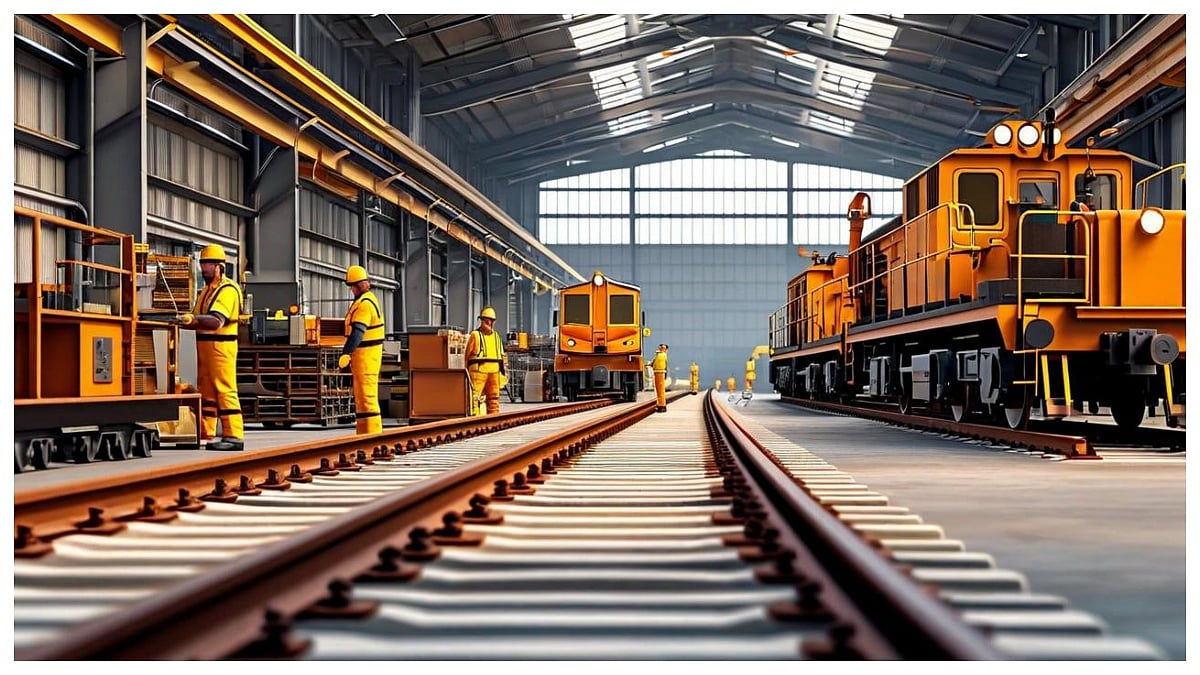

Founded in 2020, iiNeer is an optical machinery startup based in South Korea. The company designs and manufactures advanced optical equipment such as lens-edging machines and related devices. These machines are essential in shaping lenses used in eyewear. In the calendar year 2024, iiNeer reported a turnover of KRW 177.77 million.

Why This Investment Matters to Lenskart?

Lenskart said the main goal of this investment is to build its own optical hardware capabilities. By gaining access to lens edging systems like edgers, tracers, and blockers, the company hopes to improve efficiency and reduce its dependence on external suppliers. Over time, this could also lower capital costs linked to equipment purchases.

Market Reaction

Despite the strategic importance of the deal, Lenskart’s shares ended lower on December 24. The stock fell 3.62 percent to close at Rs 448.95 on the NSE, reflecting cautious market sentiment.