The shares of KRN Heat Exchangers and Refrigeration were queued to get listed today on Indian Bourses. The shares made their debut on the National stock exchange with substantial premium over the issue price of Rs 220 per share (higher price in the price band).

The shares of KRN Heat Exchangers and Refrigeration made their debut on the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE) at a premium of 118 per cent over the issue price.

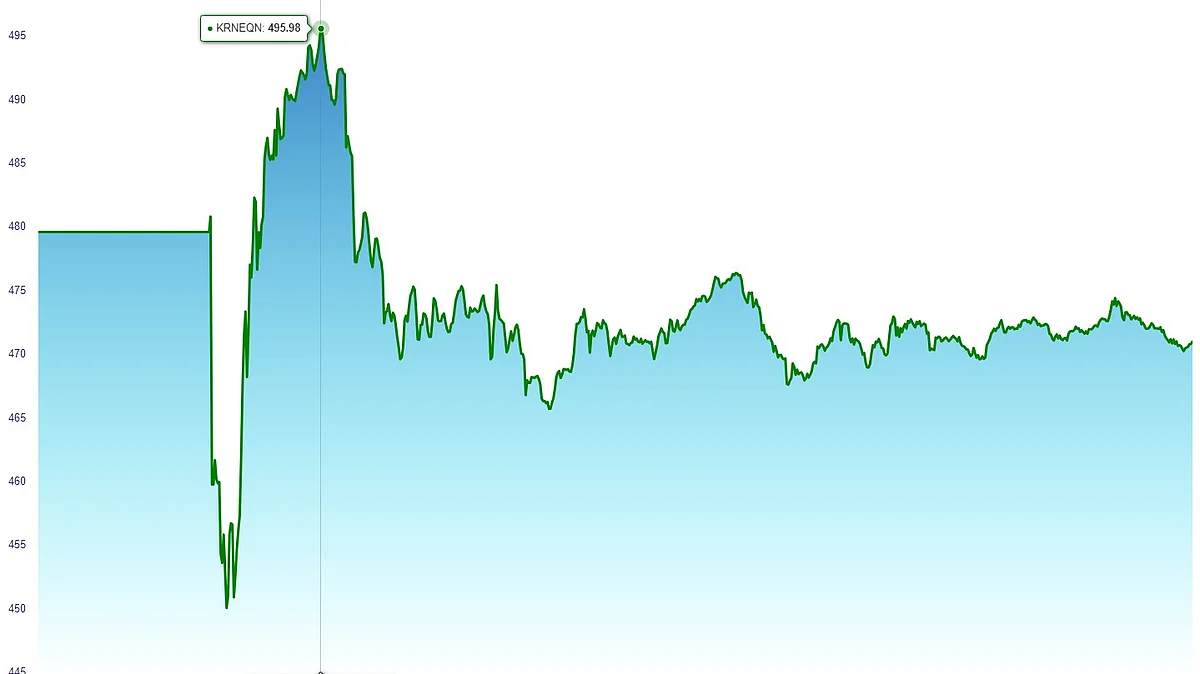

The shares are listed at Rs 480 apiece on the NSE against the issue price of Rs 220 apiece. The KRN Heat Exchanger and Refrigeration public offering received a resounding response, with the IPO being oversubscribed 213 times at the Rs 220 issue price per share.

Listing gains

The shares of KRN Heat Exchangers and Refrigeration gave their investors a hefty chunk of profits after listing at Rs 480 per share on NSE, totalling the profit to Rs 16,900 per lot (260 x 65 = 16,900), amounting to 118 per cent gains as soon as the shares started to trade on the bourse.

As of right now, KRN Heat Exchanger's shares are down 0.09 per cent on the NSE to Rs 479.56 per share.

Subscription across all categories

According to NSE coconsolidated bid data, the KRN Heat Exchanger IPO was subscribed 212.9 times overall as a result of bids for over 234 crore shares received across categories as opposed to 1.09 crore shares offered for subscription.

In contrast to the 23.87 lakh shares reserved for the Non-Institutional Investors (NIIs) category, 102.32 crore shares were applied for, and over 430 applications were received for this category.

Applications for over 52.7 crore shares were received during the nearly 95 times booking of the retail portion of the IPO, compared to the 54.98 lakh shares reserved for the segment.

Qualified Institutional Buyers (QIBs) booked their quota 253.04 times, with bids for over 78.63 crore shares as opposed to the 31.07 lakh shares set aside for the category.

Company financials

Its operating revenue increased by 25 per cent CAGR between FY22 and FY24, while its profit increased by 54 per cent.

Additionally, the Indian HVAC (heating, ventilation, and air conditioning) market had a USD 9.1 billion turnover in 2023 and is projected to grow at a 14.5 per cent CAGR to reach USD 20.5 billion in 2029, which could be advantageous to the business.