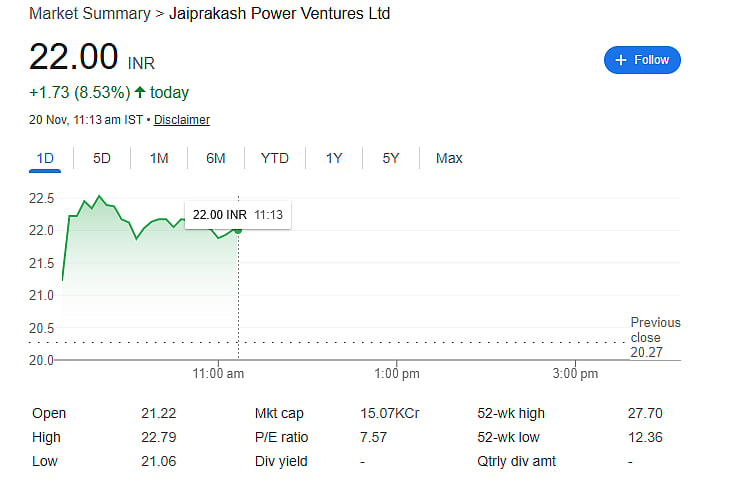

New Delhi: Jaiprakash Power Ventures Ltd. (JP Power) has been witnessing an exceptional rally this week. In just two trading sessions, the stock has jumped nearly 27 percent. On Thursday, the stock climbed another 10.5 percent to touch Rs 22.4, extending Wednesday’s sharp rise of 14.91 percent. This sudden and powerful surge is not a mere short-term reaction- its roots lie in a major corporate development involving the Adani Group.

Adani Enterprises gets approval from CoC, triggers market optimism

The rally began after Adani Enterprises announced that it had received approval from the Committee of Creditors (CoC) for its resolution plan for Jaiprakash Associates (JAL). The company informed the stock exchanges that on November 19, the Resolution Professional had issued a Letter of Intent (LoI), formally approving the Adani Group’s proposal under the Insolvency & Bankruptcy Code (IBC).

This approval marks a major turning point for the struggling Jaypee Group, and investors believe it could reshape the operating environment for group entities, including JP Power.

Why is JP Power rallying so sharply?

Jaiprakash Power Ventures is intrinsically linked to Jaiprakash Associates, the flagship company of the Jaypee Group. JAL holds nearly a 24 percent stake in JP Power, making both companies structurally interconnected. With the likelihood of Adani Group’s entry into JAL, the market is betting on a spillover effect on JP Power.

Investor sentiment has strengthened on the belief that the Adani Group’s operational expertise, stronger financial discipline, and managerial capabilities could indirectly benefit JP Power. A potential improvement in group-level debt management and restructuring also raises hopes of long-term stability.

This has created what analysts refer to as a 'proxy rally'—where the stock rises in anticipation of an improved future because of developments in the parent or related company.

JP Power’s sharp surge is, therefore, not just a reaction to news, but a reflection of broader expectations that Adani’s involvement could bring structural and financial improvements across the Jaypee Group.

Disclaimer: This content is for informational purposes only and should not be considered financial advice. Market investments carry risks; readers should conduct independent research or consult a qualified advisor before investing.