GST evasion of about Rs 23,000 crore by gaming companies between April 2019 and November 2022 is being investigated by the tax officers, Minister of State for Finance Pankaj Chaudhary said on Monday.

In a written reply to a question in the Lok Sabha, the minister said the Enforcement Directorate has attached proceeds of crime of more than Rs 1,000 crore in several cases related to Cyber and Crypto assets frauds wherein online gaming etc have been used for siphoning the proceeds.

About evasion of Goods and Services Tax (GST), Chaudhary said Central Board of Indirect Taxes and Customs (CBIC) formations have initiated investigations against some gaming companies (including online gaming firms) located in India as well as abroad.

"The estimated evasion of GST by these companies works out of Rs 22,936 crore, relating to the period April 2019 to Nov. 2022," he said.

Besides, the Directorate of Enforcement is investigating several cases related to Cyber and Crypto assets frauds wherein online gaming etc. have been used for siphoning the proceeds.

In these cases, as on December 6, 2022, proceeds of crime of more than Rs 1,000 crore have been attached/seized/freezed under the provisions of the Prevention of Money Laundering Act, 2002 (PMLA). Also, 10 Prosecution Complaints (PCs), including 2 supplementary PCs, have been filed before the Special Court PMLA.

Further, assets amounting to Rs 289.28 crore have been seized under section 37A of the Foreign Exchange Management Act, 1999, the minister said.

To a query on whether the Income Tax Department has issued notices to many gaming companies for non-payment of tax, Chaudhary said the information is not available, since no specific identification code for online gaming entities is available in Income Tax Return.

"The disclosure of information about specific taxpayer is prohibited except as provided under section 138 of the Income Tax Act, 1961," he added.

Indian gaming firms under scanner for GST evasion of Rs 23,000 cr

Further, assets amounting to Rs 289.28 crore have been seized under section 37A of the Foreign Exchange Management Act, 1999.

PTIUpdated: Monday, December 12, 2022, 09:02 PM IST

Pixabay

RECENT STORIES

Tamil Nadu News: 4 Years After Exit, Ford Set To Revive Operations At Chennai Plant With...

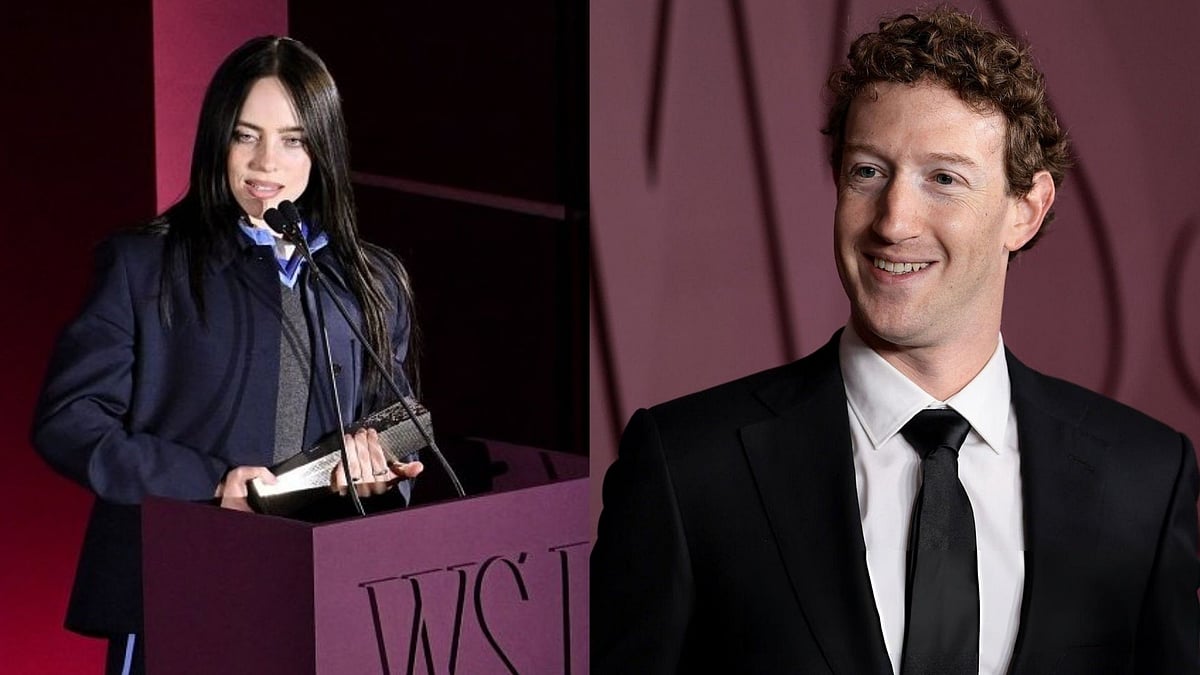

'Give Your Money Away Shorties': Singer Billie Eilish Boldly Asks Billionaires To Step Up; Mark...

Air India Completes First Phase Of Legacy Retrofit Programme, Upgrades 104 Airbus A320 Aircraft With...

Vedanta Q2 Profit Falls 38 Per Cent To ₹3,479 Crore On Exceptional Cost; Revenue Rises To...

GAIL Q2 Profit Falls 18 Per Cent To ₹2,823 Crore On Petrochemical Margin Pressure; Revenue Rises...