The shares of IIFL Securities Limited on Thursday is trading in red amid reports of market regulator SEBI investigation into Sanjiv Bhasin's alleged market manipulation.

The shares of the company at 12:25 pm IST were trading at 219.22, down by 4.05 per cent.

The drop in shares of the company is due to the recent reports that the market regulator is investigating Sanjiv Bhasin, a well-known market expert, for his alleged involvement in stock market manipulation.

This recent report of the SEBI's investigation has undoubtedly impacted investor sentiment, causing a dip in IIFL Securities’ stock.

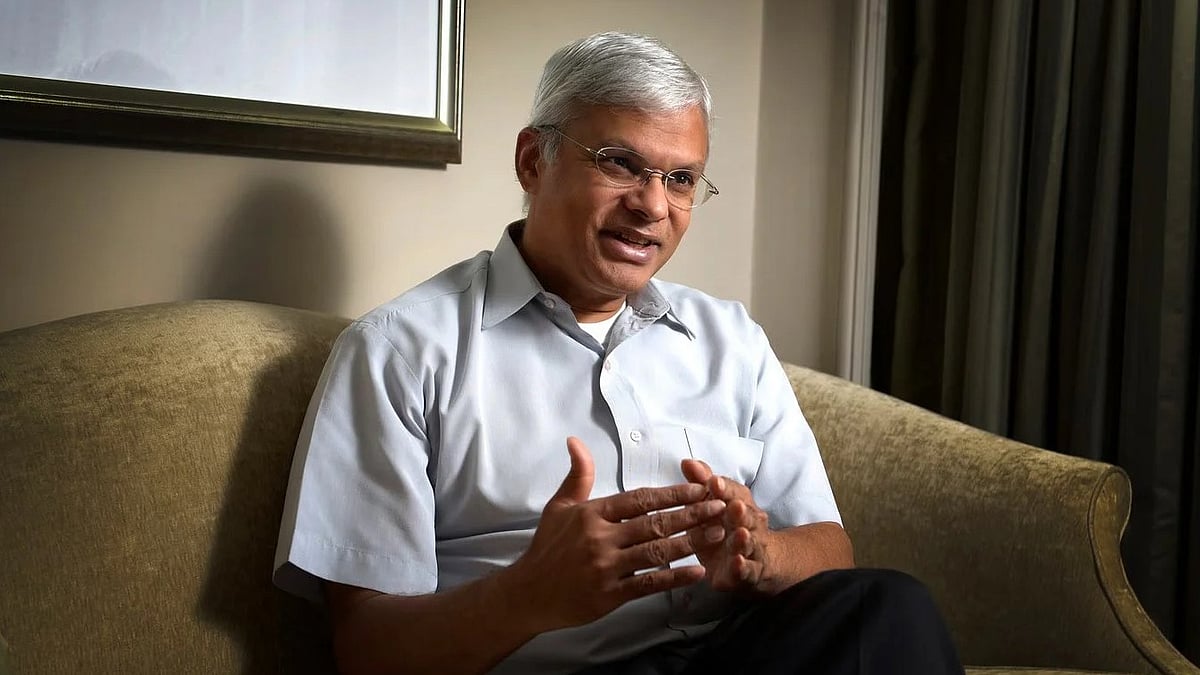

This drop in shares of the company is due to the recent reports that the market regulator is investigating Sanjiv Bhasin | Image: Wikipedia (Representative)

However, despite this recent dip, the company has had a strong performance this year, wit its stock surging over 55 per cent and outperforming the Nifty index, which surged by 9 per cent in the same period.

SEBI's Probe into Market Manipulation

The capital market regulator is reportedly investigating Bhasin, who is a consultant for IIFL Securities, for his alleged role in a pump and dump scheme, which means that this type of market manipulation involves artificially inflating the price of a stock to attract investors, , only to sell off the holdings once the price is high, leaving other investors with losses.

According to reports, the preliminary findings from the SEBI's investigation highlights digital records of Bhasin involvement in an elaborate 'pump and dump' scheme, purchasing specific stocks through a private company.

He then allegedly recommended these stocks on business news channels and digital media platforms, prompting traders to buy them and subsequently driving up their prices.