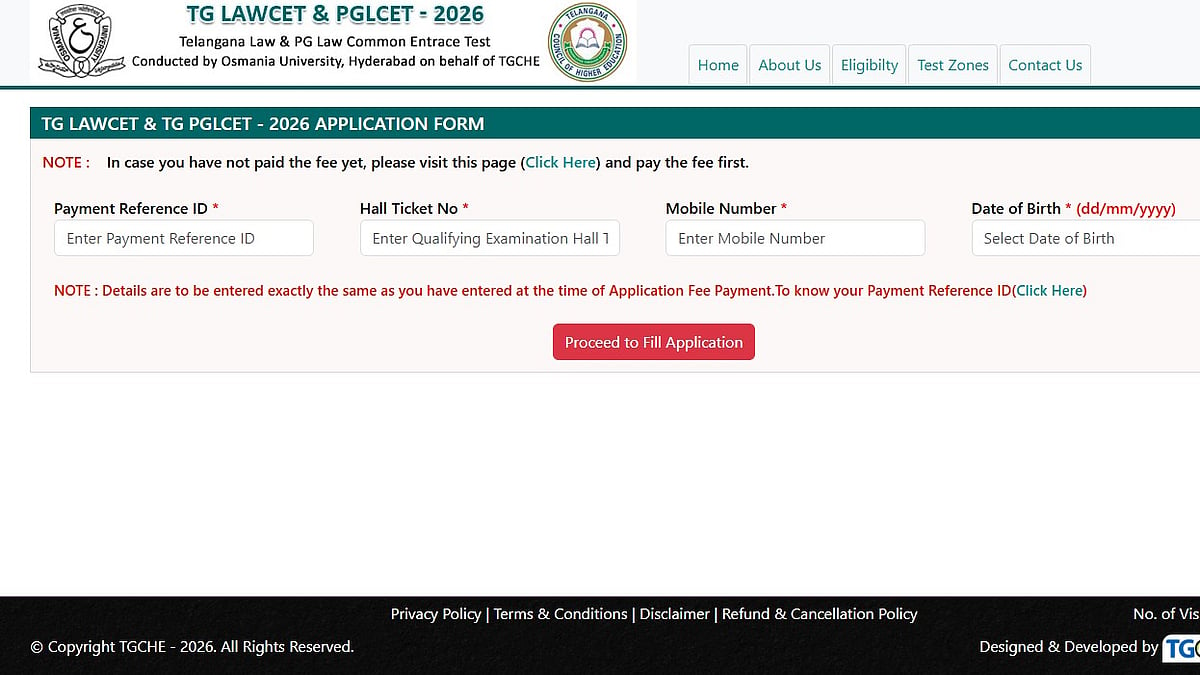

New Delhi : Dubbed by ousted chairman Cyrus Mistry as one of the Tata group’s ‘legacy hotspots’ that may lead to a writedown of Rs 1.18 lakh crore, Indian Hotels on Wednesday hit back saying its accounts and financial statements present “true and fair view” of the state of affairs, reports PTI. “The company has from time to time published its accounts and financial statements…We would like to reiterate that all such reports, accounts and financial statements present true and fair view of the state of affairs of the company and its business and at this stage the company has disclosed all material facts as required under applicable law,” Indian Hotels Co Ltd (IHCL) said in a clarification to the BSE.

Additionally, the company has employed vigorous process in preparation of all such accounts/financial statements, including detailed review by board of directors and respective committees, it added. In 2015-16, IHCL had a consolidated gross revenue of Rs 4,706.27 crore. It had a net loss of Rs 60.53 crore. For the first quarter ended June 30, 2016 the company had total income of Rs 946.63 crore and a loss of Rs 169.45 crore. Writing to the board of Tata Sons a day after he was removed on October 24, Mistry had clubbed IHCL along with Tata Motors’ passenger vehicle business, Tata Steel Europe, Tata Teleservices and Tata Power Mundra as ‘legacy hotspots’. He had said that “the capital employed in those companies has risen from Rs 1.32 lakh crore to Rs 1.96 lakh crore (due to operational losses, interest and capex)”. “This figure is close to the net worth of the group which is at Rs 1.74 lakh crore. A realistic assessment of fair value of these businesses could potentially result in a write down over time of about Rs 1.18 lakh crore,” Mistry had said in his letter.

Besides, Mistry had said that many foreign properties of IHCL and holdings in Orient Hotels have been sold at a loss. The onerous terms of lease for Pierre in New York are such that it would make it a challenge to exit. He lashed out at IHCL saying beyond flawed international strategy, it had acquired the Searock property at a highly inflated price and housed in an off-balance sheet structure. “In the process of unravelling this legacy, IHCL has had to write down nearly its entire net worth over the past three years. This impairs its ability to pay dividends,” he said.

IHCL, however, asserted that all required governance processes in respect of investment approvals, risk assessment have been considered by its board and its duly constituted committees from time to time. “In furtherance of such review, appropriate disclosures have been made by the company as required under applicable law. In our view, the board of directors has complied with its obligations under SEBI listing obligations and Disclosure Requirements, Regulations 2015,” the company added.

In yet another development government reiterated the point that it was keeping a “close watch” on the Tata-Mistry feud as developments at the USD 100 billion conglomerate could have implications for the economy, Minister of State for Finance Arjun Ram Meghwal said on Wednesday. The government, said Meghwal, who is also in charge of the Ministry of Corporate Affairs (MCA) – where corporate disputes eventually land up, will steer clear of the row as “it is an internal affair of Tata Sons”.

“The government has nothing to do with it,” the minister told PTI, adding that Tata is a USD 100 billion group and the developments can have implications for the economy. “We are keeping a close watch on the basis of whatever is coming in the media and whatever information we are getting from sources,” he added. Meghwal further said the matter has so far not been referred to MCA. “Nothing in writing has come to Ministry of Corporate Affairs.”

MCA looks after the affairs of non-listed companies while for listed firms, there is market regulator Sebi, he said. “Tata Group is a very big group and naturally has a bearing on the economy,” he said. “But so far there is nothing to be concerned about. There is no cause of alarm.”

Asked about the interest of state-owned Life Insurance Corporation which is among the biggest stakeholders in Tata Group firms, he said not just LIC but “lot of people are involved. There are concerns of investors, global investors because they have a major role in economy”.

“There is no need to be worried. Tata group itself is a respectable group and they will solve their internal issues themselves,” Meghwal said. “And if the issue comes up before the government and regulators, (they) will take action whatever rules are there. We are still keeping watch,” he added.

LIC owns 7 per cent in Tata Motors, 13.91 per cent in Tata Steel, 13.12 per cent in Tata Power and 8.76 per cent in Indian Hotels.

Cyrus Mistry, who was unceremoniously removed as Chairman last month, has sought a meeting with Finance Minister Arun Jaitley, possibly to explain his side of the story. But the finance minister has so far decided not to meet either side as the government does not want to get embroiled in the Tata Group turmoil.