New Delhi: The Enforcement Directorate (ED) has made serious allegations against the Sahara Group, claiming that the company misused money collected from millions of small investors. According to ED, Sahara used this public money to buy properties and later sold them off secretly through large cash transactions, violating financial laws.

On September 6, ED filed a chargesheet in a special PMLA court in Kolkata, naming Anil V Abraham, a senior executive of Sahara, and Jitendra Prasad Verma, a long-time property broker of the group. Both are currently in jail under judicial custody.

Ponzi-Like Schemes and Fraudulent Reinvestments

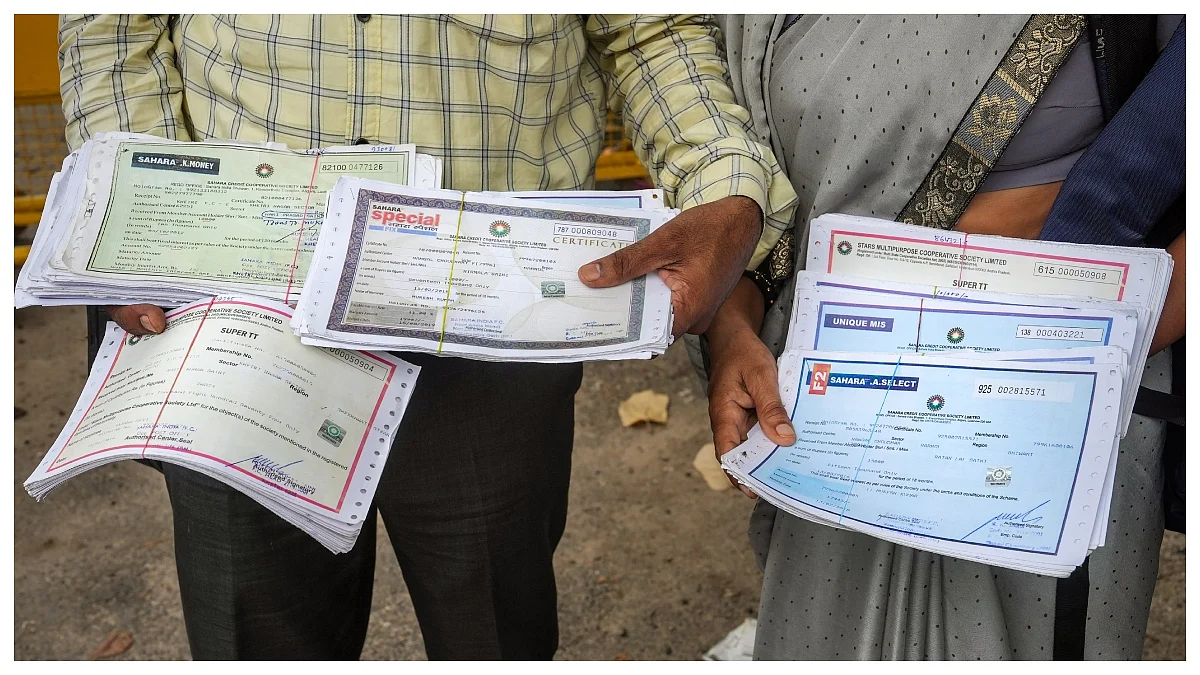

ED’s investigation found that Sahara was running what looked like a Ponzi scheme. The group collected money from investors promising returns, but instead of paying them back on maturity, they were forced to reinvest. Sahara also manipulated records to hide payment defaults, making it look like everything was in order.

ED also said that Sahara’s four cooperative societies were burdened with huge liabilities, even though they had no real financial strength. Still, they continued to collect money from new investors, using it for personal gains, loans, and to buy properties under other names (benami).

Supreme Court Allows Partial Refunds to Investors

In some relief for the victims, the Supreme Court on September 12 allowed the release of Rs 5,000 crore out of the Rs 24,000 crore held by SEBI for repaying Sahara investors. The court also extended the deadline for distribution of funds from December 31, 2025, to December 31, 2026, giving more time to return money to the rightful depositors.