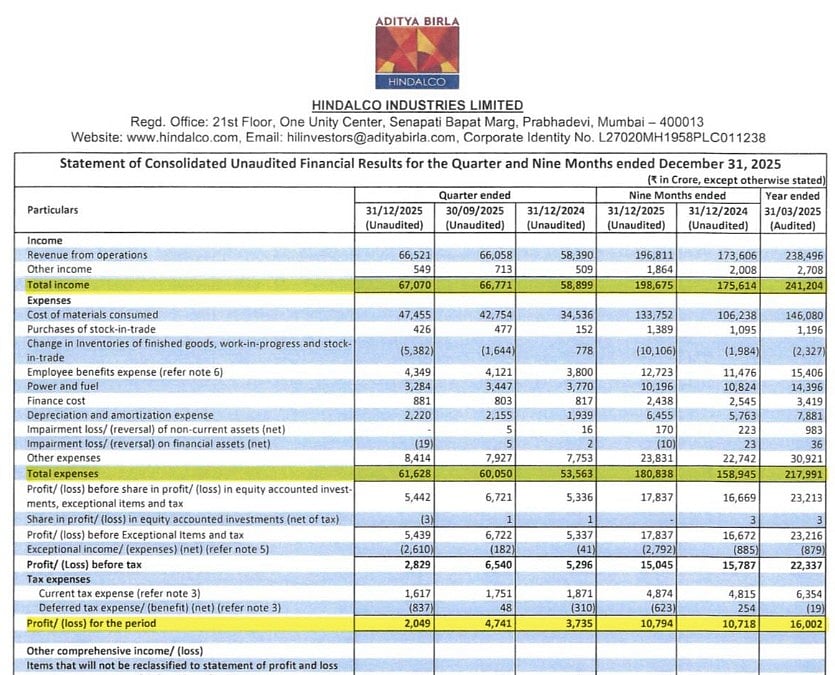

Mumbai: Hindalco Industries, the flagship metals company of the Aditya Birla Group, on Thursday reported a 45 per cent fall in its consolidated net profit for the December quarter (Q3 FY26). The company’s net profit declined to Rs 2,049 crore in the December quarter, compared with Rs 3,735 crore in the same period last financial year (Q3 FY25), according to its stock exchange filing.

Press Release |

On a sequential basis, profit after tax fell even more sharply by 57 per cent from Rs 4,741 crore reported in the September quarter (Q2 FY26). Despite the drop in profit, Hindalco’s revenue from operations increased 14 per cent year-on-year to Rs 66,521 crore during the quarter, up from Rs 58,390 crore a year ago. Compared to the previous quarter, revenue rose marginally by 0.7 per cent from Rs 66,058 crore. Hindalco said the decline in profit was mainly due to disruptions at the Oswego aluminium plant of its subsidiary Novelis in the United States.

The plant in Oswego, New York, faced two major fire incidents in the hot mill area, one on September 16, 2025, and another on November 21, 2025. Novelis Inc., which is headquartered in Atlanta, Georgia, is a wholly owned subsidiary of Hindalco. The company shared an update on these fire incidents on February 11. Before accounting for exceptional items, Hindalco’s consolidated profit after tax stood at Rs 4,051 crore, showing an 8 per cent increase year-on-year.

However, the company reported an exceptional item of Rs 2,610 crore, which significantly impacted the reported profit. Basic earnings per share also fell sharply, declining 45 per cent year-on-year to Rs 9.23 from Rs 16.82 in the corresponding quarter of the previous financial year. Commenting on the performance, Satish Pai, Managing Director of Hindalco Industries, said the company managed to sustain growth momentum despite global volatility.

He highlighted that the strong performance of the India business, which delivered an all-time high, helped offset the impact of global tariffs and the disruption at Oswego. He added that disciplined cost management and operational efficiencies across segments supported the company during the quarter.

Disclaimer: This story is from the syndicated feed. Nothing has been changed except the headline.