In case lockdown continues until mid-May 2020, there are chances that India will see negative growth of (-)2 to (-)3 per cent for the financial year 2020-2021.

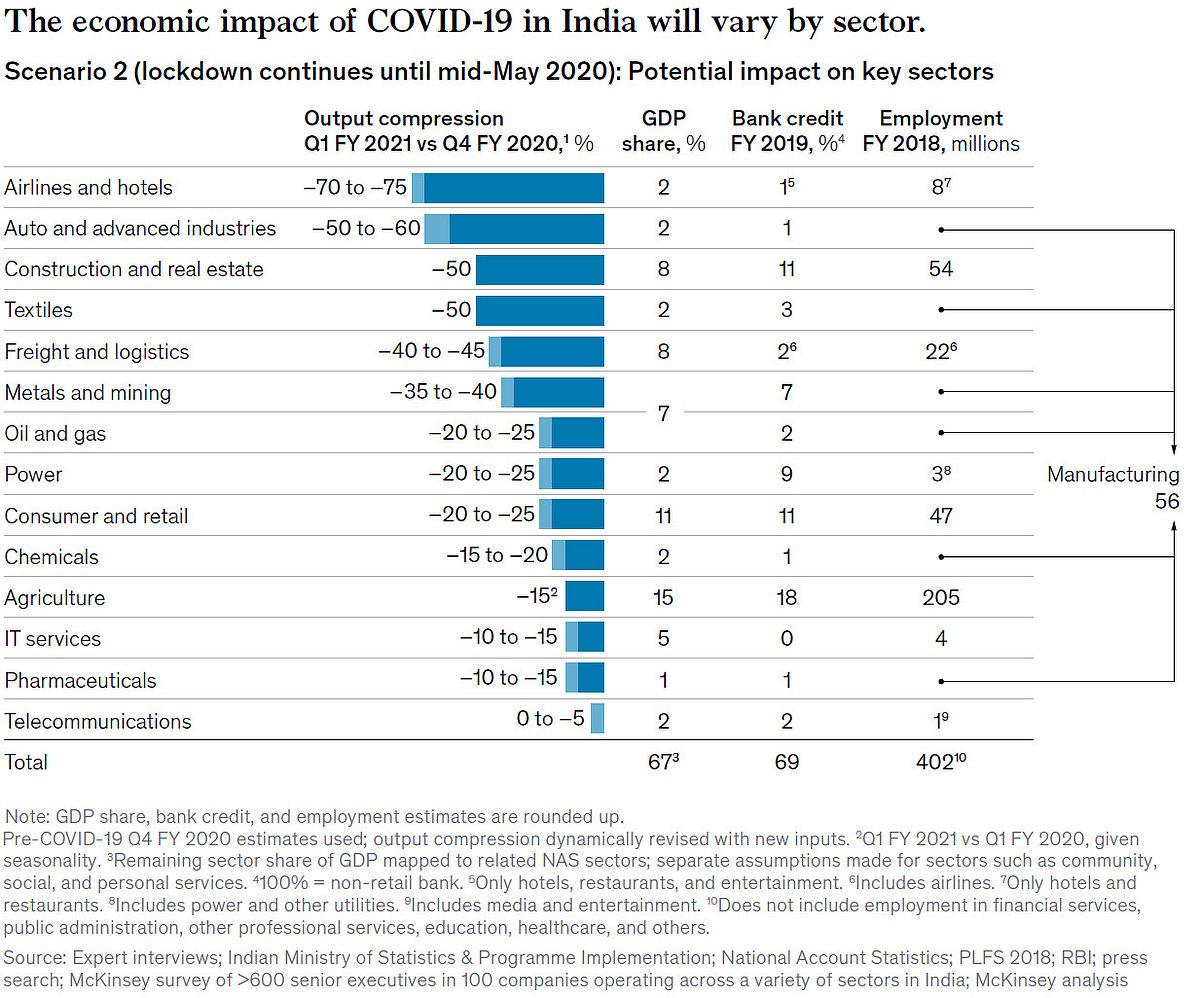

In this scenario, more than 50 per cent output compression will be seen in sectors like airlines and hotels; auto and advanced industries; construction and real estate; and textiles in the first quarter (Q1) of 2021 compared to the fourth quarter (Q4) of 2020, suggested McKinsey. But the telecommunications sector may come out safe.

In the report by McKinsey, it was stated that airlines and hotels will see a slump of 70-75 per cent in the first quarter (Q1) of 2021 compared to the fourth quarter (Q4) of 2020. In the same period, auto and advanced industries will witness a decline of 50-60 per cent. Meanwhile, construction and real estate; and textiles will see businesses shrink to half in Q1 of 2021 compared to Q4 of 2020.

The lowest impact will be felt in the telecommunications sector, a drop of maybe a mere five per cent or no drop at all. Other sectors that will see low impact are IT-enabled services and pharmaceuticals. It is stated, “Strained debt- service-coverage ratios would be anticipated in the travel, transport, and logistics; textiles; power; and hotel and entertainment sectors.”

The consulting firm also pointed out that there could be solvency risk within the Indian financial system. It claimed that almost 25 per cent of MSME and small- and medium-size-enterprise (SME) loans could slip into default, compared with 6 per cent in the corporate sector (although the rate could be much higher in aviation, textiles, power, and construction) and 3 per cent in the retail segment (mainly in personal loans for self-employed workers and small businesses).

Liquidity risk would need urgent attention. For the survival and revival of these sectors, the consulting firm suggested the Indian government will have to come up with a stimulus package that is more than 5 per cent of GDP or more than Rs 10 lakh crore (exceeding $130 billion).