The number of cyberfraud incidents is rapidly rising. Thousands of cases of financial fraud or fraud involving digital payments are reported each day to cybercrime cells.

According to data on the Statista website, there have been almost 4.8 thousand instances of online banking fraud reported in India in 2021.

RBI report also reported frauds

According to another report by the RBI that the Minister of State for Finance shared in the Lok Sabha, Scheduled Commercial Banks (SCBs) reported frauds against the Indian public in the category "Card/Internet- ATM/Debit Cards, Credit Cards, and Internet Banking" in the fiscal year 2021–2022.

While there are a number of ways that fraudsters can defraud people of their money, phishing SMS is one of the most popular methods.

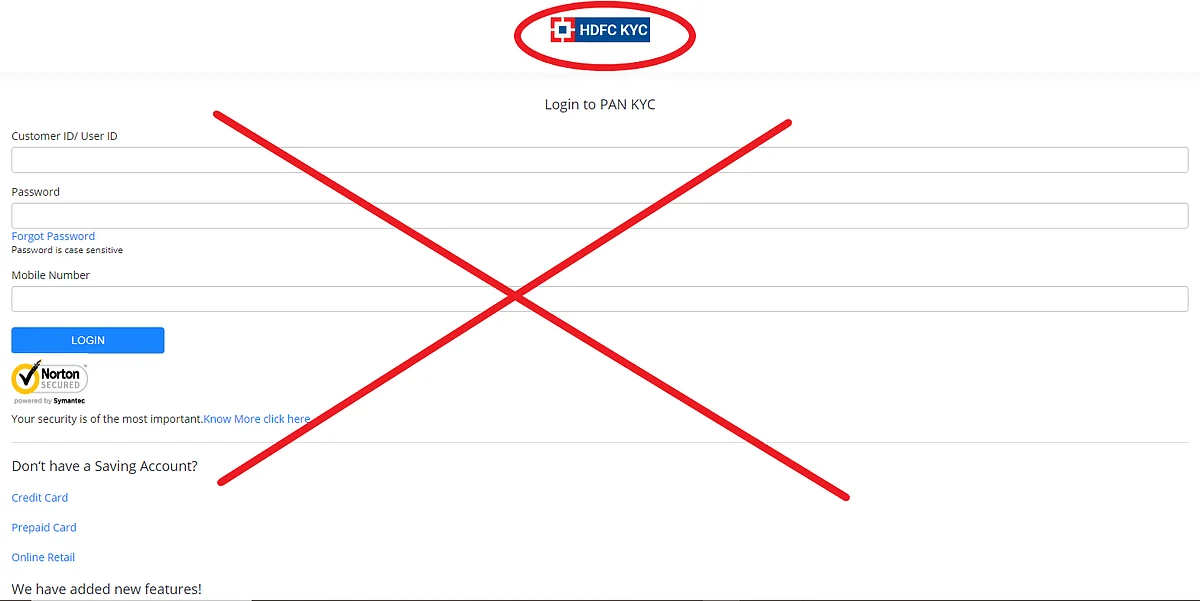

Cybercriminals frequently use the phishing bank SMS technique, in which they terrify victims by telling them that their bank accounts have been suspended and requesting that they update their KYC or PAN by clicking on the link provided in the SMS.

But, if someone clicks on the link after being duped into believing the SMS, their phone will be hacked, and they will lose their money.

HDFC recently warned its customers

Phishing SMS fraud is extremely prevalent, and several banks have issued a warning to customers not to believe such SMS. Even HDFC recently warned its clients about this fraud after some of its users reported it after receiving a popular HDFC bank SMS on their phone.

Phishing texts

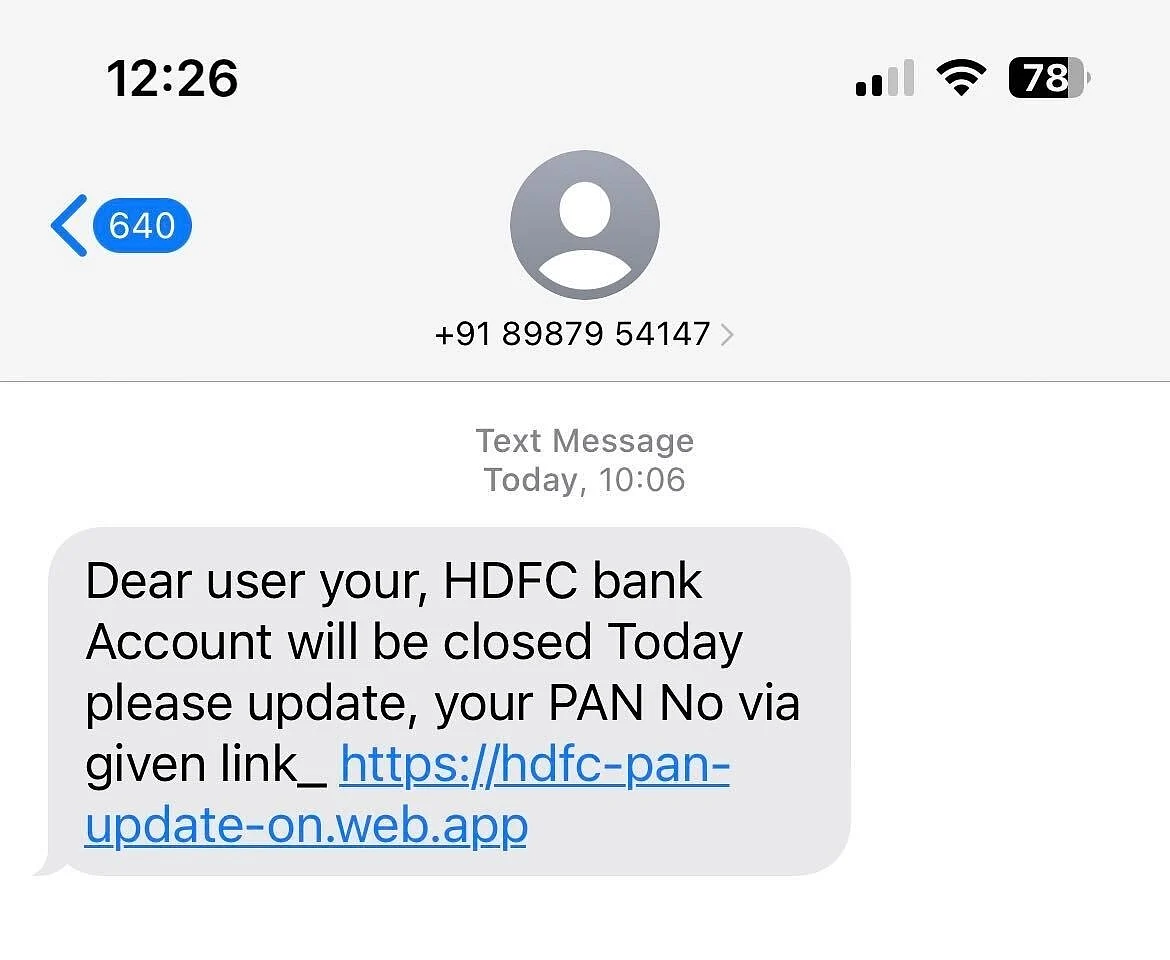

One of the phishing SMSes shared on Twitter by user Gaurav Ali, reads, " Dear customer, your HDFC NetBanking has been blocked today. Please update your pan card immediately. clik the link..." and the message is followed by a link.

Another user replied to this tweet and shared a SMS where he was asked to update his KYC. The SMS he received reads, "Dear user your, HDFC bank Account will be closed Today please update, your PAN No via given link_... ", followed by the link.

Customers who received the SMS have been tweeting about it. Some more tweets from users:

How to identify fraudulent texts

Alerting them about the phishing scam, HDFC Bank care replied to tweets and wrote, "Hi, we request you not to respond to unknown numbers asking for Pan Card / KYC update or any other banking information. HDFC Bank will always send messages from their official ID hdfcbk / hdfcbn and links in these messages will always be under http://hdfcbk.io."

HDFC bank further wrote, "HDFC Cares domain. Remember, bank will never ask for PAN details, OTP, UPI, VPA / MPIN, Customer ID & Password, Card No, ATM PIN & CVV. Please do not share your confidential details with anyone! -Anay, Service Manager."

HDFC responded to another user on Twitter, regretting for the inconvenience caused.

Legitimate banks will never request your sensitive login information or send you unsolicited communications. Never answer a suspicious SMS or request.

The most critical rule is to never divulge sensitive information like your account or card numbers, OTP, CVV, or personal identification numbers. The most typical SMS sent to deceive unknowing or innocent persons involve PAN cards and KYC.

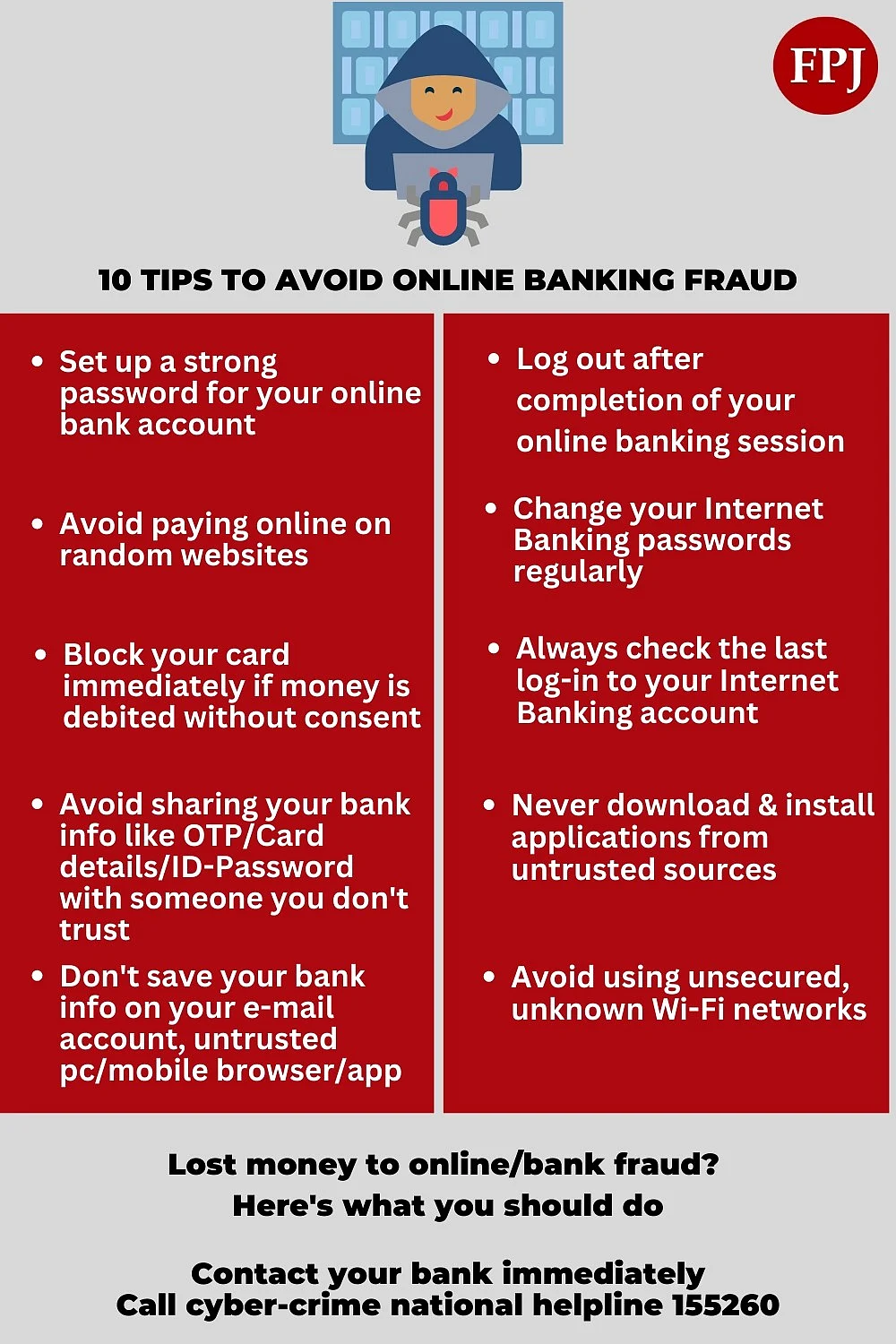

How to avoid being cheated by a phishing bank SMS

- Never give out personal information, such as an OTP, bank information, a mobile number, or anything else, via SMS or an unauthorized call.

- Always use secure passwords for your mobile phone, internet banking, and UPI. Additionally, change your passwords regularly.

- Before acting on any SMS request, you should always check the sender's identity. Contact the bank manager if you receive bank alerts or report the SMS.

- Enable two-factor authentication for online banking. You must therefore enter your password and OTP each time you access your account. You can even use a biometric, such as your fingerprint, as a second password to verify strangers.

- You can see that non-secure links are included in SMS like the one we shared above, and even the English would be poor with multiple errors and poor punctuation marks.

Always check for such details and avoid clicking the link. It would be safe to delete such messages if you have received one.