The government wants power sector lenders Power Finance Corporation (PFC) and the Rural Electrification Corporation (REC) to place their nominees in the boards of state utilities of concern.

This is being done in order to facilitate turnaround of the operations of loss-making discoms and ensure financial discipline.

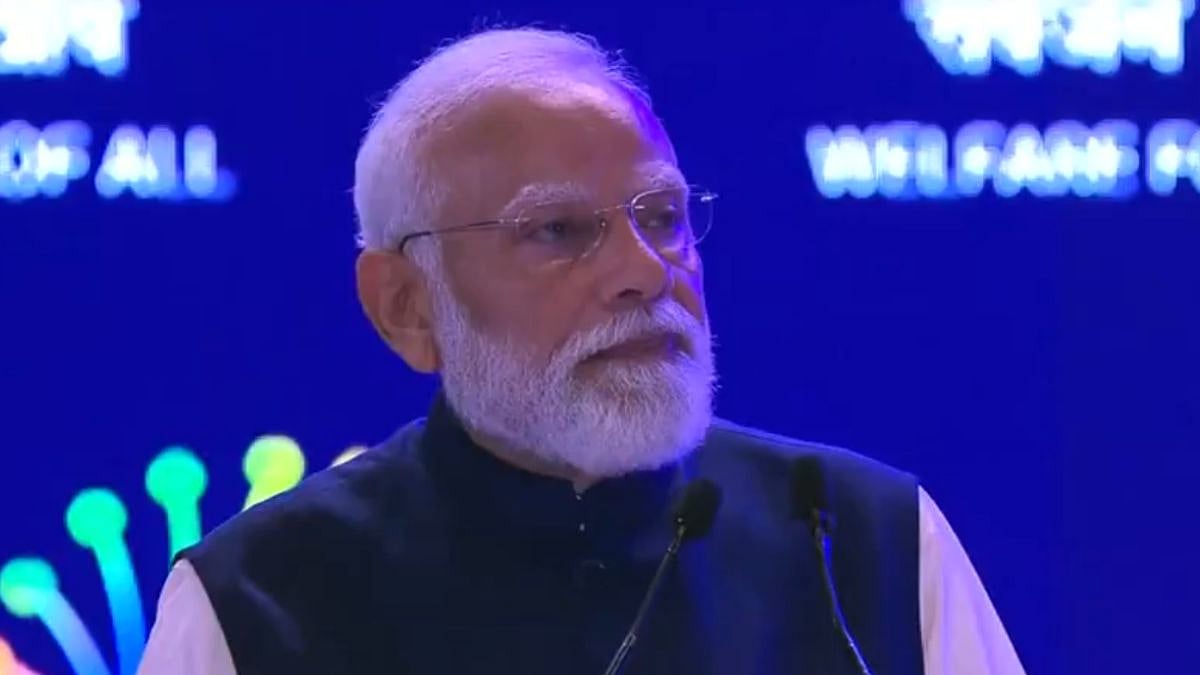

At a review meeting to gauge performance of the PFC and the REC, Union Power and New and Renewable Energy Minister R.K. Singh said that both organisations should establish the presence of their nominees in the Board of Directors of discoms of concern as a remedial measure to protect their finances.

Though under the existing insolvency and bankruptcy provisions, lead lenders are permitted to secure their position in the boards of companies they have funded, it is seldom used prior to companies becoming bankrupt.

Seeing the situation that exists in other sectors, the Power Ministry wants its lenders to secure their funds in discoms through active participation in overall management of the state utilities.

The minister also asked power sector financiers to make efforts to reduce their cost of funds. In this context, he advised them to explore better and cheaper options for raising funds, including from offshore sources, with an overall objective of ensuring that the power sector value chain gets access to cheaper funds.

For this, he directed the PFC and the REC to carry out a strategic analysis to adapt to the changed business environment in the sector with an overall objective to deliver power to consumers at a reasonable cost.

The minister also stressed upon the need for speedy resolution of stressed assets, and suggested a slew of measures to both the organisations in this context, which includes ensuring that the stressed assets are resolved at a fair value with a minimal haircut for the two, and in line with the national interests. He emphasised both the PFC and the REC must increase their outreach by establishing a physical presence across the country.

Singh said that the system of oversight on the projects funded by the PFC and the REC should also be tightened, which includes increasing frequency of inspections by the company officials as well as by hiring expert professionals from the market. He also laid emphasis on strengthening the risk management framework of both the institutions.