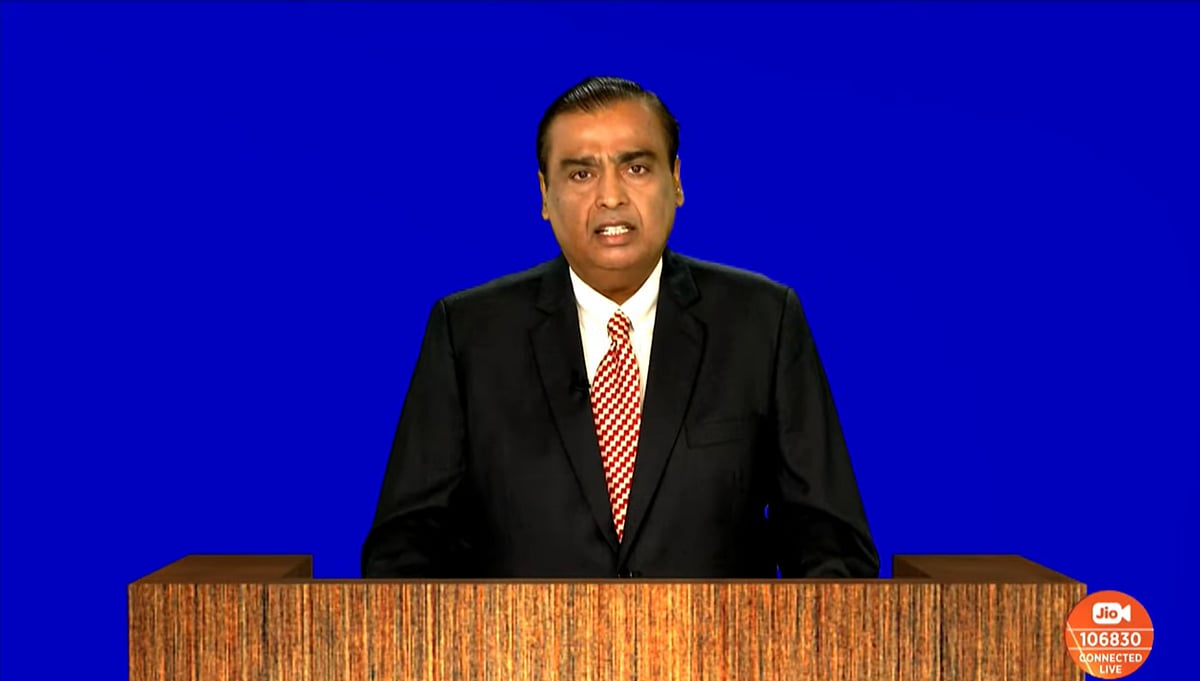

On Wednesday, Reliance Industries Limited (RIL) signed a binding partnership with Google to pick up 7.7 percent stake in Jio platforms for an investment of Rs 33,737 crore, said RIL Chairman Mukesh Ambani on Wednesday.

"We are delighted to welcome Google as a strategic investor in Jio Platforms. We have signed a binding partnership and an investment agreement under which Google will invest Rs 33,737 crores for a 7.7 per cent stake in Jio Platforms," RIL Chairman Mukesh Ambani said at the company's annual general meeting.

With this deal, Reliance has sold 32.84 per cent stake in Jio Platforms Ltd - the unit that houses India's youngest but largest telecom firm Jio Infocomm and apps. In total, Jio has raised Rs 1,52,055.45 crore.

Google, which is the 13th marquee firm to have set a sight on India's hottest digital play in 12 weeks, values Jio Platforms at Rs 4.36 lakh crore. This is less than Rs 4.91 lakh crore value at which last investor, Qualcomm had invested just last week.

Proceeds from the stake sales in Jio Platforms, along with the Rs 53,124 crore raised in a rights issue in June and sale of a 49 per cent stake in its fuel retail network to BP last summer for Rs 7,629 crore will help the company become net debt-free, Ambani said.

This debt-free status will be in place after the promised funds come in (75 per cent of the funds from the rights issue will come in next year).

Reliance had a net debt of Rs 1,61,035 crore as on March 31, 2020.

Here's a look at all the investors so far;

1. Facebook: It all started on May 22 when Jio announced that Facebook is acquiring 9.99 per cent stake in the company. The transaction is valued at Rs 43,573.62 crore. This deal will be completed through a new entity Jaadhu Holdings, according to regulatory documents.

2. Silver Lake Partners: Technology investing firm, Silver Lake, has over USD 43 billion in combined assets under management and committed capital. It decided to buy 1.15 per cent stake for Rs 5,655.75 crore. This announcement of this deal was made on May 3.

3. Vista Equity Partners: On May 8, the US-based private equity firm announced that it will pick up 2.32 per cent stake for Rs 11,367 crore. This 2000-founded company focuses on financing and forwarding software and technology-enabled startup businesses, as well as passive equity investment.

4. General Atlantic: It is a 40-year company, headquartered in New York. On May 17, the private equity firm announced investment of Rs 6,598.38 crore in Jio by picking up 1.34 per cent stake in the platform.

5. KKR: American global investment firm, KKR & Co, has bought 2.32 per cent stake for Rs 11,367 crore. This firm announced the investment in the digital arm of Reliance on 22 May.

6. Mubadala: Abu Dhabi-based sovereign investor Mubadala Investment Company invested Rs 9,093.60 crore to acquire 1.85 per cent stake.

7. Silver Lake: Private equity firm Silver Lake has invested an additional Rs 4,546.80 crore in Reliance Industries' digital arm Jio Platforms to raise its stake in the firm to 2.08 per cent.

8. ADIA: Jio Platforms raises Rs 5683.50 crore from Abu Dhabi Investment Authority (ADIA), the largest investment arm of the government of Abu Dhabi, by selling a 1.16% stake. The investment pegs Jio Platforms’ equity value at Rs 4.91 lakh crore and enterprise value at Rs 5.16 lakh crore. With the latest tranche, parent Reliance Industries stands to get Rs 97,885.65 crore from the seven investors in exchange for 21.06% stake, the group said in a statement Sunday.

9. TPG: Reliance Industries and Jio Platforms announced that US-based alternative asset firm TPG would be buying a 0.93% equity stake in Jio Platforms on a fully diluted basis. TPG will invest Rs. 4,546.80 crore in Jio Platforms at an equity value of Rs. 4.91 lakh crore and an enterprise value of Rs. 5.16 lakh crore.

10. L Catterton: Reliance Industries Limited and Jio Platforms Limited announced an investment of Rs 1894.50 crore by L Catterton, one of the world's largest consumer-focused private equity firms.

"This investment values Jio Platforms at an equity value of Rs 4.91 lakh crore and an enterprise value of R 5.16 lakh crore. L Catterton's investment will translate into a 0.39 per cent equity stake in Jio Platforms on a fully diluted basis," a RIL release said.

11. The Public Investment Fund (PIF): PIF had announced an investment of ₹ 11,367 crore. This investment values Jio Platforms at an equity value of ₹ 4.91 lakh crore and an enterprise value of ₹ 5.16 lakh crore. PIF’s investment will translate into a 2.32% equity stake in Jio Platforms on a fully diluted basis.

12. Intel Capital: Electronic chip maker Intel's investment arm, Intel Capital, will buy 0.39 per cent stake in billionaire Mukesh Ambani's digital unit, Jio Platforms, for Rs 1,894.50 crore. "Intel Capital will invest Rs 1,894.50 crore in Jio Platforms at an equity value of Rs 4.91 lakh crore and an enterprise value of Rs 5.16 lakh crore. Intel Capital's investment will translate into a 0.39 per cent equity stake in Jio Platforms on a fully diluted basis," Reliance Industries and Jio Platforms said in a joint statement.

13. Qualcomm: Reliance Industries Limited and Jio Platforms Ltd. announced that the world's leading wireless technology innovator "Qualcomm" is committed to invest up to Rs 730 crore in Jio Platforms to bolster Jio's initiatives towards building an advanced digital platform for Indian consumers. As per the press-release by Reliance-Jio, Qualcomm Ventures' investment will translate into 0.15 per cent equity stake in Jio Platforms on a fully diluted basis. The investment will be at an equity value of Rs 4.91 lakh crore and an enterprise value of Rs 5.16 lakh crore.

14. Google: Google has agreed to invest Rs 33,737 crore to buy a 7.7 per cent stake in Reliance Industries' technology venture, adding to a slew of investments since April that has crossed Rs 1.52 lakh crore.