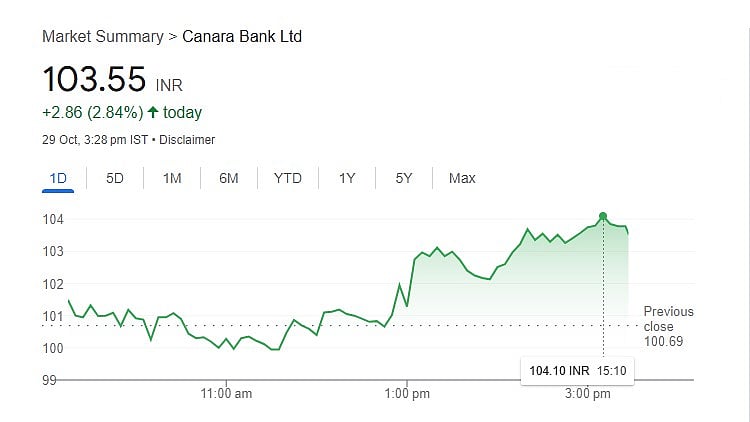

Canara Bank shares climbed more than 3 per cent after declaring Q2 FY25 earnings, which declared net profit surged 11 per cent for period under review. The touhced a day high level of Rs 104.14 per share on the NSE (National Stock Exchange).

The stock was surging after hitting the opening bell at Rs 101.50 on NSE; it surged 3.5 per cent when it touched the day high level of Rs 104.14 per share on NSE (National Stock Exchange).

The stock was currently trading at Rs 103.55 per share on the indian bourses with a 2.84 per cent upswing amounting to Rs 2.86 per share.

Canara Bank Q2 FY25

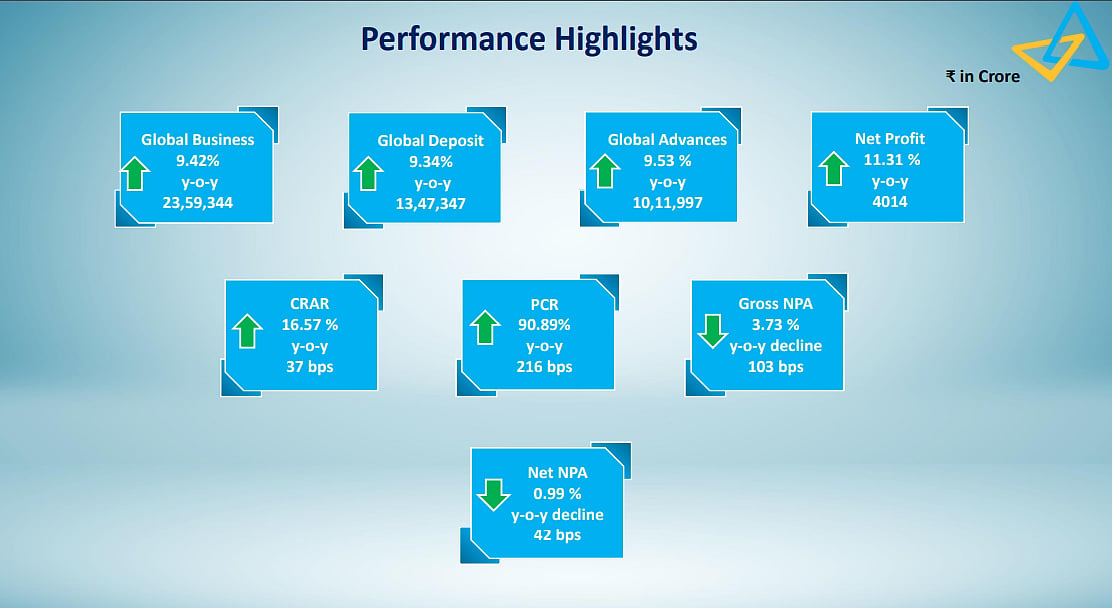

The net profit of the state-run Canara Bank increased by 10 per cent to Rs 4,188 crore for the quarter that ended in September 2024. In the same period last fiscal year, the post-tax profit was Rs 3,798 crore.

In the second quarter of the current fiscal year, total income climbed 10.3 per cent to Rs 34,721 crore from Rs 31,472.1 crore in the same period last year.

Net interest income and margin

In the quarter under review, the bank earned Rs 29,740.07 crore in interest, nearly 11 per cent more than the Rs 26,837.68 crore it earned in the same quarter of the prior fiscal year.

Advances and deposits

The bank's domestic deposits increased 8.34 per cent year over year to Rs 12,38,713 crore during the reviewed quarter. However, gross domestic advances increased 8.64 percent year over year to Rs 9,54,149 crore.

As of September 2024, the retail lending portfolio had grown by 31.27 per cent YoY to Rs 1,94,556 crore, while RAM (retail, agriculture, and MSME)) credit had increased by 11.54 per cent YoY to Rs 5,76,589 crore. At Rs 99,452 crore, the housing loan portfolio grew 12.29 per cent year over year.