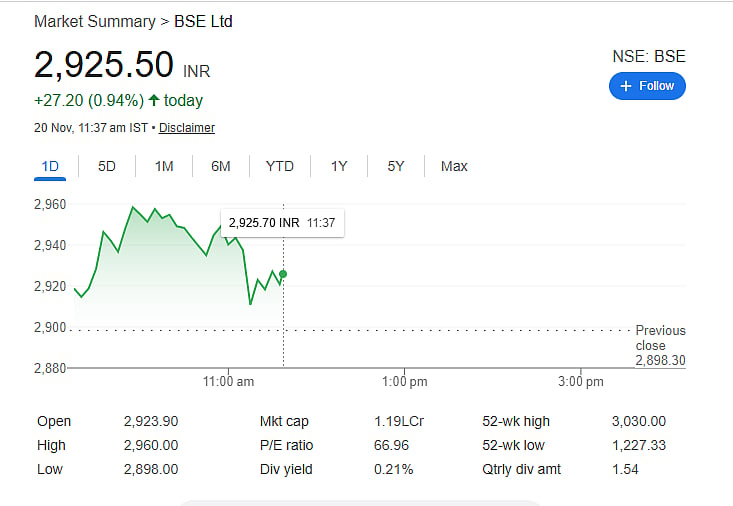

Mumbai: Bombay Stock Exchange (BSE) Ltd. shares continued their upward momentum on Thursday, 20 November, gaining nearly 2 percent intraday. This marks the third straight month of sustained gains for the stock. Over the past three days alone, BSE has climbed 5 percent, and it has logged gains in six out of the last nine trading sessions.

Close to its all-time high after strong recovery

With the latest surge, BSE’s stock is now inching closer to its all-time high of Rs 3,030, a level it had last touched on 10 June this year. Following that peak, the stock witnessed a sharp decline over the next three months, slipping to around Rs 2,000. This correction was primarily driven by market concerns regarding possible changes to the weekly options expiry cycle, an issue flagged by SEBI.

However, the sentiment has since reversed, with the stock making a robust comeback as regulatory worries ease.

Government and SEBI’s reassurances calm the market

Recent statements by Finance Minister Nirmala Sitharaman and SEBI Chairman Tuhin Kanta Pandey helped cool fears surrounding potential reforms in the derivatives (F&O) segment.

On 6 November, during the SBI Banking and Economics Conclave, the Finance Minister clarified that the government has no intention of shutting down the F&O segment.

Echoing this, SEBI’s Chairman stated at the CNBC-TV18 Global Leadership Summit that the derivatives segment is functioning well and that any future changes, if required, would be implemented only after public consultation.

These assurances restored investor confidence, sparking a renewed rally in BSE shares.

Strong rally over months, supported by easing F&O concerns

From its 26 September low of Rs 2,021, the stock has staged a remarkable 50 percent rebound. It gained 21.5 percent in October and has risen 19.5 percent so far in November, making this month BSE’s second-best in 2025. The best month so far has been April, when the stock surged 26 percent.

Analysts’ outlook and long-term performance

BSE is currently tracked by 16 analysts, of whom 10 recommend a ‘Buy’, five suggest ‘Hold’, and one advises ‘Sell’.

The stock has also shown extraordinary multi-year performance—rising 66 percent in 2025 so far, 139 percent in 2024, and more than quadrupling in 2023.

On Thursday, it traded around Rs 2,956, up nearly 2 percent.

Disclaimer: This content is for informational purposes only and should not be considered financial advice. Market investments carry risks; readers should conduct independent research or consult a qualified advisor before investing.