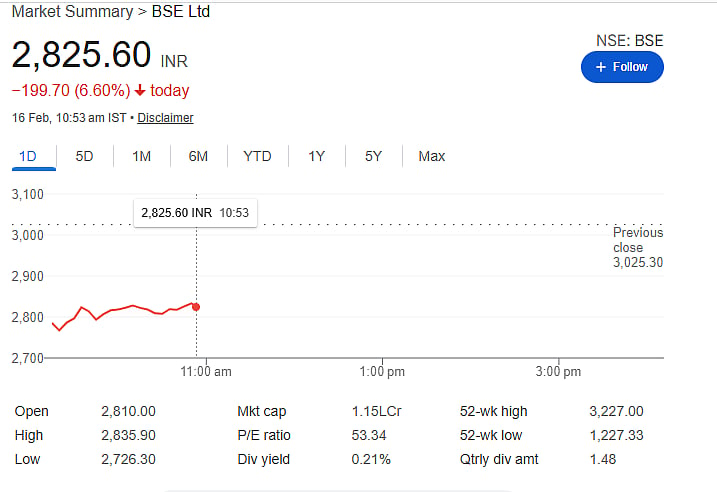

Mumbai: Shares of BSE and other capital market companies fell sharply on February 16 after the Reserve Bank of India (RBI) tightened rules on bank lending to brokers and market intermediaries.

BSE and other stocks in the sector declined between 2 percent and 10 percent. At around 10:15 am, the Nifty Capital Markets index was down nearly 2 percent. Angel One fell about 4 percent, while Groww slipped 3.5 percent.

The fall came after the RBI issued revised lending norms on February 13.

What Has RBI Changed?

Under the amended rules, banks cannot give loans to brokers for buying securities on their own account, including for proprietary trading. Only limited market-making activities are allowed.

Brokers must now provide 100 percent collateral against loans used for proprietary trading. A large part of this collateral must be in cash form.

The circular clearly states that banks cannot finance brokers for proprietary trades or investments on their own books.

The new rules will come into effect from April 1.

Why Is This Important?

Proprietary trading means a company trades using its own money instead of clients’ funds. According to Jefferies, such trading accounts for nearly 50 percent of equity options premium turnover.

Jefferies said BSE could face up to a 10 percent impact on earnings due to lower proprietary trading activity.

Devarsh Vakil of HDFC Securities said the tighter rules will increase costs for brokers and reduce leverage and liquidity in the derivatives market. Proprietary desks contribute around 40 percent of futures and options turnover.

Industry participants said proprietary and arbitrage desks help maintain liquidity and reduce price gaps in markets. They play a key role in cash-futures and options trading.

Impact On Broking Firms

Analysts at JM Financial said Angel One may need to review its margin trading funding model. Groww may need to raise fresh funds from the market.

The new rules, along with the recent hike in transaction tax on equity derivatives, may reduce trading volumes. Regulators have been trying to cool the derivatives market after many retail investors faced losses.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Stock market investments are subject to risk. Investors should consult a qualified financial adviser before making any decisions.