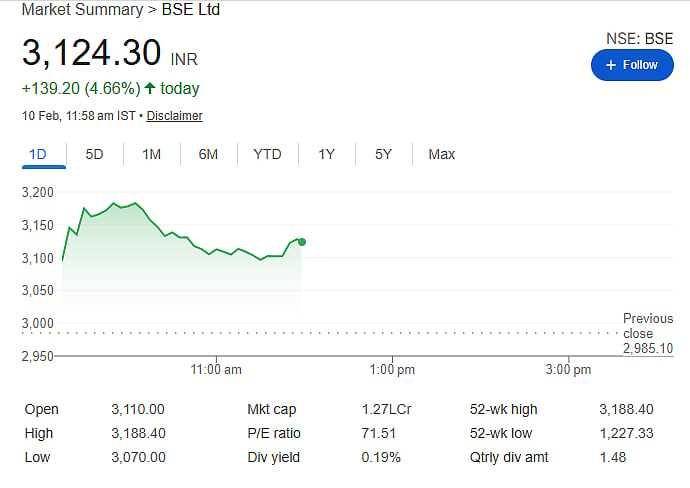

Mumbai: Shares of BSE Ltd jumped nearly 7 percent on February 10 after the company announced strong Q3 earnings. The stock rose 6.81 percent to Rs 3,188.40, touching its 52-week high during morning trade.

After this sharp rise, BSE’s total market value increased by about Rs 8,292 crore. The company’s market capitalisation reached around Rs 1.30 lakh crore. The rally shows strong investor confidence after the earnings announcement.

At the same time, the broader market also remained positive. The NSE Nifty index rose 100 points, or about 0.39 percent, showing overall market strength.

Profit nearly triples in Q3

BSE reported consolidated profit of Rs 602 crore for the December 2025 quarter. In the same quarter last year, the company had posted a profit of Rs 220 crore. This means profit has nearly tripled year-on-year.

The strong performance came mainly from higher trading activity and more business across segments. BSE said growth was driven by equity derivatives trading, new company listings and higher mutual fund transaction volumes.

Revenue hits all-time high

The exchange reported total revenue of Rs 1,334 crore in Q3. This is 61 percent higher than Rs 829 crore reported in the same period last year.

The company also said this is its 11th consecutive quarter of record performance. This shows steady business growth and strong demand across its trading and transaction platforms.

What is driving the growth

Rise in derivatives trading: More investors are trading futures and options, which generates higher transaction income.

Strong listing pipeline: More companies are choosing to list on exchanges, helping increase listing fees and activity.

Mutual fund transaction growth: Retail participation in mutual funds continues to increase, helping exchange transaction volumes.

Outlook for BSE

Market experts believe exchange stocks may stay strong if trading volumes remain high. Growth in retail investors, derivatives trading and capital market activity could support future earnings. However, stock prices may remain volatile based on overall market conditions.

Disclaimer: This content is for informational purposes only. It is not investment advice. Stock market investments are subject to risks. Please consult a financial advisor before making investment decisions.