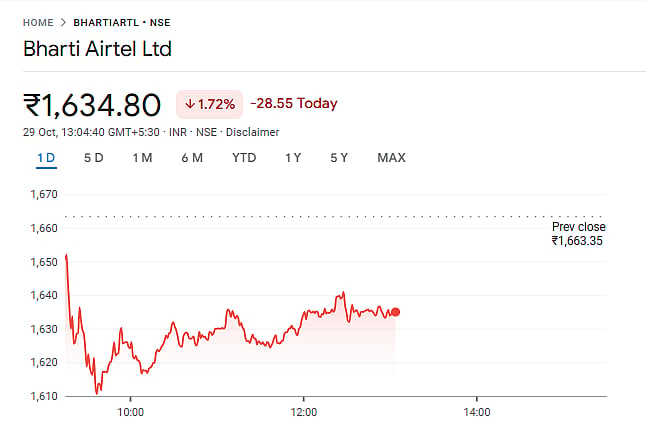

Business tycoon Sunil Mittal-led Bharti Airtel and India's second-largest telecom operator in the competition of telecom race on Tuesday (October 29), saw its shares continue to decline for a seventh consecutive session.

The shares of the company slipped by 3.18 per cent to hit Rs 1,610 at its lowest, in the early hours of trading.

The sharp decline in the company's shares comes in contrast to the financial performance Airtel reported just a day prior. Although, the company reported a positive result for the Q2FY25, but, investors seemed unpersuaded, as the results fell slightly below market expectations.

The stock opened on Tuesday at Rs 1,650.50 and rose to an intraday high of Rs 1,667.95 before settling down.

By 12:30 pm IST, the shares were trading at Rs 1,632.25, marking a decline of 1.87 per cent from Monday’s close. This ongoing slump has brought Bharti Airtel’s market cap to approximately Rs 9.78 lakh crore.

Financial Highlights

The telecom giant on Monday (October 28) posted a consolidated net profit of Rs 3,593 crore for Q2FY25, a 168 per cent surge year-on-year (YoY)

Airtel's quarterly consolidated revenue reached Rs 41,473 crore, up 12 per cent YoY. In the India segment alone, quarterly revenue grew by 16.9 per cent to Rs 31,561 crore, fueled by higher mobile revenues.

Despite these positive indicators, investors were concerned about the Rs 318 crore exceptional loss in the quarter, which played a role in the results missing some analyst estimates.

Image used for representational purposes only |

The telecom giant’s EBITDA for the quarter rose by 12 per cent to Rs 22,021 crore with an EBITDA margin increase from 52.7 per cent to 53.1 per cent.

For investors, the recent decline in the company's stock may raise some question about the disconnect between the company’s financial performance and the market’s lukewarm response as well.

With Airtel’s shares hovering below their 52-week high of Rs 1,779, whether the stock can regain momentum will likely depend on broader market dynamics and how the company’s future growth strategies play out.