New Delhi: The unified payments interface (UPI) saw 29 per cent transaction count growth (year-on-year) at 21.63 billion in the month of December — along with registering 20 per cent annual growth in transaction amount at Rs 27.97 lakh crore, the National Payments Corporation of India (NPCI) data showed on Thursday.

Month-wise, the UPI transaction count as well as amount grew significantly too.

Average daily transaction amount in December stood at Rs 90,217 crore, up from Rs 87,721 crore in November, the NPCI data showed.

The month of December recorded 698 million average daily transaction counts, up from 682 million registered in November.

In November, the UPI saw 32 per cent transaction count growth (year-on-year) at 20.47 billion — along with registering 22 per cent annual growth in transaction amount at Rs 26.32 lakh crore.

Meanwhile, monthly transactions via instant money transfer (IMPS) stood at 6.62 lakh crore in December, up 10 per cent on-year and increased from 6.15 lakh crore in November.

The IMPS transaction count came at 380 million, up from 369 million in November. Daily transaction amount via IMPS stood at Rs 21,269 crore, up from Rs 20,506 crore in November.

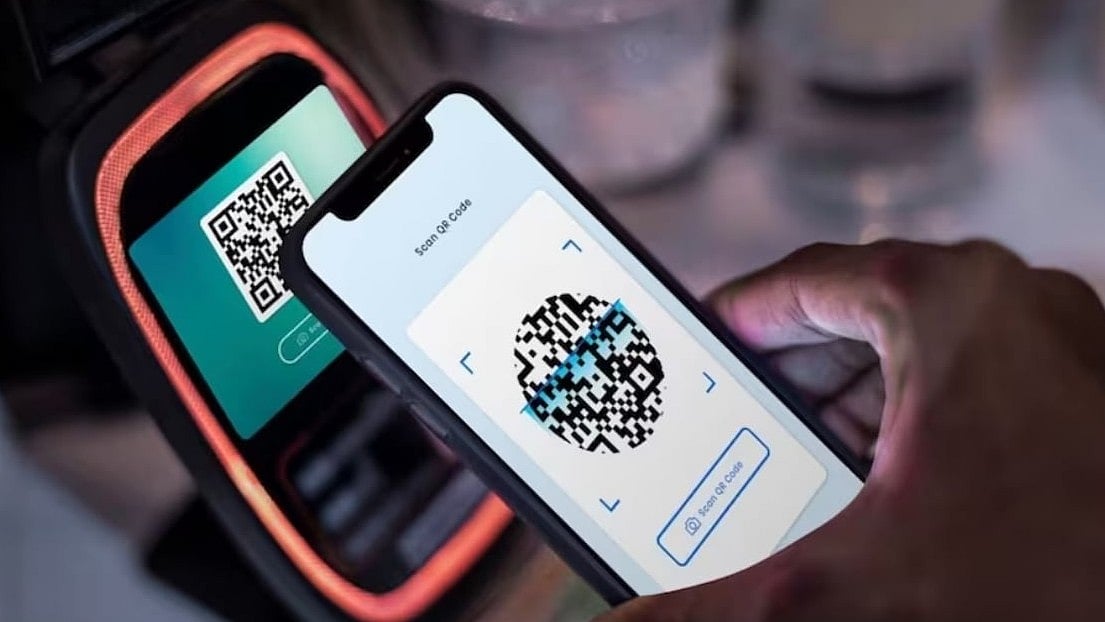

According to a recent report, India reached 709 million active UPI QRs, marking a 21 per cent increase since July 2024. Dense QR acceptance across kiranas, pharmacies, transport hubs, and rural markets has made scan-and-pay the default payment mode nationwide, according to the report by Worldline India.

Person-to-merchant (P2M) transactions continued to outpace person-to-person (P2P), reflecting UPI’s dominance in everyday retail payments.

P2M transactions were up 35 per cent to 37.46 billion transactions while P2P transactions rose 29 per cent to 21.65 billion transactions, the report had said. The average ticket size declined to Rs 1,262 (from Rs 1,363), highlighting increased usage for micro-transactions such as mobility, food, healthcare essentials, and hyperlocal commerce.

Notably, India’s Digital Public Infrastructure (DPI) has played a transformational role in enabling universal access to services, bridging urban–rural gaps and strengthening the country’s position as a global digital powerhouse.

(Except for the headline, this article has not been edited by FPJ's editorial team and is auto-generated from an agency feed.)