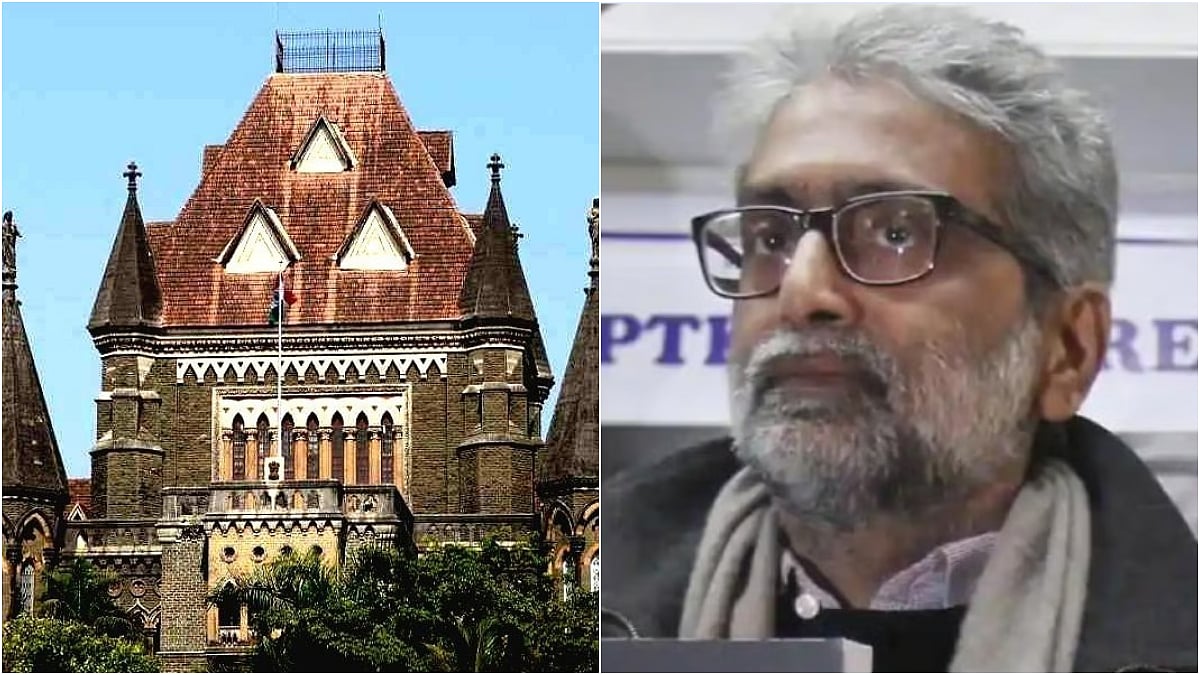

Mumbai, Dec 16: The Bombay High Court on Monday asked the Enforcement Directorate (ED) to seriously consider the implementation of a One Time Settlement (OTS) scheme approved by the National Company Law Tribunal (NCLT) for resolving long-pending claims arising out of the 2013 National Spot Exchange Limited (NSEL) payment crisis.

The court observed that “there cannot be a better way” to ensure relief to affected creditors, who have been waiting for over a decade.

63 Moons Seeks Directions For Enforcement Of Settlement

A bench of Justices Bharati Dangre and Shyam Chandak was hearing a plea filed by 63 Moons Technologies Ltd, seeking directions to ensure that authorities act in consonance with the NCLT-sanctioned scheme, including release of attached properties.

Overwhelming Creditor Support For Settlement Scheme

Senior advocate Vikram Nankani, appearing for 63 Moons, submitted that the settlement scheme between NSEL and a class of “specified creditors” — traders with claims exceeding Rs 10 lakh — was approved by the NCLT on November 28 after receiving overwhelming support. “91.35% of creditors by value and 92.81% by number voted in favour of the scheme,” Nankani told the court.

Rs 1,950 Crore To Be Distributed Under Court-Supervised Mechanism

The scheme envisages payment of Rs 1,950 crore to 5,682 traders in proportion to their outstanding dues as on July 31, 2024. Nankani clarified that the money would be deposited into a separate settlement account, to be administered by retired Bombay High Court judge Justice Shirish Gupte.

“All attached properties — bonds, mutual funds — will go into the settlement account. The money will not go to 63 Moons but directly to the creditors,” he said.

Addressing concerns raised by the ED under the Prevention of Money Laundering Act (PMLA), Nankani argued that the scheme does not dilute or interfere with criminal proceedings.

The bench observed that the scheme had been approved by a competent tribunal and noted that traders have been waiting for relief for nearly 12 years.

Advocate Pendse, appearing for the ED, sought time to take instructions, stating that distribution of funds and overlapping attachments required further consideration. Accepting the request, the court granted the ED time to consult its officers and kept the matter for hearing on December 22.

Also Watch:

Closure Of Litigation And Earlier Payments Noted

The settlement scheme also provides for closure of legal proceedings by traders against the NSEL group, including assignment of all rights and claims to 63 Moons. In 2013, NSEL had earlier paid around Rs 179 crore to over 7,000 small traders with claims below Rs 10 lakh.

To get details on exclusive and budget-friendly property deals in Mumbai & surrounding regions, do visit: https://budgetproperties.in/