Indore: The money charged from the purchaser for maintenance of building or as contribution to a corpus fund cannot be considered as an income of builder.

Therefore, a builder cannot deposit the money into his company account. The builder will have to open a separate account for that purpose, which will be certified by a chartered accountant showing the annual expenses from these bank accounts. The auditor will also have to ensure that money has been spent for the purpose intended.

This has been made clear by MP Real Estate Regulatory Authority (MP RERA) in a statement issued here recently. In some real estate projects, a builder makes commitment to maintain building in initial years and he recovers a maintenance charge for this from purchaser either in lump sum or in instalments. At times, the builder asks the purchaser to pay lump sum amount towards a building maintenance corpus. Though these practices are contrary to the provisions of RERA Act, they can be accepted with certain conditions.

In case where the builder has given possession to purchasers without making arrangement for domestic electricity connection and consequently undertakes to pay difference between the higher rate charged by discoms (electricity distribution companies) and the normal rate for the domestic connection, this difference cannot be charged from the maintenance account but must come from builder’s own resources.

RERA has also made clear that at the time of handing over the maintenance of the building to the Residents’ Welfare Association (by whatever name called), the builder will hand over the balance amount in each of the bank accounts related to maintenance. The builder will also hand over the copy of description of income and expenditure statement duly certified by the chartered accountant to the Association.

The basic principle is that the maintenance accounts are only managed by the builder in trust for a limited period on behalf of Residents’ Welfare Association and does not constitute as source of income for builder.

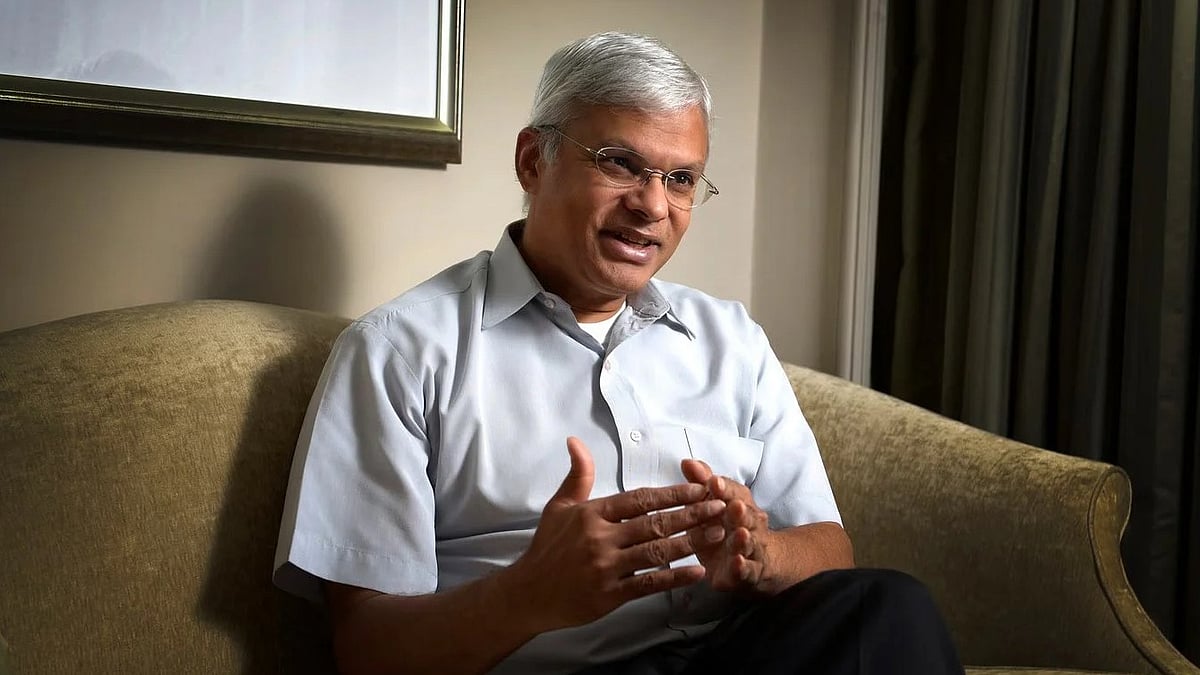

– CA Vishnu Agrawal RERA case practitioner