Indore (Madhya Pradesh): Highlighting the discrepancy in the GST law, tax consultants have said that even if a taxpayer buys goods from someone after paying tax, he can take credit only if the provider has paid the GST by showing it in his return.

Similarly, on the credit note issued by him, he is eligible to take back the tax paid by him earlier only when the credit note taken by the payee has been reversed.

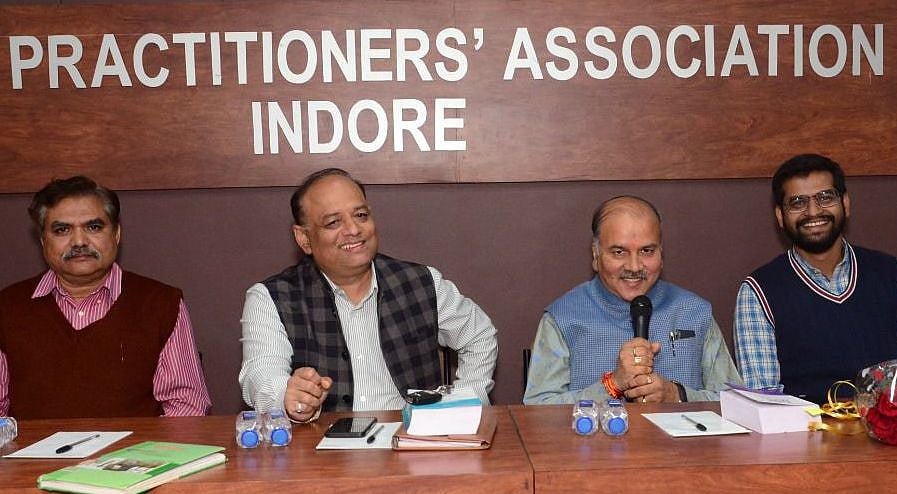

Two senior consultants of GST CA Sunil G Khandelwal and CA Krishna Garg threw light on various aspects of the GST in a seminar organised to solve practical problems under GST.

The seminar was organised by the Tax Practitioners Association and Indore CA branch to discuss and solve the problems being faced by people on many topics like refund, return filing, input tax credit, payment of tax under GST, etc.

CA Sunil Khandelwal addressing the seminar on the subject of 'notice to be issued by the department if the input tax credit (ITC) availed by the taxpayer does not match with GSTR 2A', said that from January 1, 2022, the government will take credit only if GSTR 2B is matched. The provision has been implemented. The credit should not be disallowed merely on account of non-disclosure of transactions or non-payment by the provider if the taxpayer satisfies all other conditions specified in sections 16(1) and 16(2) of the earlier GSTR2A mismatch. It has been decided by the Madras High Court in the case of DY Bethal that in such cases the department should first take action against the supplier and try to recover money from him.

CA Krishna Garg said that the tax paid on the invoice is issued by the taxpayer. If a credit note is issued by him in respect of this sale on account of the return of goods or defect in quality, he is entitled to take back the tax already paid on the amount of this credit note. He can adjust this from his other tax liabilities.

Earlier, CA Shailendra Singh, president of TPA said that GST law has imposed all the conditions on the credit taker only which is unfair.

Refund, payment of tax and other topics were also discussed in the seminar. A large number of chartered accountants, advocates and tax consultants were present in the seminar.