Startup digital enterprises are the new breed of companies hitting the IPO market and majority of them if not all, are loss making and their IPOs richly valued. Lots of questions are being asked on the valuations and the investment value they provide for investors, for instance: Why should I invest in such loss making companies? Why the valuations are so high, since many of them have short business history? Are these sustainable business models?

I firmly believe that it is very important to first understand the nature of these companies by finding the answers to several fundamental questions: What lies underneath them? What are the unit economics? How are they positioned for the future? When I say ‘future’, I am not talking about 3 to 5 years, instead of 10 years, 15 years, and 20 years down the line.

Some of these companies have the characteristics of a disruptive business model, and have the capability to capture large market shares and pose as competitors to well-established market players. And a lot of them, may be all of them, are currently loss making and are being funded by Private Equity players. Case is the point is the recent Zomato IPO or the Policybazaar, Oyo, Ola and Paytm IPOs that are lined up to take place in the near future.

Zomato, driven by the pandemic, has caused turbulence in the existing land scape that some of the big chain restaurants have converted themselves into cloud kitchens, depending upon Zomato for delivery and saving costs on the real estate in the process.

Currently, the market is dominated by old age brick and mortar companies in India and Indian businesses have not yet seen big digital companies overtaking the reins of traditional businesses successfully. Unlike India, U.S is a mature digital economy where there are large numbers of digital companies that have become successful (Amazon, Salesforce). There are few SaaS companies that trade more on the futuristic valuations rather than the current earnings but they have the potential to disrupt the way businesses are done. Also, Amazon at one point was in a similar situation where there were doubts about its sustainability and its business model, as the losses were mounting.

As internet penetration grows – as the smartphone user number keeps increasing – I believe that digital business models will do exceedingly well here in India. However, we need to be aware that there are no hard assets for such companies, and hence the whole investment is in technology and the human capital.

Digital companies have relatively much lower fixed costs initially and the marginal costs are also low, but the initial customer acquisition costs may be high. As the volumes rise – the number of users’ increase – the operating leverage kicks in and there comes in a tipping point when the business is highly profitable as the incremental revenues far exceed the incremental costs.

The valuation of these companies also needs to be looked in a different way. The traditional matrix – PE, P/B, or EV/EBITDA – is not applicable. There are multiple dimensions through which we should evaluate such companies’ especially in the context of under penetrated country like India where the digital penetration is still in mid-single digits.

There are some unique economic characteristics that are associated with these firms and which help in creating a differentiated business in the long run. The fact that one can introduce multiple products across its customer base digitally is a huge moat in the long run.

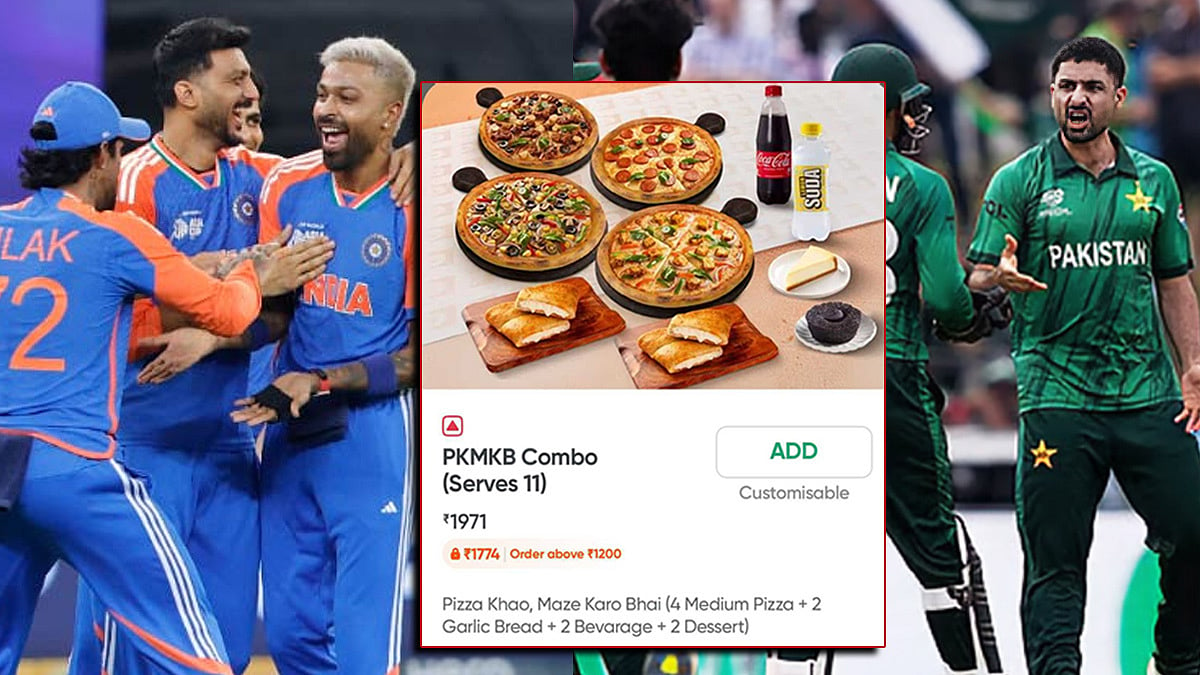

Since the marginal costs of launching multiple products are quite low, it is possible to give away (discounts) some of the value to the end customer in order to attract them. As the switching costs are low, the unit economics (lower the better) plays a very significant part in retaining customers and having repeat sales. The life time value derived from such repeat customers keep on increasing. We would have noticed discount coupons on Zomato, Pharmeasy, Policybazaar.com, and Paytm, which is one way of attracting, retaining and deriving value from the customer.

The other important aspect is that such digitally enabled companies are sitting on a valuable info (data) on the consumer behavior, and hence this information can be utilized to sell multiple products targeted at particular set of customers.

Time and again, we have companies like Amazon, Salesforce that have disrupted the traditional business models. Investors who have focused on valuations in the short-term have missed the bus. We have to evaluate these companies on a much longer timeframe with an eye on the huge market opportunity.

We are well aware that as scalability comes, the unit costs will come further down and can help win both customers and revenues fairly quickly. There is a big first mover advantage and the winner takes it all. The markets will take time to digest the rich valuations and the ones that survive will make big money for the patient investors.

(Arun Malhotra, Founder & CIO, CapGrow Capital Advisors LLP)