Trading in India has expanded over the past few years. This is largely due to the rise of cheap internet and the rise in the prominence of online trading, which have simplified the idea of buying shares into an act of a few clicks.

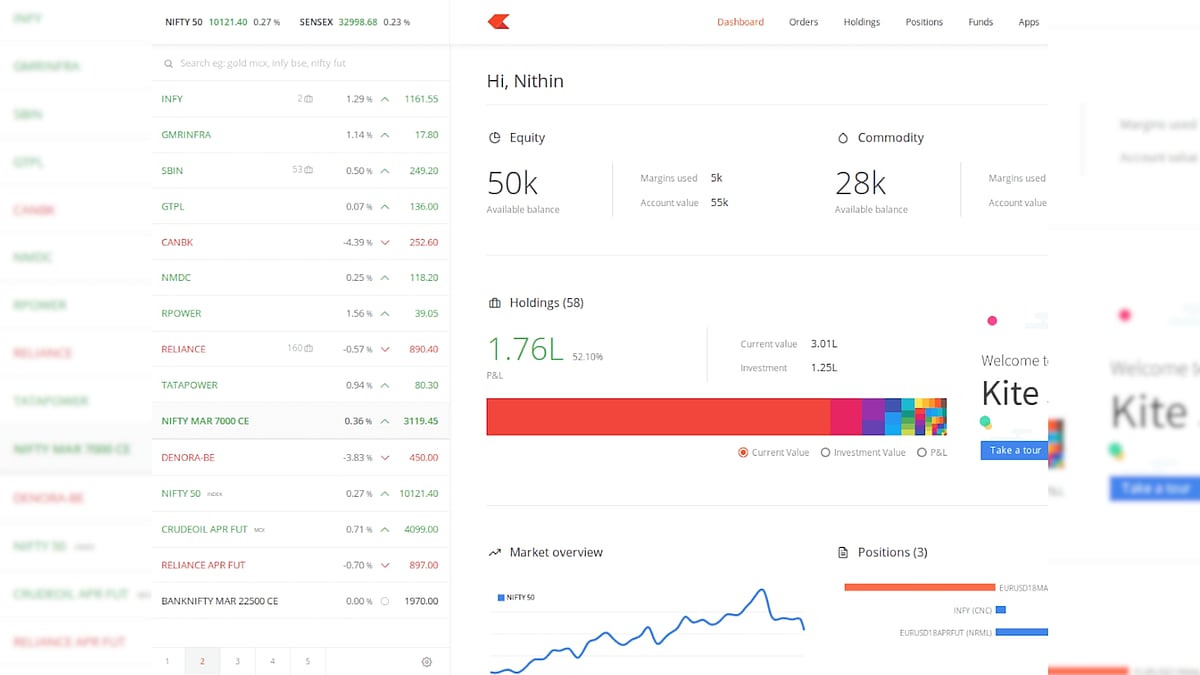

Zerodha Kite

Zerodha is the second-largest trading platform in the country after Groww. Zerodha, founded by Nithin and Nikhil Kamath, is now looking to make trading easier with its Kite system.

The company describes Kite as a 'sleek' investment and trading platform built for modern times and sensibilities. The company has termed it a ground-breaking innovation presented with excellent usability.

The company CEO recently took it to X to announce new feature to this facility.

Here are some of the key updates:

Available margin: This new feature allows users to instantly know available funds on the Kite order window.

Remember F&O quantity: The company claims that Kite remembers the quantity you entered for a contract and automatically fills it in when user opens the order window next time.

Order slicing: This feature from Kite allows users to place large orders without having to worry about exchange freeze limits.

Market depth: Now easily access market depth on the order window itself. The market dept is an order book which refers to the number of orders to buy and sell that are open at different price levels for a stock.

Market Protection: With a rise in miscreants in the segment, a rise in cyber fraud has become an important topic of discussion, and it is therefore crucial to focus on the protection of investors.

The new safety feature makes market orders safer, preventing them from executing at unexpected prices. This is even more crucial during volatile market conditions.

This moves at a time, when Zerodha is trailing behind Groww. Groww or Next Billion Technology, according to Entrackr, leads the market share of 26.59 per cent, followed by Kamath's Zerodha with 16.41 per cent.