In a report published by the reputed British-Finance/ Business outlet, The Financial Times, Hedge Fund investors may leave India on account of additional scrutiny from authorities.

Hedge funds unlike the popular Mutual Funds, that are publicly available for daily trading, irrespective of the profile of the investor, are private investment avenues that is open only to accredited investors. Accredited investors themselves in many ways function with limited scrutiny, as they trade with securities, that are generally not available for public, and are outside the purview of regulatory oversight.

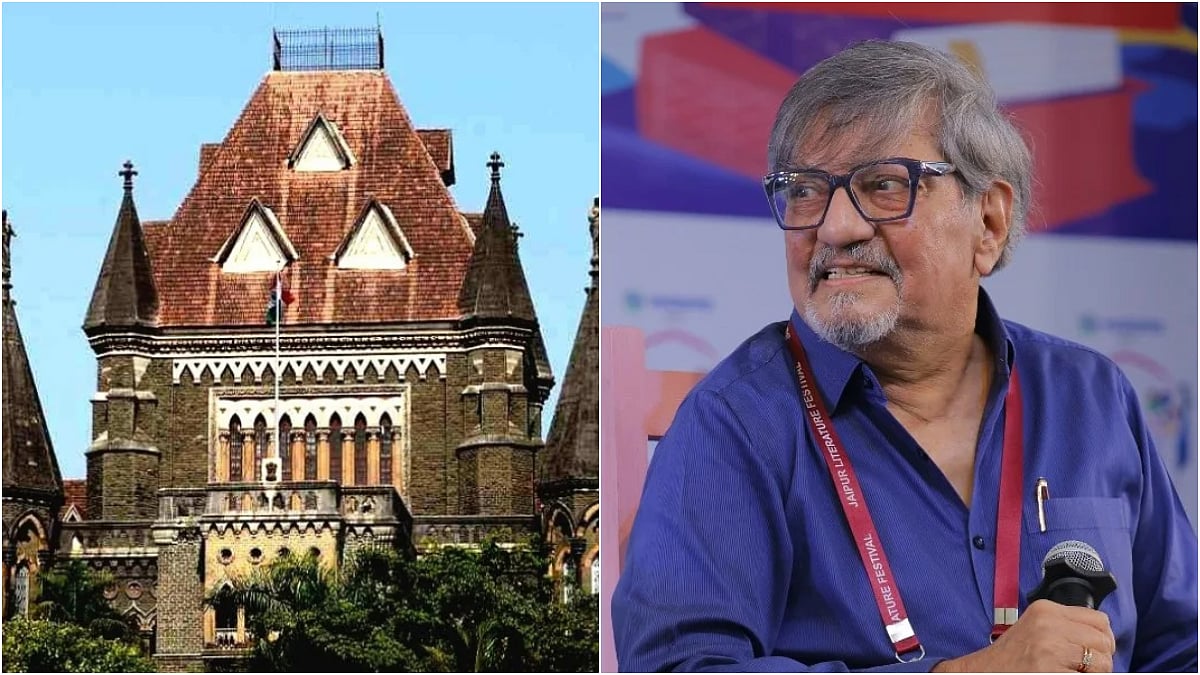

These developments come to pass at a time when FDI has dropped and FII in companies have increased. The alarm was raised after SEBI, the Security and Exchange Board of India brought in regulations, as a knee jerk reaction to the Hindenburg fiasco, where the short-selling firm, accused Adani Group of indulging in malpractices, resulting in discrepancies.

Anxious Investors

Adani, along with other allegations was accused of not abiding by the market rules of withholding under 75 per cent of the stakes of a company.

Like Mutual Funds and Exchange Traded Funds, large Hedge Funds are regulated by SEBI. In which the Hedge funds are required to register and adhere to the operational guidelines. In addition restrictions are placed on advertising, the SEBI's guidelines hold the investor's interests paramount, as framework are established to protect them and the market integrity.

According to the FT report, the updated rules will ostensibly impact the functioning of Hedge Funds, as rules strive for greater transparency, including revealing their end investors for those foreign investors with more than USD 3 billion.

SEBI's actions for transparency

This comes to light, as SEBI's endeavors to uncover the identities of foreign investors are also motivated by a broader governmental initiative to closely monitor capital inflows into India from neighboring nations, such as China.

Although efforts to assuage the fears of the these investors have been made, the extent of the regulation and its purported consequences along with the perceived impact would eventually determine the future of Hedge fund investors in India.

The Hindenburg reports, that came out in 2023, swept away a large chunk of Adani Group's resources. The shares of the company swung, as the trust in the company took a major hit. Gautam Adani, the company founder's own fortunes took a major hit, at the advent of the report. The investigation in matter is currently being carried out by SEBI. However Adani has recovered from the blow, as the company looks to stabilize its fortunes.