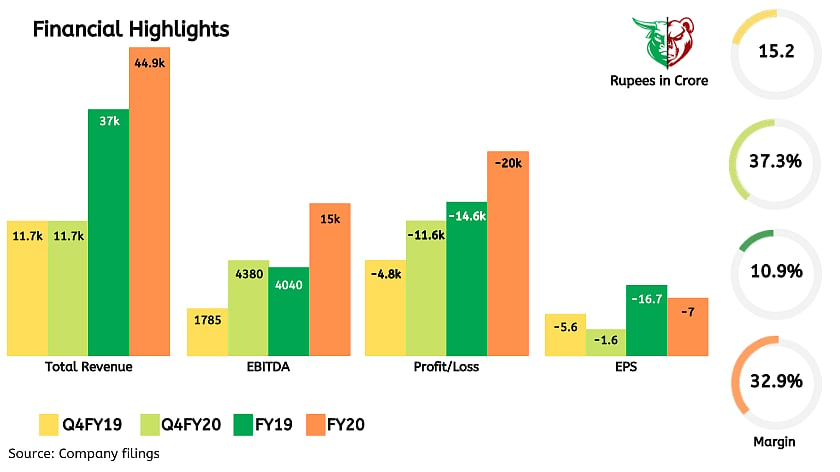

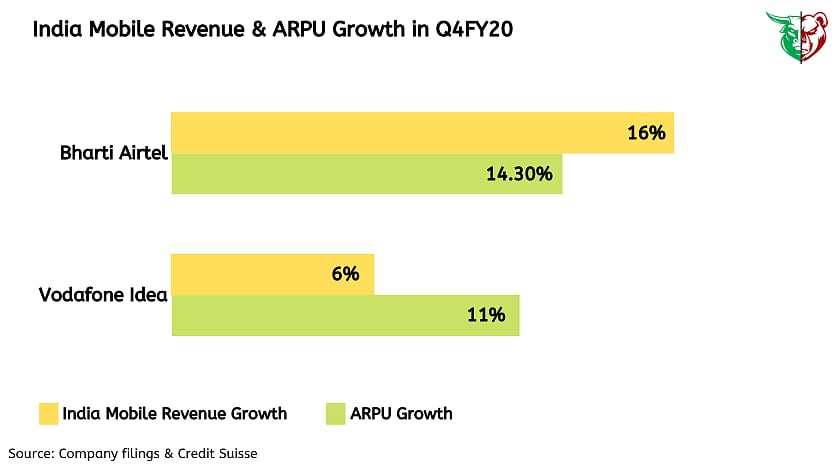

Vodafone Idea reported 6% revenue growth since the last quarter on the back of 11% growth since December quarter in ARPU, partly offset by a 3.3% decline in average subscribers since last quarter. This was 2.6% ahead of street expectations. Apart from the flow-through of revenue growth, a 3.8% decline in operating expenditure since the last quarter led to a 28% growth in reported EBITDA since last quarter. An increase in finance costs offset EBITDA growth resulting in 3.2%. During the quarter, the company recorded another Rs 6,140 crore of exceptional loss as it provided for OTSC and AGR dues resulting in Rs 11,640 crore loss for the quarter.

Teji Mandi

Continues to trail Bharti Airtel on growth and subscriber metrics

Vodafone Idea's ARPU and revenue growth since last quarter though is ahead of street expectation but continues to trail that of Bharti Airtel. Further, the company lost 13 million subscribers in the last quarter vs average quarterly loss of 8 million subscribers in the 2nd and 3rd quarter of Financial Year 2020. Quarterly 4G subscriber net addition has also slowed down considerably for Vodafone Idea.

Teji Mandi

Net debt expands as cash balance shrinks

Net debt (excluding lease liabilities and AGR dues) increased 8.9% since last quarter as cash balance depleted from Rs 12,530 crore in the third quarter to Rs 2,480 crore in the fourth quarter of the Financial Year 2020. However, EBITDA recovery helped reduce leverage from 20.2 times to 13.3 times since last quarter. Including AGR dues, leverage remains high at 18.8 times in the fourth quarter ended in March 2020.

Teji Mandi

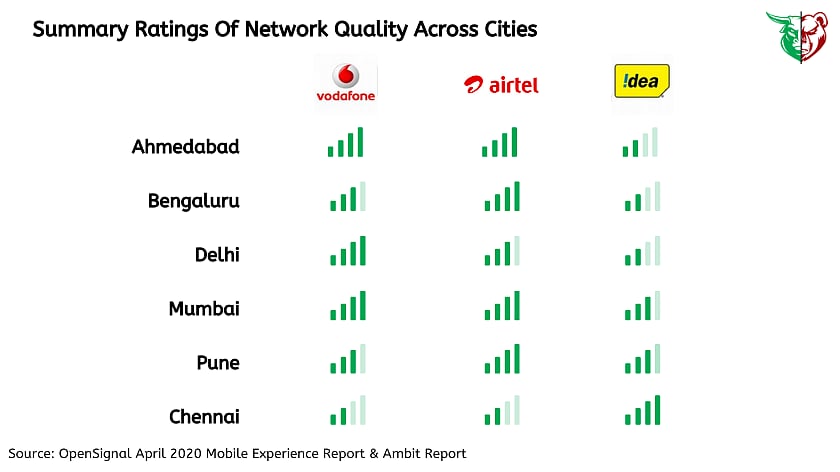

Vodafone strong in cities though

Vodafone Idea is investing a lot in its core circles in general and large cities in particular. The same is also visible in the network quality experience across large cities. It dominates the same and is thus able to hold on to high-ARPU postpaid users. Airtel also matches Vodafone Idea in stellar network performance in cities.

AGR issue

The sheer magnitude of the implications of the potential AGR judgment creates a perceived bankruptcy overhang, thereby delaying potential liquidity. However, an early resolution of the issue would help IDEA monetise its Indus Towers stake and the fibre business. The matter is sub judice and in the final stages, but one cannot be certain on the timeline of the verdict.

Indus-Bharti Infratel merger update

The merger of Indus Towers and Bharti Infratel has received FDI approval for FDI. The long stop date on the original agreement has been extended to August 31, 2020. Vodafone Idea plans to monetize its 11.15% stake in Indus on completion of the Indus-Infratel merger.

Downward factor

Increased competition in data may impact data pricing power which may lead to lower data revenue growth

Increase in competition intensity to put further pressure which would be negative

Lack of any relief with respect to AGR related liabilities would be another source of risk

Teji or Mandi?

The domestic telecom industry has been through a roller coaster ride over the past few years. The price war, which started after Reliance Jio launched its services, has eroded the industry's revenue. This, along with a reduction in call termination charges, led to a significant decline in ARPU.

The recent tariff hike by Vodafone IDea with effect from December 3, 2019, is expected to improve profitability, assuming there will be no significant churn in subscribers, pricing discipline is maintained by telcos, and subscribers do not shift to lower price packs. However, the benefits will be more pronounced next Financial Year 2021, given the full-year impact of the tariff hike.

While Vodafone Idea is going through a rough patch, a favourable resolution of AGR dues and a sharper-than-expected tariff hike can script a heroic comeback but for the time being our take is Mandi given its dependence on external factors with limited control.

Teji Mandi is a proactive investment manager for everyone. To read more of our research, please visit https://tejimandi.com/research