The impact of the novel Coronavirus on Indian real estate has been unprecedented. Not just construction activities have come to a halt, the buyer-base has also significantly depleted. With property transactions dipping to near-zero, the sector is looking at challenging times ahead. The interdependence of supply chains, migration of labourers, cost overruns, and liquidity constraints are some of the other looming challenges.

The COVID-19 crisis and its impact on Indian real estate are such that it is being considered as the third ‘Black Swan’ event for the realty sector in the last five years, the first two being Demonetisation and the implementation of the RERA in 2016.

So, whether you’re thinking of selling, buying, or are just interested in the housing market, this blog will help you understand the real estate market, and what’s in store for the future.

Introduction

The real estate sector is one of the most globally recognized sectors. It comprises four sub-sectors - housing, retail, hospitality, and commercial. The growth of this sector is to be led by growing demand for office space as well as urban and semi-urban accommodations. By 2040, the real estate market is expected to grow to Rs 65,000 crore (US$ 9.30 billion) from Rs 12,000 crore (US$ 1.72 billion) in 2019.

Impact of COVID-19 on Indian real estate

According to a recent study by PropEquity, a real estate data, research, and analytics firm, buying of housing units dropped by 66% across the top nine cities in India. During the second quarter of the calendar year 2020, 21,294 units were sold versus 62,851 units in the first quarter of the calendar year 2020.

The new supply or launches of housing units also decreased by 81% during the same period to 11,967 units from 63,535 units due to the higher inventory in the system.

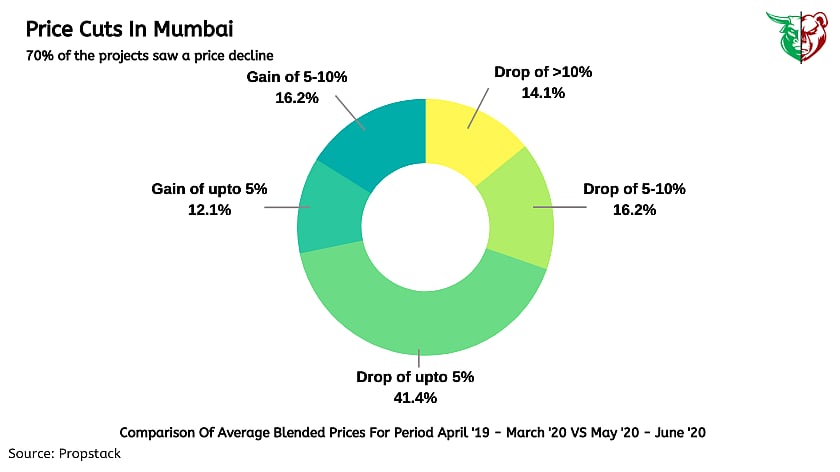

Developers bending down to push sales:

Property prices have started falling, as developers are offering discounts to counter a liquidity crunch and elevated inventory levels. Developers are also offering flexible or deferred payment schedules. At a mid-level range, the developers are seeing a discount of ~15% in property rates, said Bhavin Thakker, managing director, Mumbai at property adviser Savills India.

Great time to buy your dream house:

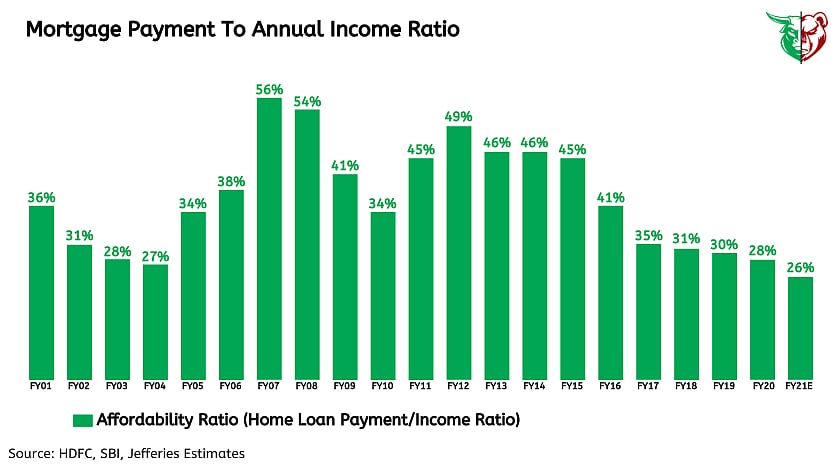

The prices, however, have bottomed out and it is not expected to fall significantly from the current levels. Besides, Home loan rates are lower than the global financial crisis. It has set affordability levels at best in the last two decades.

What to expect for the remainder of 2020

Moving forward to the remainder of 2020, all depends on how long social distancing and concerns over spreading the virus remain in effect. When looking at the real estate trends for the remainder of the year, we expect ~15% drop in the prices similar to the ongoing trend for the mid size segment. The ones with more financial stability and working from home will likely benefit from these low prices. The prices are likely to recover from 2021 onwards, but that is dependent on how 2020 ends.

Teji or Mandi?

Owing to the threat of an infection, the real estate sector has already seen a decline in property visits and buyer interest. However, the world has faced similar outbreaks in the past such as the SARS virus, and the bird flu etc. and has successfully recovered.

Thus our take is Mandi on the sector. However, every calamity is an opportunity to scale new heights. Indian real estate and allied manufacturing industries will find positivity in the current bad scenario and should try to benefit by increasing local production, indigenous innovation, and by being Atmanirbhar.

Teji Mandi is a proactive investment manager for everyone. To read more of our research, please visit https://tejimandi.com/research