Mumbai: In an international climate increasingly governed by tariffs, blocs and political brinkmanship, India’s Union Budget for FY 2026–27 represents a deliberate refusal to join the chorus of economic nationalism. Instead of retaliatory theatrics, the government has chosen fiscal composure. This is both its strength and its gamble.

Washington’s imposition of punitive duties on Indian exports amounts to a direct assault on trade competitiveness at a moment when global demand is already anaemic. Such a shock would tempt many governments towards subsidy-driven protection or populist fiscal expansion. New Delhi has resisted both.

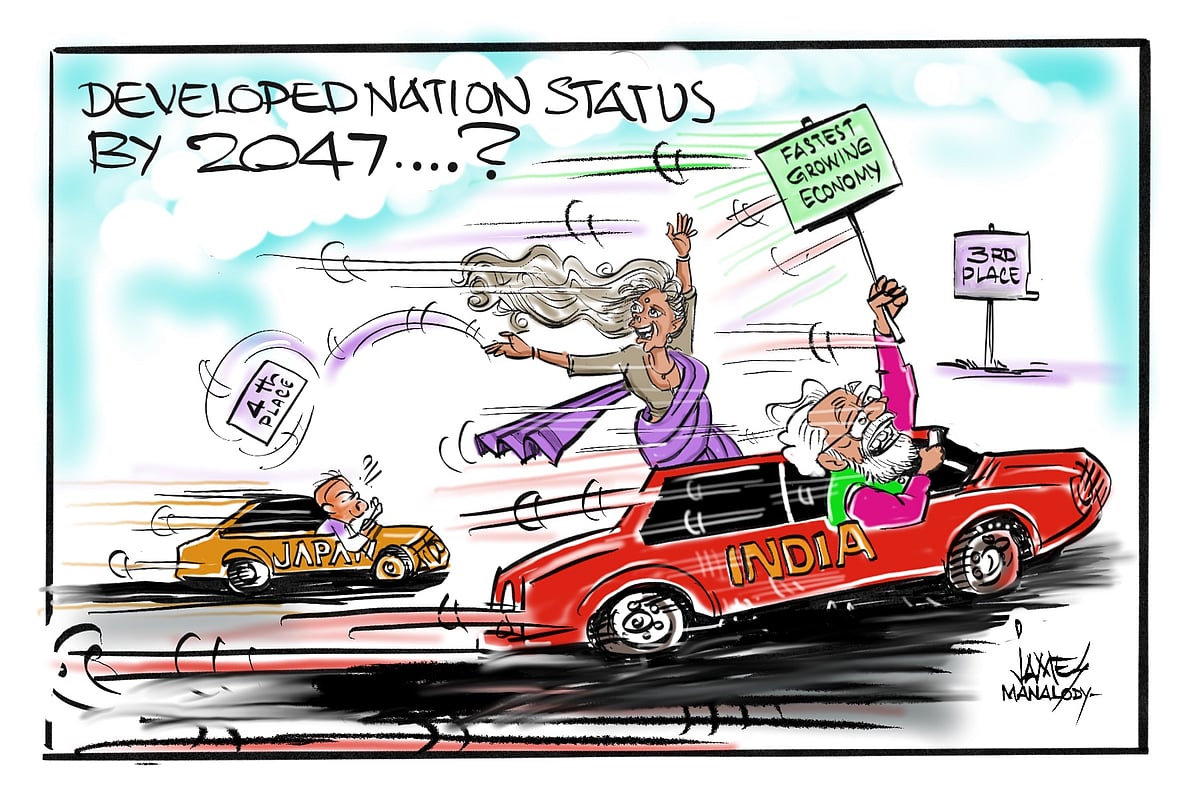

Finance Minister Nirmala Sitharaman’s ninth Budget seeks to preserve macroeconomic credibility even as the external environment deteriorates. The architecture of the Budget is orthodox: sustained public investment, cautious deficit reduction and incremental reform. Infrastructure spending remains intact, signalling continued faith in capital formation as the ultimate antidote to external weakness. The emphasis on manufacturing, MSMEs and supply-chain resilience reflects a realistic reading of the new trade order — one in which market access can no longer be taken for granted.

Yet restraint is not without risk. Export-dependent sectors now face a double squeeze: foreign tariffs abroad and limited fiscal relief at home. The absence of targeted trade compensation or aggressive export incentives suggests that the government is placing its wager on domestic demand and strategic realignment rather than short-term protection. That wager assumes that India can reposition itself quickly enough within alternative supply chains — a process historically slow and politically fraught.

The fiscal path remains the budget’s most disciplined feature. With the deficit projected to fall to 4.3% of GDP, the government is signalling to investors that debt sustainability will not be sacrificed on the altar of global turbulence. In doing so, it preserves monetary flexibility and shields the rupee from excessive volatility. But discipline also constrains ambition. A world sliding into tariff warfare may ultimately demand a more activist industrial policy than this budget is willing to countenance.

Diplomacy has been quietly elevated to economic strategy. Trade negotiations with Europe and other partners are framed as counterweights to American protectionism. This is sensible, but fragile. Free trade agreements cannot be negotiated at the speed of tariff escalation, and India’s historic reluctance to open sensitive sectors could yet limit the scope of these hedges.

This is, therefore, a Budget of strategic conservatism. It neither capitulates to protectionism nor confronts it head-on. Instead, it seeks to outlast it through stability, signalling that India’s ascent will be built on predictability rather than provocation.

Whether such composure proves sufficient is the unanswered question. Trade wars reward speed and scale, not merely steadiness. Fiscal restraint may protect India’s balance sheet, but it does little to offset immediate losses in export competitiveness. The danger is that prudence, if prolonged, hardens into passivity.

For now, the government has chosen the narrow ridge between panic and populism. It has refused to dramatise global disorder, preferring to anchor policy in continuity. In an age of economic disruption, that is an act of confidence. It may also be an act of faith.