Mumbai: Indian stock markets ended sharply higher on Tuesday after India and the United States announced a major trade deal. Under the agreement, the US will reduce reciprocal tariffs on Indian goods to 18 percent from 25 percent. This boosted investor confidence and led to heavy buying across sectors.

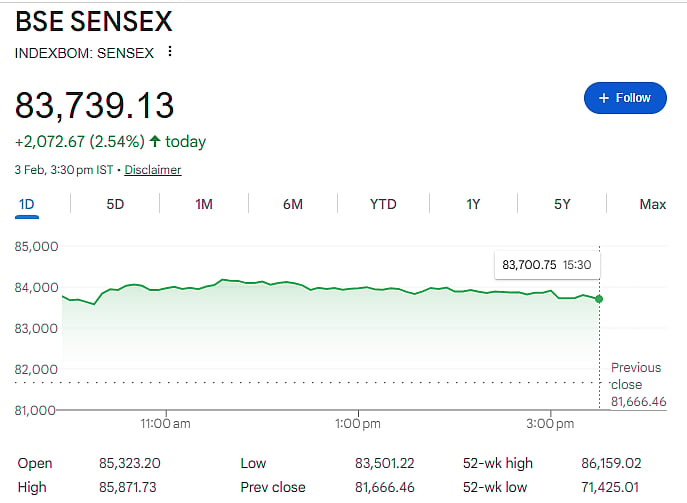

The BSE Sensex closed at 83,739, rising 2,073 points or 2.54 percent. During the day, it touched a high of 85,872, gaining more than 5 percent at one point.

The NSE Nifty ended at 25,728, up 639 points or 2.55 percent. It also hit an intraday high of 26,341, jumping nearly 5 percent.

What the trade deal means?

The trade deal was confirmed by US President Donald Trump after a phone call with Prime Minister Narendra Modi. The reduction in tariffs makes Indian exports cheaper and more competitive in the US market. This is expected to benefit export-focused sectors like textiles, gems and jewellery, seafood, chemicals and pharmaceuticals.

Top stock movers

Among the Sensex stocks, Adani Ports was the biggest gainer, rising over 9 percent. Other strong performers included Bajaj Finance, Bajaj Finserv, Reliance Industries, Sun Pharma, Power Grid, and InterGlobe Aviation.

Only two stocks ended lower-Tech Mahindra and Bharat Electronics.

Export-related stocks saw strong buying, especially in textiles, leather, jewellery, seafood and specialty chemicals, as investors expect higher overseas demand.

Expert view

Vinod Nair of Geojit Investments said the rally was driven by the trade deal and a stronger rupee. He added that lower US tariffs improve India’s position among emerging markets and increase the growth outlook for export-oriented companies.

Global markets supportive

Asian markets also ended higher. South Korea’s Kospi jumped nearly 7 percent, while Japan’s Nikkei, China’s Shanghai index, and Hong Kong’s Hang Seng closed in the green. European markets were also trading higher.

US markets had ended higher on Monday, adding to positive global sentiment.

FII and oil update

On Monday, Foreign Institutional Investors (FIIs) sold shares worth Rs 1,832 crore, while Domestic Institutional Investors (DIIs) bought shares worth Rs 2,446 crore.

Meanwhile, Brent crude oil fell 0.65 percent to $65.87 per barrel, which is positive for India as lower oil prices help control inflation and improve the trade balance.

Overall, the India–US trade deal acted as a strong trigger for markets, pushing indices to record levels and improving investor confidence.