Indian equity market witnessed a sharp surge during week gone by amidst strong FPIs inflow and upbeat sentiments over liquidity, pick up in vaccination drive and economic recovery.

Enduring its strong gaining trend, market up by 3.6 percent during week after posting 1.4 percent gain in the previous week. Following the dovish comments from the US Fed, FPIs inflow has been remained strong and invested Rs 4,787 crore in India during the first three sessions of September.

Strong economic data include GST collections, auto sales number and manufacturing PMI also provided boost to sentiments. GST collections rose 30 percent YoY to Rs 1.12 lakh crore in August and crossed 1 lakh crore mark for second consecutive month backed by India’s GDP that grew by 20.1 percent in Q1FY22 on low base last year as manufacturing, construction and tourism sectors saw strong revival in activity during the quarter.

Investors were seen piling up position in strong fundamental large cap stocks. While the rally was broad based during week with strong participation from the mid and small cap stocks amid rising earning visibility on broader level.

Strong buying interest was seen across sectors as all defensive and cyclical indices ended in green. Banking, metal were the top gaining indices, though mid cap index with a gain of 4.8 percent outperformed major indices.

Investors should keep a close eye on COVID situation and vaccination drive, economic developments and key global economic data like ECB interest rate decision and US vehicles sales data.

From a technical perspective during the week, the Nifty index gained more than 3 percent and set a new milestone at 17,340.10 levels on the last trading day of the week. All the sectoral indices performed well, wherein Nifty Realty was the star of the week with a gain of 10 percent while the rest of the indices closed with an average gain of 5 percent.

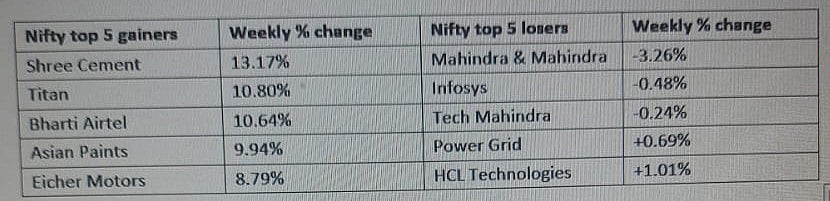

On the stock front, the top gainers were Bharti Airtel, Asian Paints, and Eicher Motors, which supported the index gains while M&M, Infosys were the top laggards.

Nifty Top Gainers, Losers |

On the technical chart, the index has given a Rising Trendline breakout on a weekly chart, which indicates further robustness in the counter. All the key indicators like RSI, MACD & Stochastic are supporting the positive trend in the index.

Overall, market momentum remains positive along with the volatility, so it is advisable to be with the market trend. At present, the psychological level of 17,500 could be a resistance while on the downside, 17,000 may act as support for the index.

(Satish Kumar is Research Analyst at Choice Broking, Mumbai-based full-service stockbroking firm)